Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

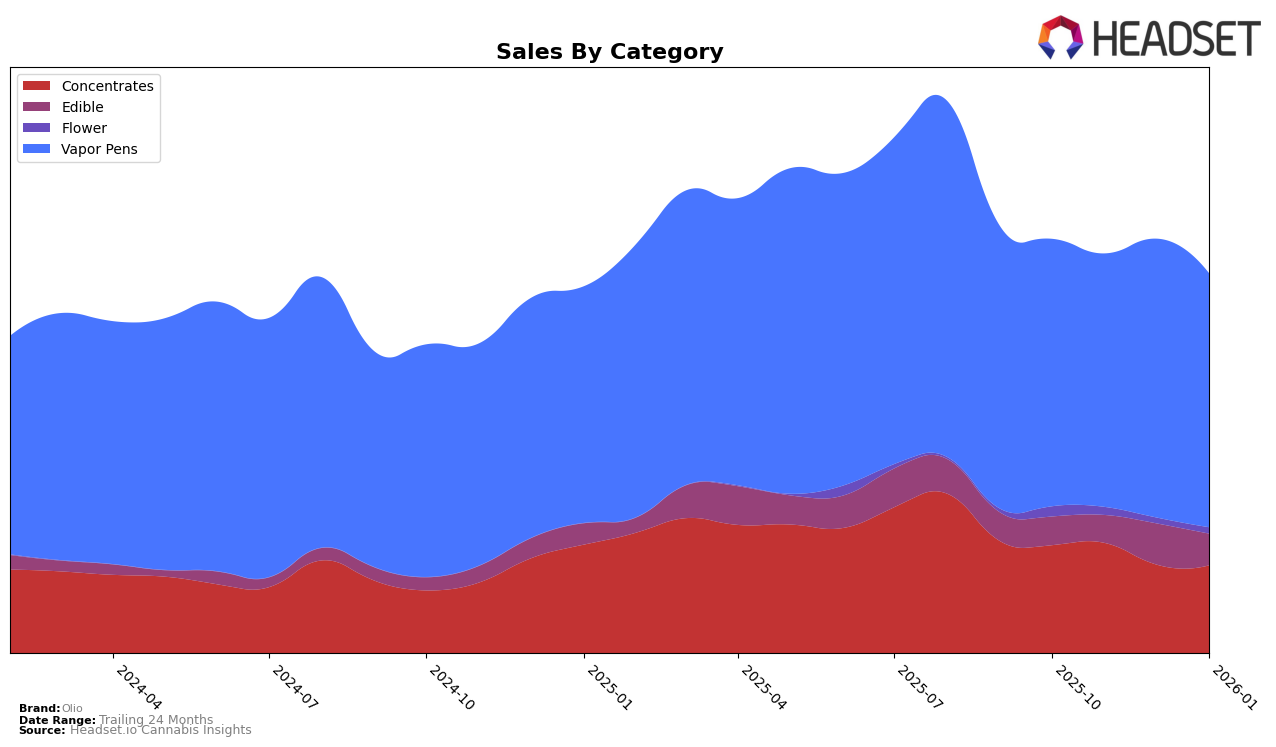

Olio's performance in the Colorado market demonstrates varied results across different product categories. In the Concentrates category, Olio experienced a downward trend, moving from a rank of 10th in October 2025 to 26th by January 2026, with a corresponding decrease in sales. This indicates a potential challenge in maintaining its market position in Concentrates within the state. Conversely, the Vapor Pens category shows a more stable performance, maintaining a strong presence with rankings consistently around the top 10, although there was a slight drop to 12th place in January 2026. The Edible category also reflects a steady performance, hovering around the low 20s in ranking, which suggests a stable consumer base for their edible products. However, in the Flower category, Olio did not maintain a top 30 position after October 2025, which could indicate a need for strategic adjustments or a shift in market focus.

In New York, Olio's presence in the Concentrates category shows a positive trajectory, with the brand improving its rank from 14th in November 2025 to 10th by January 2026, alongside an increase in sales. This suggests a strengthening market position and possibly growing consumer preference for Olio's concentrates in New York. However, in the Edible category, Olio did not break into the top 30 rankings, indicating a potential area for growth or a need for increased market penetration strategies. The Vapor Pens category in New York also shows a consistent performance, with rankings remaining in the high 30s, which may reflect a stable but less dominant market presence compared to other categories. Meanwhile, in Michigan, Olio made a brief appearance in the Concentrates category rankings in November 2025, but did not maintain a top 30 position in subsequent months, highlighting an opportunity for growth in this market.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Olio has demonstrated a relatively stable performance with its rank fluctuating slightly between 10th and 12th place from October 2025 to January 2026. During this period, Olio's sales peaked in December 2025, which coincided with maintaining its 10th rank, before experiencing a dip in January 2026, resulting in a drop to 12th place. Notably, Packs (fka Packwoods) showed a significant improvement, climbing from 14th in October 2025 to 10th by January 2026, surpassing Olio in the process. Meanwhile, Edun maintained a competitive edge, closely trailing Olio and even surpassing it in December 2025. Sauce Essentials also posed a competitive threat by achieving a higher rank than Olio in December 2025. These shifts highlight the dynamic nature of the vapor pen market in Colorado, where Olio faces stiff competition from brands that are either improving their rank or maintaining a strong presence, impacting Olio's market share and necessitating strategic adjustments to regain a higher position.

Notable Products

In January 2026, the top-performing product for Olio was the Sour Blue Raspberry Rosin Gummies 10-Pack (100mg) in the Edible category, maintaining its number one rank from December 2025 with sales of 1676 units. The Traditional Rosin Gummies 10-Pack (100mg) also performed well, ranking second, though its sales declined to 914 units from previous months. The Gas Tanker Live Rosin Cartridge (0.5g) emerged as a new entry in the Vapor Pens category, securing the third position. Sour Grape Live Rosin Gummies 10-Pack (100mg) experienced a drop to the fourth rank from second in December 2025. Meanwhile, Coolio (7g) reappeared in the rankings at fifth place, having last been ranked third in October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.