Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

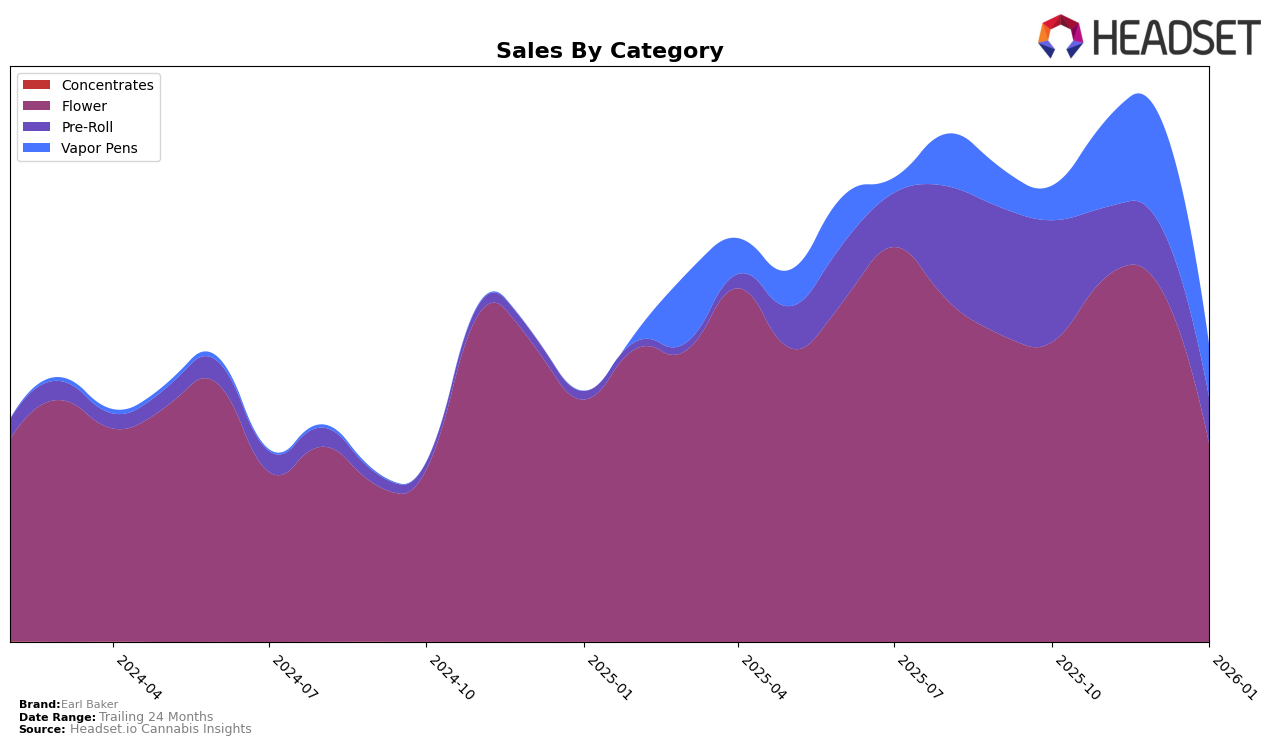

In the state of Connecticut, Earl Baker has demonstrated a consistent performance in the Flower category, maintaining a strong presence within the top 15 rankings over the past four months. Despite a notable drop from 11th to 15th place in January 2026, the brand's sales figures suggest a robust market presence, with a significant peak in December 2025. This fluctuation in ranking might indicate increased competition or seasonal demand variations. Meanwhile, in the Pre-Roll category, Earl Baker's ranking experienced a decline from 10th to 16th place, which could be a cause for concern as it indicates a potential loss of market share. The Vapor Pens category also saw Earl Baker's ranking slip from 14th to 18th place, despite a strong showing in November 2025, highlighting possible volatility in consumer preferences or competitive pressures.

In Oregon, Earl Baker's performance in the Flower category has been less stable, as evidenced by its erratic ranking trajectory, jumping from 50th to 31st in November 2025, only to fall to 73rd in December before a slight recovery to 62nd in January 2026. This inconsistency suggests challenges in maintaining a foothold in a competitive market. Similarly, the Pre-Roll category has not seen Earl Baker break into the top 30, with rankings consistently outside this bracket, ending at 73rd in January 2026. Such persistent low rankings in Oregon's Pre-Roll market might indicate a need for strategic adjustments to improve brand visibility and consumer engagement in this category.

Competitive Landscape

In the Connecticut flower category, Earl Baker has experienced notable fluctuations in its market position, reflecting a dynamic competitive landscape. From October 2025 to January 2026, Earl Baker's rank dropped from 10th to 15th, indicating increased competition and challenges in maintaining its market share. Despite this decline, Earl Baker's sales saw a significant peak in December 2025, suggesting a temporary surge in consumer demand or successful promotional efforts. In contrast, Grassroots emerged strongly in January 2026, securing the 12th position, which may have contributed to Earl Baker's ranking decline. Meanwhile, AGL / Advanced Grow Labs and Rodeo Cannabis Co. consistently trailed behind Earl Baker, although their sales figures suggest they remain competitive threats. Let's Burn showed a remarkable improvement, climbing to the 13th position by January 2026, potentially capturing market share from Earl Baker. These shifts underscore the importance for Earl Baker to innovate and adapt strategies to reclaim its higher rank and stabilize sales in the evolving Connecticut flower market.

Notable Products

In January 2026, Ice Cream Man (Bulk) from the Flower category emerged as the top-performing product for Earl Baker with sales reaching 1173 units. Baby Cakes Pre-Roll (1g) secured the second position in the Pre-Roll category, showing strong sales of 879 units. Headspace (1g), also in the Flower category, ranked third with a notable presence in the market. Iccee Blizzard (3.5g) maintained its fourth position from December 2025, although sales dipped from 1050 to 642 units. Suga T's (3.5g) saw a decline in ranking, moving from second in December 2025 to fifth in January 2026, with sales dropping to 572 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.