Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

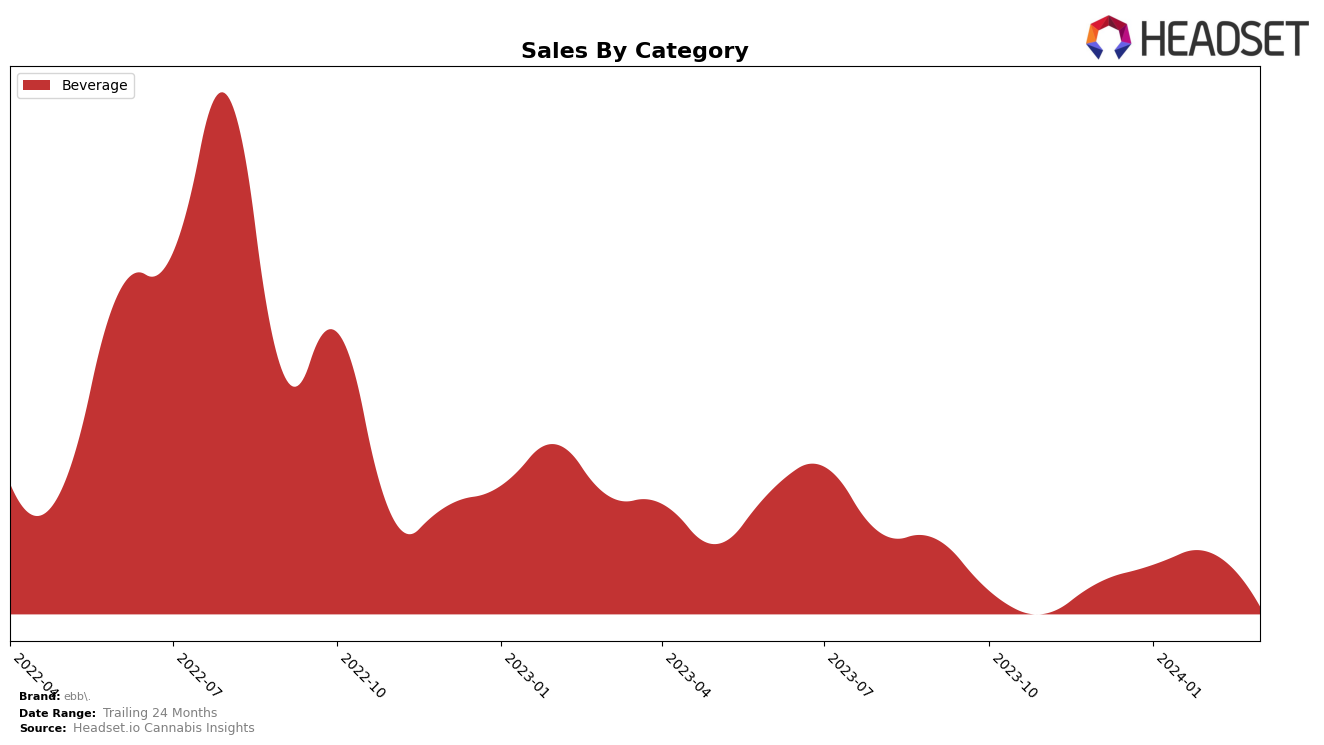

In the competitive cannabis market of Colorado, the brand ebb. has shown a notable performance within the Beverage category, demonstrating a fluctuating yet promising trajectory over the recent months. Starting from December 2023, ebb. was ranked 12th, and it saw a steady climb to 9th place by February 2024, indicating a growing consumer preference and market share in this category. However, there was a slight dip to 11th place in March 2024. This movement, coupled with a significant sales increase from 3011.0 in December to 5139.0 in February, reflects ebb.'s strong market presence and consumer acceptance in Colorado. The drop in rank in March, despite high previous sales, suggests a dynamic market environment where brand positions can change quickly, underscoring the importance of continuous innovation and marketing efforts to maintain or improve market standing.

While the provided data focuses solely on ebb.'s performance in the Beverage category within Colorado, it hints at a broader narrative of the brand's journey and its resilience in a highly competitive market. The absence of data for other states or provinces might indicate that ebb.'s presence is either concentrated in Colorado or that its performance in other regions has not ranked within the top 30 brands, which could be seen as an area for growth or improvement. The fluctuation in ranking, despite an initial sales increase, highlights the volatile nature of consumer preferences and market dynamics in the cannabis industry. For potential investors or stakeholders, these movements suggest that while ebb. has a strong foothold in the Colorado cannabis beverage market, there are opportunities and challenges ahead in maintaining and expanding its market share.

Competitive Landscape

In the competitive landscape of the beverage category in Colorado, ebb. has experienced a notable fluctuation in its market position over the recent months. Initially ranked 12th in December 2023, ebb. saw a significant improvement, climbing to 9th by February 2024, before slightly dropping to 11th in March 2024. This trajectory suggests a volatile market presence, with sales peaking in February before a sharp decline in March. Competitors such as Highgrade Brands have maintained a more stable position, consistently ranking around the 10th to 11th spots and even overtaking ebb. in March. Meanwhile, The Myx has shown significant growth, moving from 10th to 9th, and outperforming ebb. in both rank and sales by a considerable margin in March 2024. Another notable competitor, Betty, despite starting from a lower rank, has shown impressive growth, indicating a potential future threat to ebb.'s market share. This competitive analysis highlights the importance of monitoring both stable players like Highgrade Brands and fast movers like The Myx and Betty, as ebb. seeks to improve its market position and sales performance in a highly competitive sector.

Notable Products

In March 2024, ebb's top-performing product was the Orange Mango Dissolvable THC Powder (100mg) within the Beverage category, maintaining its number one rank from February and achieving sales of 86 units. Following closely was the Pink Lemonade Dissolvable THC Powder (100mg), which also held its position from the previous month, ranking second. Notably, the Pure Drink Dissolvable THC Powder (100mg), which was previously ranked in the top during January and December 2023, dropped out of the rankings by March 2024. The Wildberry Dissolvable THC Powder (100mg), despite leading the sales in December 2023 and being the top product in January 2024, saw a decrease in its ranking, eventually not being ranked in March. This shift highlights a changing consumer preference within ebb's beverage category, with Orange Mango and Pink Lemonade emerging as the preferred choices over time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.