Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

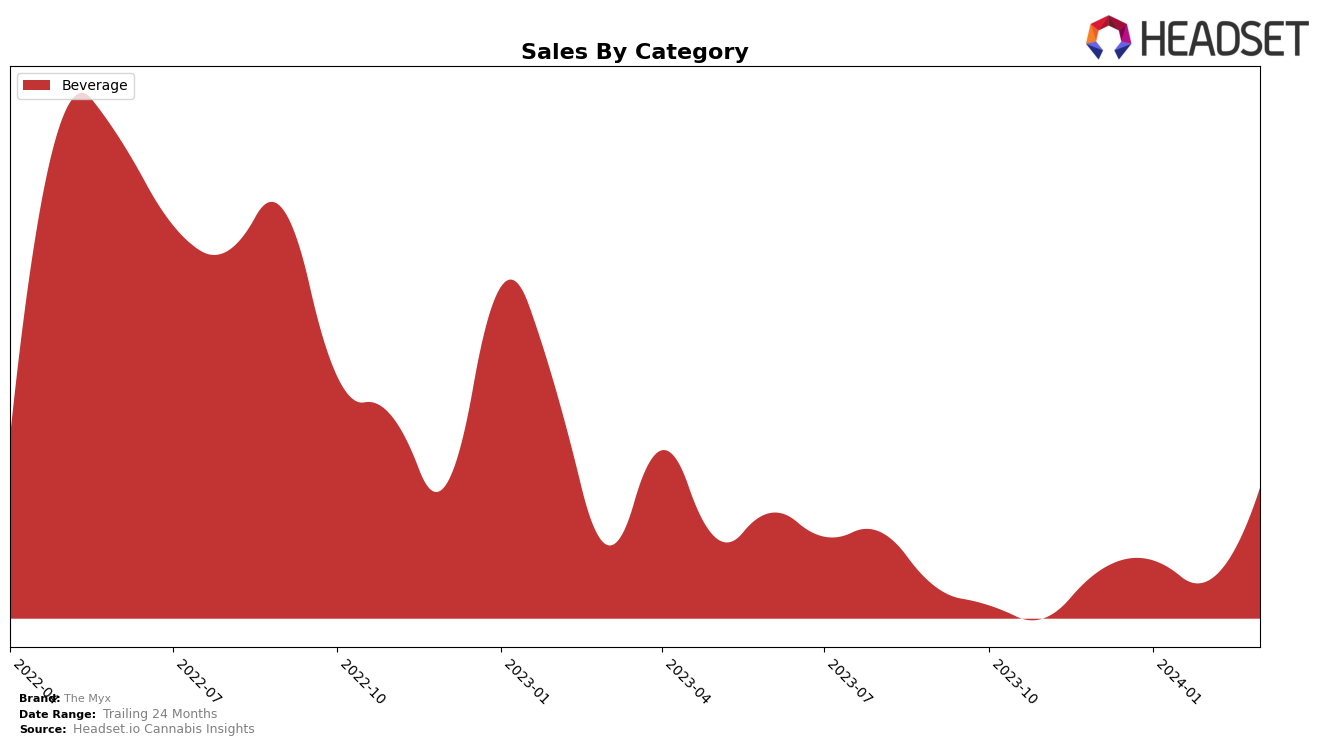

In the Colorado market, The Myx has shown a consistent presence within the Beverage category, maintaining its position within the top 10 brands across the reported months. Starting from December 2023, The Myx held the 10th position, slightly improved to 9th in January 2024, returned to 10th in February, and then moved back up to 9th in March 2024. This fluctuation indicates a stable consumer demand for The Myx's beverage offerings in Colorado, with a notable sales increase in March 2024 to 5985.0, showcasing a peak in consumer interest or possibly effective marketing strategies during this period. The brand's ability to remain within the top 10, despite minor rank adjustments, highlights its resilience and potential for growth within Colorado's competitive cannabis beverage market.

However, the absence of The Myx from the top 30 brands in any other state or province categories outside of Colorado suggests a significant opportunity for expansion or an indication of focused market penetration efforts. The brand's performance in Colorado, particularly within the Beverage category, could serve as a strong foundation for exploring additional markets or categories. The consistent top 10 ranking, alongside the sales uptick in March 2024, points towards a loyal consumer base and a potentially untapped market outside of Colorado. For The Myx, leveraging its success in Colorado could open doors to new markets, although the brand's current focus appears to be on solidifying its position and possibly expanding its product range within the state.

Competitive Landscape

In the competitive landscape of the cannabis beverage category in Colorado, The Myx has shown a notable fluctuation in its market position from December 2023 to March 2024. Initially ranked 10th in December, The Myx improved its standing to 9th in January and February, before slightly dropping to 9th again in March. This movement is indicative of a fiercely competitive market, especially when compared to Major, a leading competitor that held its 6th position steadily until it experienced a slight dip to 7th in March. Another notable competitor, Bosky Labs, showed resilience by maintaining its rank around the 7th and 8th positions, indicating a stable consumer base. ebb., on the other hand, displayed significant volatility, moving from 12th to 11th, showcasing the dynamic nature of consumer preferences in this category. Despite these challenges, The Myx's sales trajectory from December to March suggests a positive growth trend, outpacing Highgrade Brands and ebb. in terms of sales growth, highlighting The Myx's potential to further climb the ranks in Colorado's competitive cannabis beverage market.

Notable Products

In March 2024, the top-performing product for The Myx was the Fast Acting Dissolvable Powder (100mg) within the Beverage category, maintaining its number one rank consistently from December 2023 through March 2024. This product achieved remarkable sales figures in March, reaching 387 units sold. Notably, its sales in March showed a significant increase from the previous months, highlighting its growing popularity among consumers. The consistent top ranking over four months underscores its strong market presence and consumer preference. This performance indicates a steady demand for the Fast Acting Dissolvable Powder (100mg), solidifying its position as a leading product in The Myx's lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.