Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

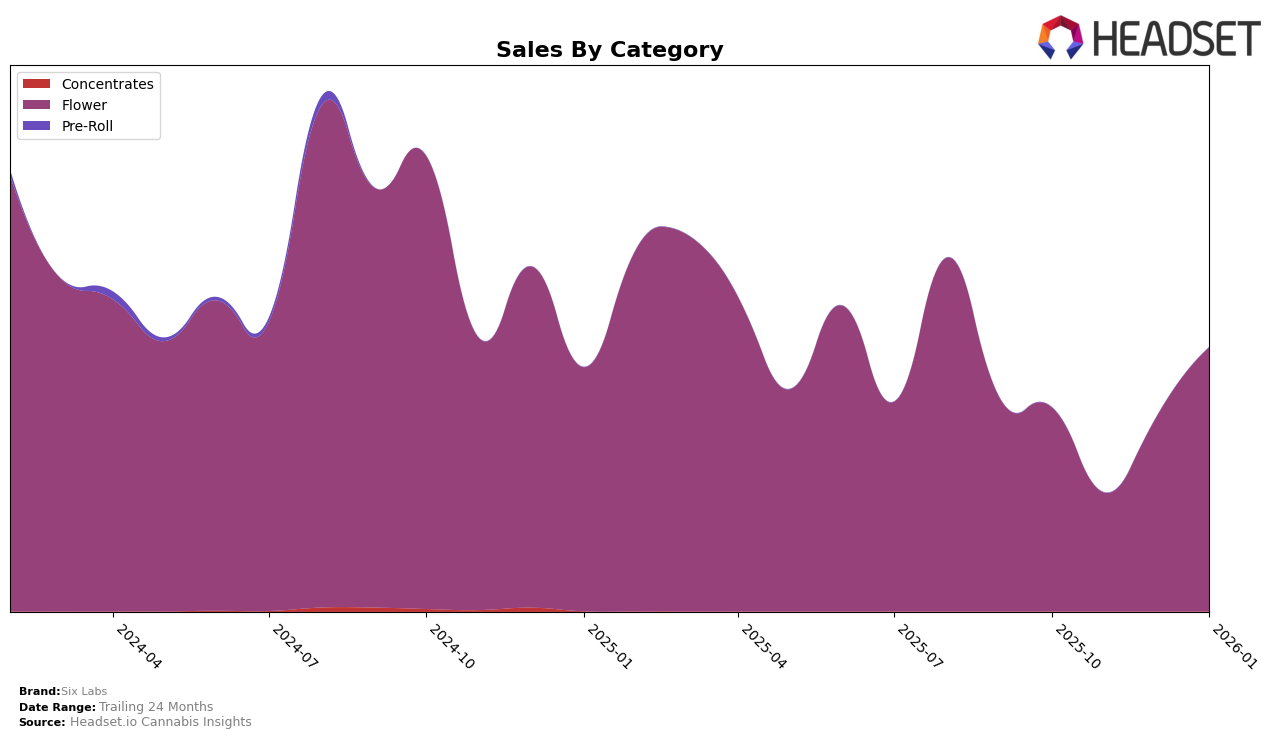

In the Michigan market, Six Labs has demonstrated notable fluctuations in their performance within the Flower category over the past few months. While they did not secure a spot in the top 30 brands in October and November 2025, their rank improved significantly by December 2025, reaching 42nd place, and further climbed to 27th in January 2026. This upward trend indicates a positive momentum, possibly driven by strategic adjustments or new product offerings that have resonated well with consumers. The sales figures reflect this growth, with a substantial increase from approximately $381,849 in November 2025 to $851,782 in January 2026, suggesting a successful turnaround after a dip in performance.

Despite the challenges faced in the latter months of 2025, Six Labs' recovery in Michigan is commendable, especially considering their absence from the top 30 in the earlier months. This recovery could be attributed to various factors, such as enhanced marketing strategies, improved distribution channels, or changes in consumer preferences. The brand's ability to rebound and climb the rankings in a competitive market like Michigan's Flower category suggests resilience and adaptability. Observing these trends can provide insights into potential future movements and opportunities for Six Labs to further solidify their position in the market.

Competitive Landscape

In the Michigan flower category, Six Labs has demonstrated a notable fluctuation in its market position over the past few months. Starting from a rank of 39 in October 2025, Six Labs experienced a significant drop to 78 in November, indicating a challenging period. However, the brand made a remarkable recovery by December, climbing to rank 42, and further improved to 27 by January 2026. This upward trajectory suggests a positive shift in consumer perception or strategic adjustments that have bolstered its standing. In contrast, competitors like North Cannabis Co. and Light Sky Farms have maintained relatively stable positions, with ranks fluctuating slightly but remaining within the top 35. Meanwhile, Glorious Cannabis Co. and Carbon have consistently outperformed Six Labs, although Glorious Cannabis Co. saw a decline from rank 10 in November to 25 in January. These dynamics highlight Six Labs' potential for growth amidst a competitive landscape, especially as it closes the gap with higher-ranked brands.

Notable Products

In January 2026, the top-performing product for Six Labs was Strawberry Marg (Bulk) in the Flower category, securing the number one rank with sales of 7,371 units. Death Star (Bulk) followed closely in second place, maintaining a strong position after being ranked first in December 2025. Danimals (1g) emerged as a new contender, achieving the third rank, while Biggie Runtz (Bulk) witnessed a slight drop from second in December to fourth in January. Lastly, Zurf N Turf (Bulk) rounded out the top five, making its first appearance in the rankings this January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.