Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

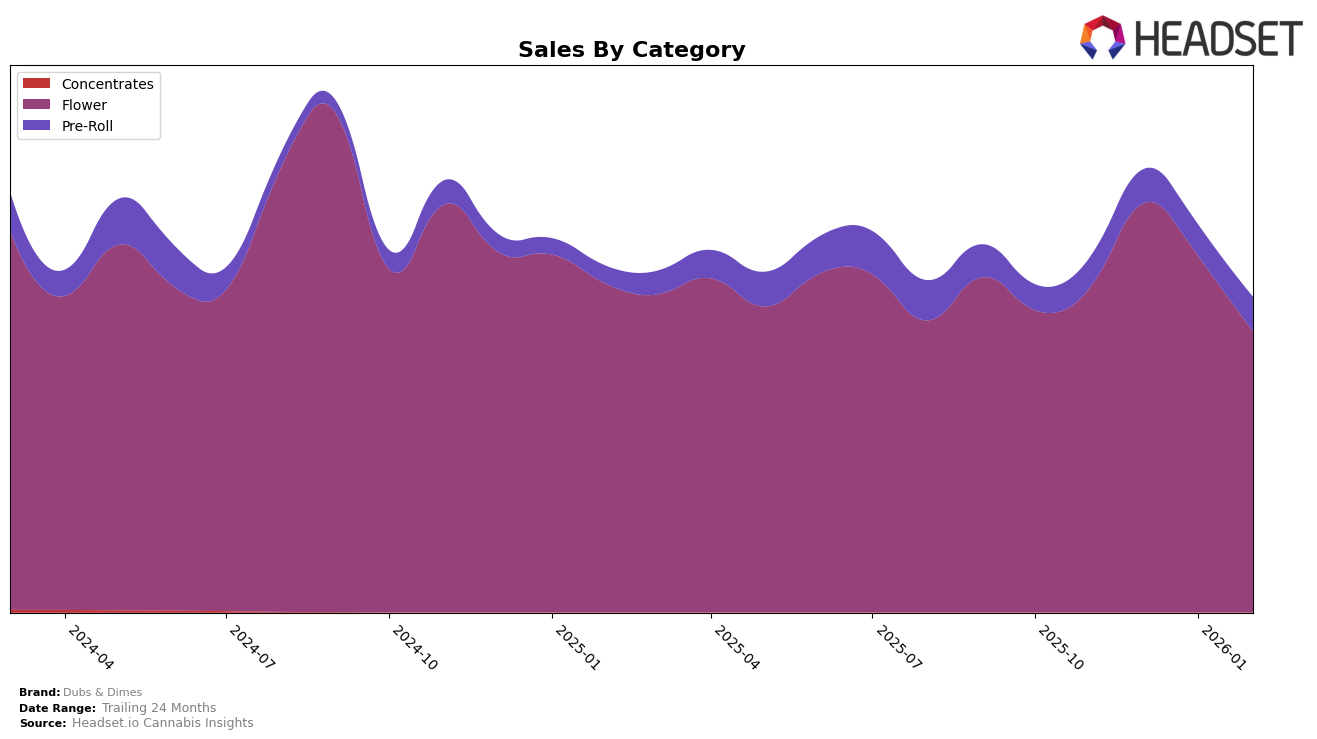

Dubs & Dimes has shown a varied performance across different categories and states. In the Michigan market, their Flower category has experienced some fluctuations in ranking, starting at 19th in November 2025, climbing to 14th by January 2026, and then dropping to 20th by February 2026. This indicates a competitive landscape where Dubs & Dimes is maintaining a presence but facing challenges in sustaining higher rankings. Despite this, the brand's sales figures in the Flower category show a significant peak in December 2025, suggesting a possible seasonal demand or promotional success. In contrast, their Pre-Roll category hasn't broken into the top 30 rankings, which could be a point of concern or an area for potential growth focus.

The overall trend for Dubs & Dimes in Michigan shows a brand that is actively competing but experiencing variability in its market position. The Pre-Roll category, while not in the top 30, has shown a gradual improvement in rankings from 85th in November 2025 to 69th in February 2026, indicating a positive trajectory and potential for future growth if this trend continues. This incremental progress suggests that Dubs & Dimes might be gaining traction in the Pre-Roll market, possibly through strategic initiatives or consumer preference shifts. Understanding these dynamics could be crucial for stakeholders looking to capitalize on emerging opportunities within the cannabis industry.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Dubs & Dimes has experienced notable fluctuations in its rank over recent months, reflecting a dynamic market environment. In November 2025, the brand was ranked 19th, but it climbed to 15th in December, showcasing a positive trajectory. However, by February 2026, Dubs & Dimes had slipped to 20th, indicating increased competition and potential challenges in maintaining its market position. Among its competitors, OG Farms showed a relatively stable performance, moving from 15th in November to 19th in February, while Glorious Cannabis Co. saw a more dramatic drop from 10th in November to 18th in February, suggesting volatility in their sales. Meanwhile, Zones maintained a consistent presence, albeit with a slight decline from 17th to 22nd over the same period. The data highlights the competitive pressures in the Michigan flower market, where Dubs & Dimes must strategize effectively to regain and sustain higher rankings amidst fluctuating sales and strong competition.

Notable Products

In February 2026, the top-performing product for Dubs & Dimes was the Classic Ice Cream Cake Pre-Roll (1g) in the Pre-Roll category, which rose to the number one rank from its previous second position in January. The Classic Honey Banana Pre-Roll (1g) debuted impressively at second place, indicating strong consumer interest. The Connoisseur Kush Mints (3.5g) in the Flower category secured the third position, maintaining a steady presence since its introduction. Meanwhile, the Classic Motor Breath Pre-Roll (1g), which had peaked at the top in January, dropped to fourth place with sales of 3,089 units. Lastly, the Classic Sour Garlic Cookies Pre-Roll (1g) slipped from fourth to fifth, showing a slight decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.