Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

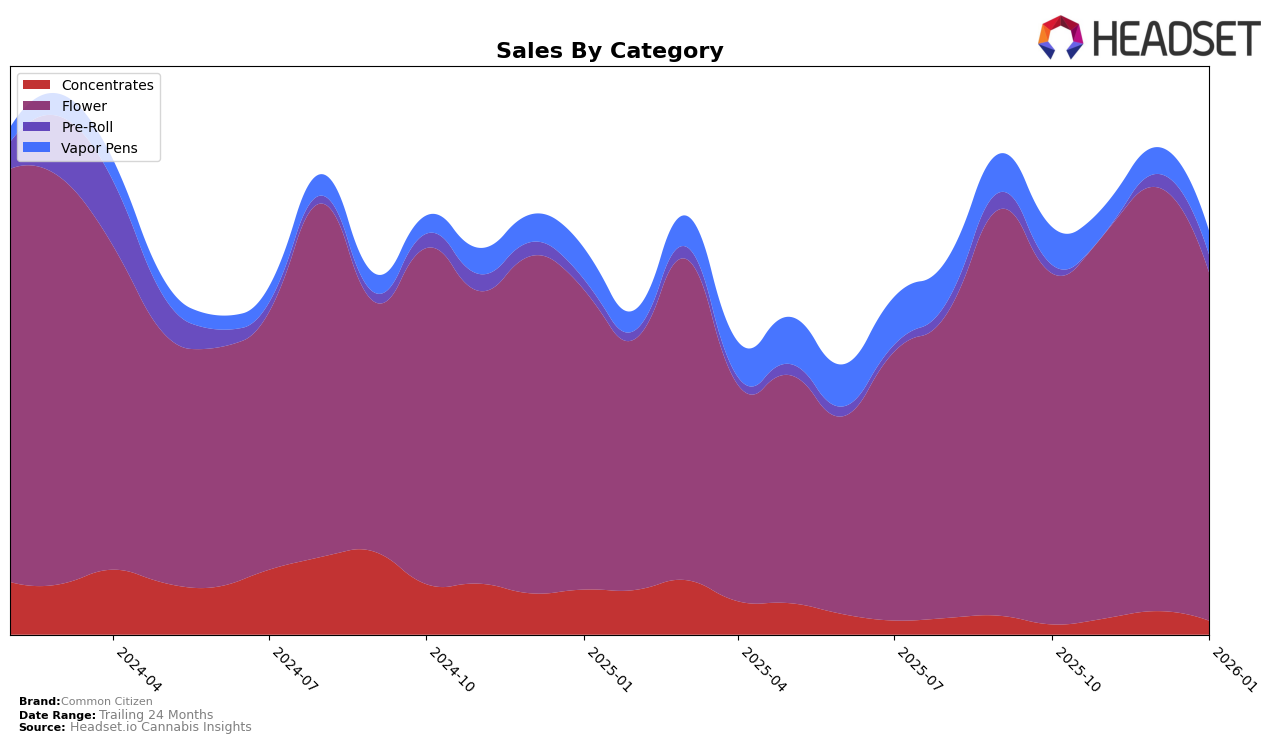

In Michigan, Common Citizen has demonstrated a notable presence in the cannabis market, particularly in the Flower category. Over the months from October 2025 to January 2026, the brand consistently ranked within the top 10, peaking at 6th place in December before settling at 7th in January. This stability in the upper ranks suggests a strong consumer preference and market penetration for their Flower products. In the Concentrates category, Common Citizen showed an upward trend initially, improving from 24th to 16th by December, although it dropped back to 20th in January. This fluctuation might indicate a competitive market landscape or seasonal demand variations. Their performance in the Pre-Roll category is also noteworthy, with a significant leap from being outside the top 30 in November to 46th by January, hinting at potential growth opportunities in this segment.

Shifting focus to Ohio, Common Citizen's performance presents a mixed picture. In the Flower category, the brand has maintained a consistent ranking, hovering around the 24th to 25th positions from November to January. This consistency, along with a peak in sales during November, suggests a steady foothold in this category. However, the Vapor Pens category tells a different story, with the brand's ranking slipping from 37th in October to falling out of the top 30 by January. This downward trend could indicate challenges in maintaining competitiveness or shifts in consumer preferences. The absence from the top 30 in January particularly highlights the need for strategic adjustments to regain market share in this category.

Competitive Landscape

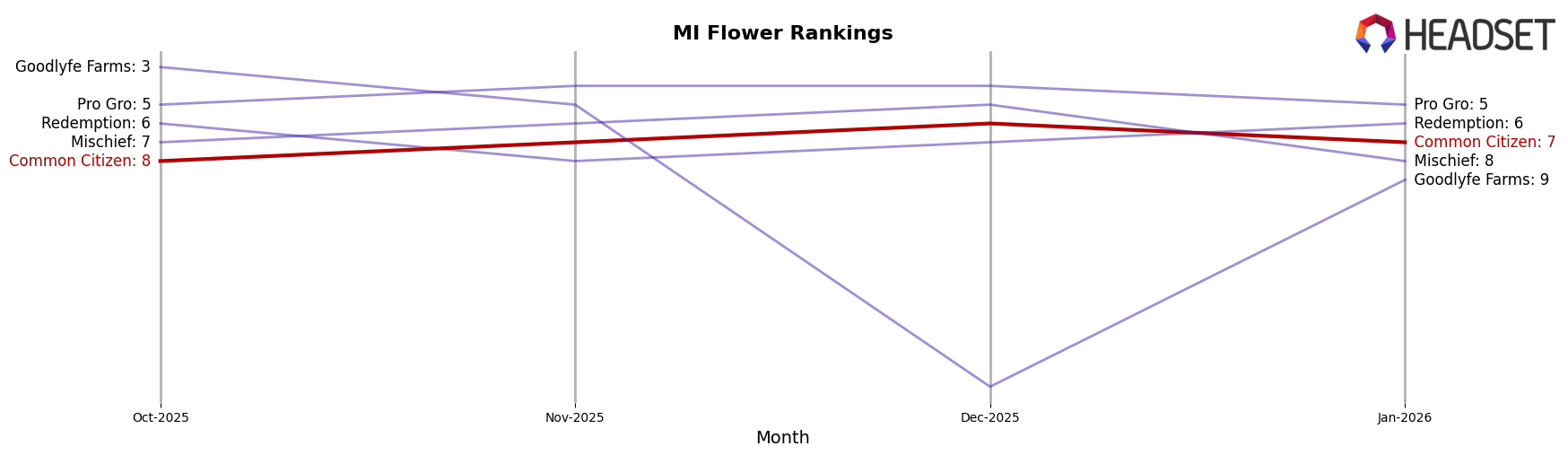

In the competitive landscape of the Michigan flower category, Common Citizen has shown a dynamic performance from October 2025 to January 2026. Starting at the 8th position in October 2025, Common Citizen improved its rank to 6th by December 2025, before slightly dropping to 7th in January 2026. This fluctuation in rank is reflective of the competitive pressures from brands like Redemption, which maintained a fairly stable position around 6th to 8th, and Mischief, which demonstrated a similar pattern of rank changes. Notably, Pro Gro consistently outperformed Common Citizen, holding a higher rank throughout the period, while Goodlyfe Farms experienced a significant drop in December 2025, falling out of the top 20, before recovering to 9th in January 2026. Despite these challenges, Common Citizen's sales peaked in December 2025, indicating a robust market presence, although the subsequent decline in January 2026 suggests potential areas for strategic improvement to sustain its competitive edge.

Notable Products

In January 2026, Buddha Tahoe OG (3.5g) from Common Citizen maintained its top position as the best-selling product, with impressive sales reaching 15,748 units. Morning Diesel (3.5g) entered the rankings for the first time, securing the second spot with notable sales figures. Animal Sorbet Kush Mints (7g) also debuted in the rankings, taking third place. LA Pop Rockz (3.5g) remained consistent, holding onto the fourth position, while Orange Wedding Cake (3.5g) rounded out the top five. Compared to previous months, Buddha Tahoe OG (3.5g) rose to the top from its fourth position in November, while LA Pop Rockz (3.5g) maintained its position for two consecutive months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.