Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

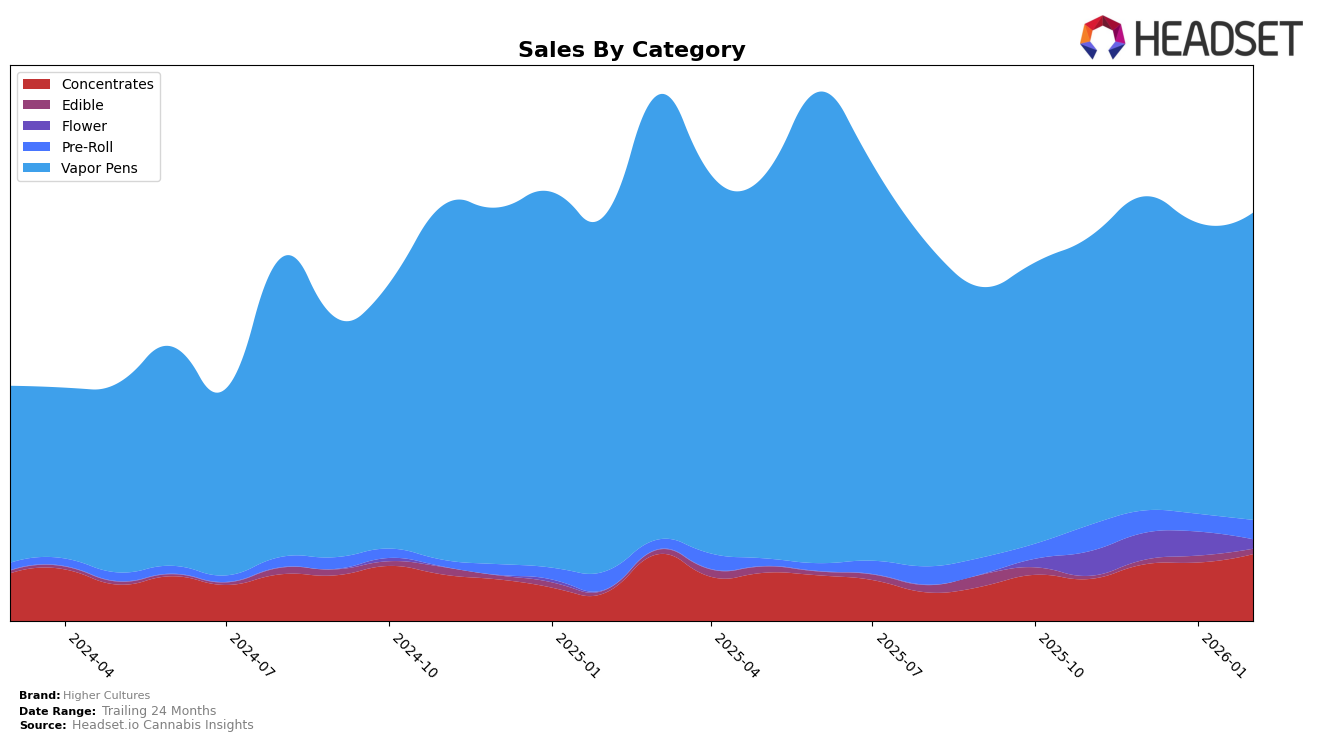

Higher Cultures has shown notable performance across different categories in Oregon. In the Concentrates category, the brand has climbed the ranks steadily, moving from 22nd place in November 2025 to 13th by February 2026. This upward trajectory is accompanied by a significant increase in sales, suggesting a growing consumer preference for their concentrates. However, in the Flower category, Higher Cultures did not make it into the top 30 in November, and by December, they ranked at 99, indicating a challenge in penetrating this market segment. This contrast highlights the brand's varying performance across categories, suggesting potential areas for strategic focus and improvement.

In the Pre-Roll category, Higher Cultures experienced a slight decline in their ranking from 47th in November 2025 to 53rd by February 2026. This downward trend in rankings, along with a decrease in sales, suggests that the brand may need to reassess its offerings or marketing strategies in this area. Conversely, in the Vapor Pens category, Higher Cultures maintained a strong position, consistently ranking around 12th and improving slightly to 11th in February 2026. The sales figures in this category remained robust, indicating a stable demand for their vapor pen products. This performance across categories in Oregon provides insights into where Higher Cultures is excelling and where they might focus efforts to enhance their market presence further.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Higher Cultures has shown a steady presence, maintaining a rank of 12th from November 2025 to January 2026, before slightly improving to 11th in February 2026. This consistent ranking indicates a stable market position amidst fluctuating sales figures. Notably, Farmer's Friend Extracts has consistently outperformed Higher Cultures, ranking between 6th and 9th during the same period, suggesting a stronger market hold. Similarly, White Label Extracts (OR) maintained a competitive edge, hovering around the 9th and 10th positions. Meanwhile, Echo Electuary and Altered Alchemy trailed behind Higher Cultures, with ranks consistently lower, indicating that Higher Cultures is outperforming these brands. The data suggests that while Higher Cultures is holding its ground, there is room for growth to climb higher in the rankings by potentially capturing market share from its closest competitors.

Notable Products

In February 2026, the top-performing product for Higher Cultures was The Limit - Blue Razz Distillate Disposable (2.5g) in the Vapor Pens category, which climbed to the number one rank with impressive sales of 1319 units. Following closely behind, The Limit - Strawnana Distillate Disposable (2.5g) held the second position, demonstrating a slight dip from its first-place rank in January. The Limit - Peach Mango Flavored Distillate Cartridge (1g) secured the third spot, marking its debut in the rankings. Magic Melon Flavored Distillate Disposable (2.5g) entered the list at fourth place, showing a strong introduction. The Limit - Tangie Flavored Distillate Cartridge (1g) rounded out the top five, dropping from second place in November 2025 to fifth in February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.