Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

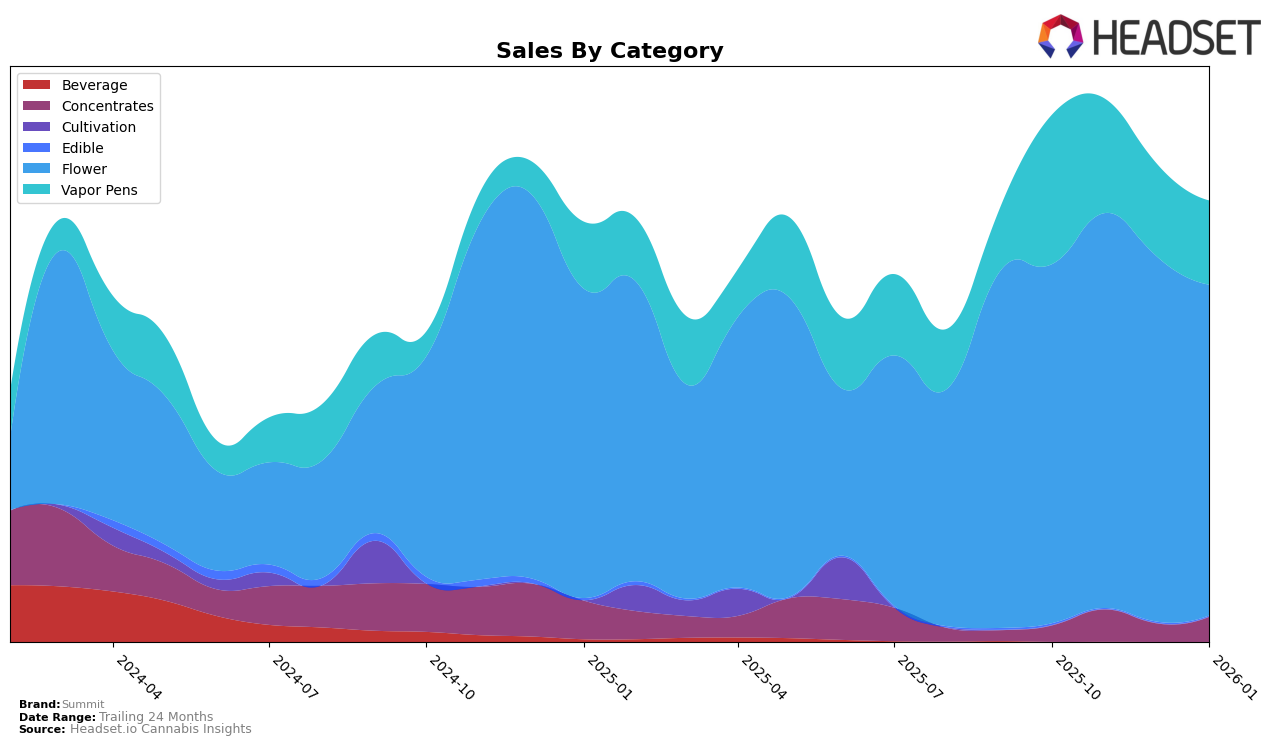

Summit has shown varied performance across different categories in Colorado over the past few months. In the Concentrates category, Summit has made a notable climb, improving from a rank of 60 in October 2025 to 42 by January 2026. This upward trajectory suggests a strengthening position in this segment, driven by a significant increase in sales from October to November, although there was a slight dip in December. In contrast, the Flower category saw Summit's ranking fluctuate, peaking at 20 in November but slipping to 27 by January. Despite this, the brand maintained its presence within the top 30, indicating a stable but competitive position. It's worth noting that Summit did not break into the top 30 in the Vapor Pens category, with its ranking hovering around the 40s and 50s, suggesting room for improvement in this area.

While Summit's performance in Colorado shows areas of strength and potential growth, particularly in the Concentrates category, the brand faces challenges in maintaining a consistent top-tier presence across all categories. The Vapor Pens segment, in particular, highlights a struggle to gain a competitive edge, as Summit did not make the top 30 in any of the months analyzed. This contrasts with their stronger showing in the Flower category, where they consistently ranked within the top 30, albeit with some volatility. These movements underscore the importance of strategic focus on categories where Summit can leverage its strengths while exploring opportunities to bolster its presence in less dominant areas.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Summit has experienced notable fluctuations in its market position from October 2025 to January 2026. Starting at rank 23 in October 2025, Summit improved to rank 20 in November, but then saw a decline to ranks 25 and 27 in December and January, respectively. This downward trend in rank coincides with a decrease in sales from $358,817 in November to $300,320 in January. In contrast, The Health Center showed a consistent upward trajectory, moving from rank 36 in October to 28 in January, indicating a strengthening market presence. Mischief also demonstrated a significant recovery, jumping from rank 60 in December to 29 in January. Meanwhile, The Organic Alternative maintained a relatively stable position, hovering around rank 26, while Lost in Translation (LIT) experienced a slight decline from rank 20 in October to 25 in January. These dynamics suggest that Summit faces increasing competition, particularly from brands like The Health Center and Mischief, which are gaining traction in the market.

Notable Products

In January 2026, Summit's top-performing product was Apricot Scone Bulk in the Flower category, maintaining its leading position from the previous months with sales reaching 9,655 units. Rainbow Chip Bulk also held steady in the second position, showing a slight sales increase compared to December 2025. Platinum Cake Mints Popcorn Bulk, which had no ranking in December, reemerged in the third spot. Sour Sorbet Bulk improved its standing to fourth place after a previous absence in December. Kandy Fumez Bulk dropped to fifth, showing a decline from its earlier position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.