Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

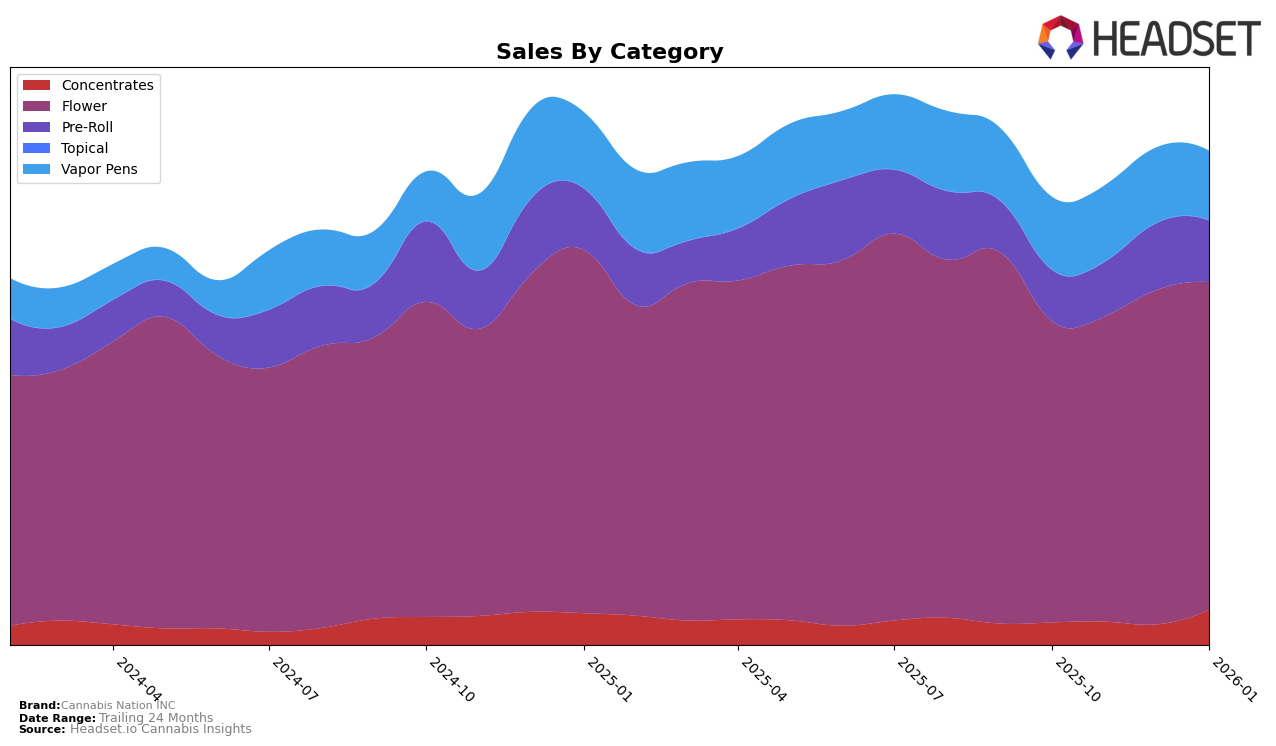

In the state of Oregon, Cannabis Nation INC has shown varied performance across different product categories. The brand has made a notable leap in the Concentrates category, moving from a ranking of 53 in December 2025 to 32 by January 2026, indicating a positive trend and increased consumer interest. Conversely, their position in the Vapor Pens category has seen slight fluctuations, with a rank of 38 in October 2025, dipping to 39 by January 2026. This suggests a relatively stable but competitive market space for Vapor Pens. The Pre-Roll category presents a consistent upward trend, moving from 46 to 37 over the same period, showcasing a growing preference for their offerings in this segment.

Focusing on the Flower category, Cannabis Nation INC has maintained a strong presence, consistently ranking within the top 10 throughout the observed months. This stability in the Flower category, with a minor dip from 8 to 9 in January 2026, underscores the brand's solid footing and popularity in this segment. Despite not making it into the top 30 for Concentrates until January 2026, the brand's significant jump could indicate a strategic shift or successful marketing efforts in that category. The overall sales trajectory across these categories shows a mix of stability and potential growth opportunities, particularly in the Concentrates and Pre-Roll segments, where the brand appears to be gaining traction.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Cannabis Nation INC has demonstrated a consistent presence, maintaining a steady rank between 8th and 10th from October 2025 to January 2026. This stability is noteworthy, especially when compared to brands like Otis Garden, which experienced a significant rise in rank from 13th to 4th, and High Tech, which fluctuated but remained within the top 10. Despite the competitive pressure, Cannabis Nation INC's sales have shown a slight upward trend, indicating resilience and potential for growth. Meanwhile, Deep Creek Gardens and Kaprikorn have seen more variability in their rankings, suggesting that Cannabis Nation INC's consistent performance could be leveraged as a competitive advantage in the Oregon market.

Notable Products

In January 2026, Widow's Cookies Pre-Roll 2-Pack (1g) emerged as the top-performing product for Cannabis Nation INC, achieving the number one rank with sales of 1203 units. Shotgun Wedding Pre-Roll 2-Pack (1g) followed closely as the second highest seller. Memory Loss Pre-Roll 2-Pack (1g) maintained a strong performance, securing the third position, consistent with its earlier ranking in October 2025. GMO Pre-Roll 2-Pack (2g) and GMO Shake (Bulk) rounded out the top five, indicating a strong preference for pre-roll products. Notably, Memory Loss Pre-Roll retained its rank from October, while the other products have newly entered the rankings in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.