Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

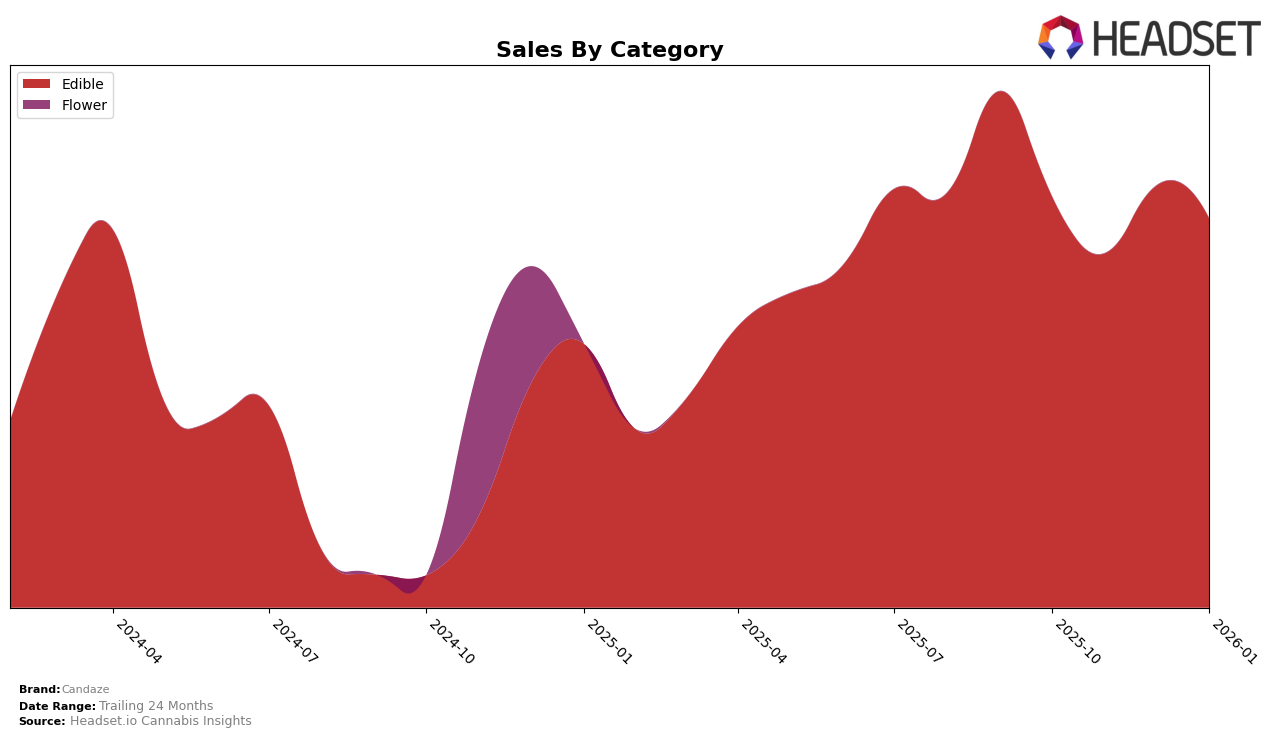

Candaze has shown a consistent presence in the Colorado market, particularly in the Edible category. Over the months from October 2025 to January 2026, the brand maintained a steady ranking, hovering around the 17th and 18th positions. This consistency suggests a stable demand and a loyal customer base in Colorado. Despite a slight dip in sales in November 2025, Candaze quickly rebounded in December, indicating resilience in a competitive market. However, the brand's absence from the top 30 rankings in other categories or states highlights areas for potential growth and expansion.

The performance of Candaze in the Edible category in Colorado provides insights into consumer preferences and market trends. While the brand did not break into the top 15, its consistent ranking suggests a reliable product offering that resonates with its target audience. The fluctuation in sales figures from month to month could be attributed to seasonal variations or promotional activities, but the overall trend remains positive. The lack of presence in other states or provinces within the top 30 rankings, however, points to a need for strategic initiatives to broaden its market footprint and enhance brand visibility beyond Colorado.

```Competitive Landscape

In the competitive landscape of the edible cannabis market in Colorado, Candaze has maintained a relatively stable position, ranking 17th in October, November, and January, with a slight dip to 18th in December 2025. Despite this consistency, Candaze faces stiff competition from brands like Cheeba Chews and Coda Signature, which have experienced fluctuations in their rankings but remain ahead of Candaze. Notably, Cheeba Chews consistently ranks higher, although their sales have shown a downward trend from October to January. Meanwhile, Coda Signature has seen a more volatile ranking, dropping to 16th in January, which could indicate a potential opportunity for Candaze to climb the ranks if they capitalize on this instability. Additionally, Nove Luxury Chocolate and Billo are noteworthy as they have improved their positions over the months, with Billo breaking into the top 20 by January, suggesting a dynamic and competitive environment where Candaze must innovate to enhance its market presence and sales performance.

Notable Products

In January 2026, the top-performing product for Candaze was Dipz - Chocolate Dipped Strawberry Rosin Gummies 10-Pack (100mg), which achieved the number one rank with sales of 491 units. Following closely, Dipz - Peanut Butter & Strawberry Jelly Rosin Gummies 10-Pack (100mg) secured the second place, climbing from its fifth position in December 2025. Dipz - Green Apple Caramel Rosin Gummies 10-Pack (100mg) entered the rankings at third place, showing strong performance. Dipz - Strawberry Shortcake Rosin Gummies 10-Pack (100mg) was ranked fourth, having previously been unranked in December 2025. Dipz - Chocolate Dipped Cherry Rosin Gummies 10-Pack (100mg) experienced a decline, moving from fourth in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.