Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

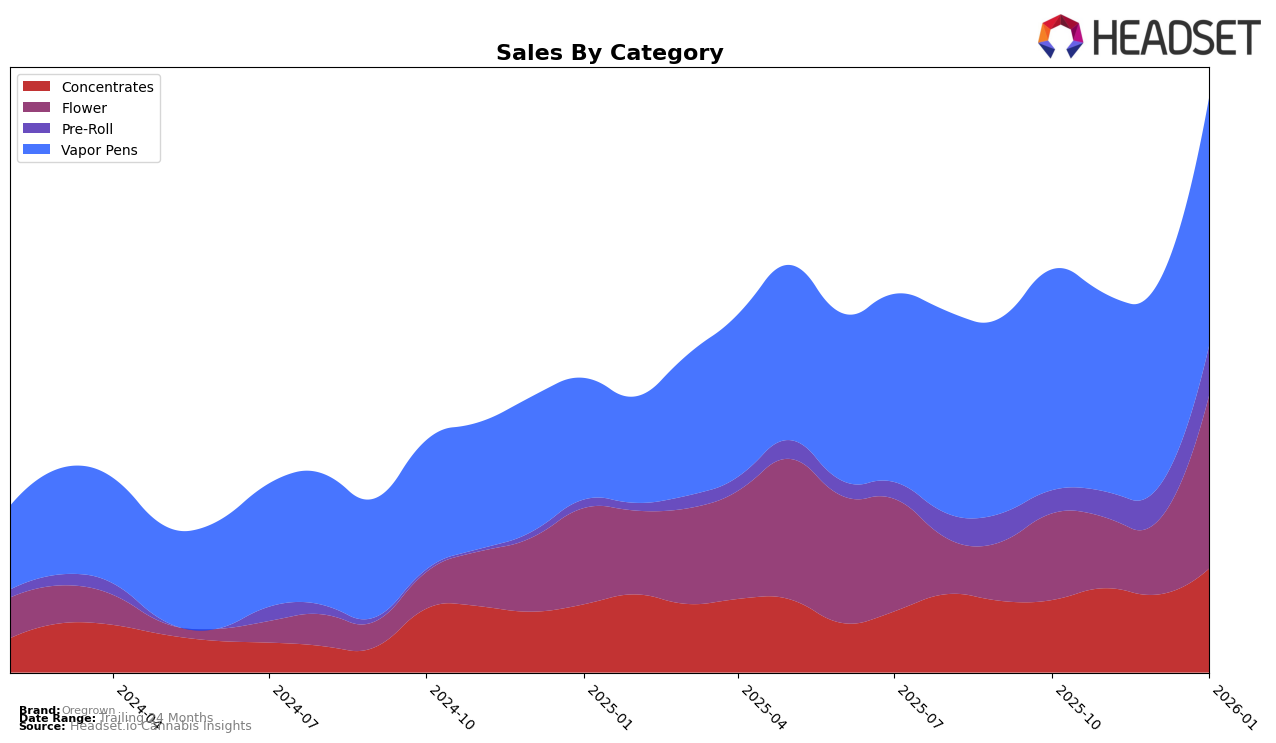

Oregrown has demonstrated a consistent performance in the Oregon cannabis market, particularly within the Concentrates category. Over the past few months, the brand has maintained a stable third-place ranking in this category, suggesting a strong foothold and consumer preference. This consistent ranking indicates that Oregrown has successfully captured a significant share of the Concentrates market, which is further supported by a notable increase in sales from October to January. However, their performance in the Flower category has seen more volatility, with rankings fluctuating from 8th to 13th before achieving an impressive jump to 3rd place by January. This upward movement in the Flower category could suggest strategic adjustments or successful marketing efforts that have resonated well with consumers.

In the Pre-Roll category, Oregrown has shown a positive trend, climbing from a 21st place rank in October and November to 10th place by January. This improvement in ranking is indicative of growing consumer interest and possibly an enhancement in product offerings or distribution strategies. Meanwhile, in the Vapor Pens category, Oregrown has also experienced a positive trajectory, moving from the 9th position in October to 5th by January. This rise in ranking, coupled with increased sales, highlights a strengthening position in the Vapor Pens market. Notably, Oregrown's absence from the top 30 in any other states or categories suggests a concentrated focus on the Oregon market, where they appear to be capitalizing on their brand strength and consumer loyalty.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Oregrown has shown a notable improvement in its market position from October 2025 to January 2026. Initially ranked 9th in October, Oregrown experienced a slight dip to 10th in November and December, before making a significant leap to 5th place in January 2026. This upward trajectory in rank is indicative of a strategic shift or successful campaign that resonated well with consumers, as evidenced by the increase in sales from December to January. In contrast, competitors like NW Kind and Farmer's Friend Extracts maintained relatively stable positions, consistently ranking around 6th and 7th, respectively. Meanwhile, Hellavated and FRESHY have consistently outperformed Oregrown, with FRESHY climbing to 3rd place by January. This competitive analysis suggests that while Oregrown is gaining momentum, it still faces strong competition from established brands in the Oregon vapor pen market.

Notable Products

In January 2026, Garlic Cocktail (Bulk) from the Flower category reclaimed its top spot with impressive sales of 4028 units, marking a significant increase from previous months where it was not ranked. High Desert Sour Sage Pre-Roll (1g) rose to second place, showing strong performance with sales reaching 3070 units. Hash Burger Infused Pre-Roll (1g) debuted at third place, indicating a successful entry into the market. Pineapple Cake Pre-Roll (1g) fell from its leading position in December 2025 to fourth place, despite maintaining solid sales figures. Swiss Watch Pre-Roll (1g) also experienced a drop in ranking from second in December to fifth in January, reflecting a competitive pre-roll market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.