Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

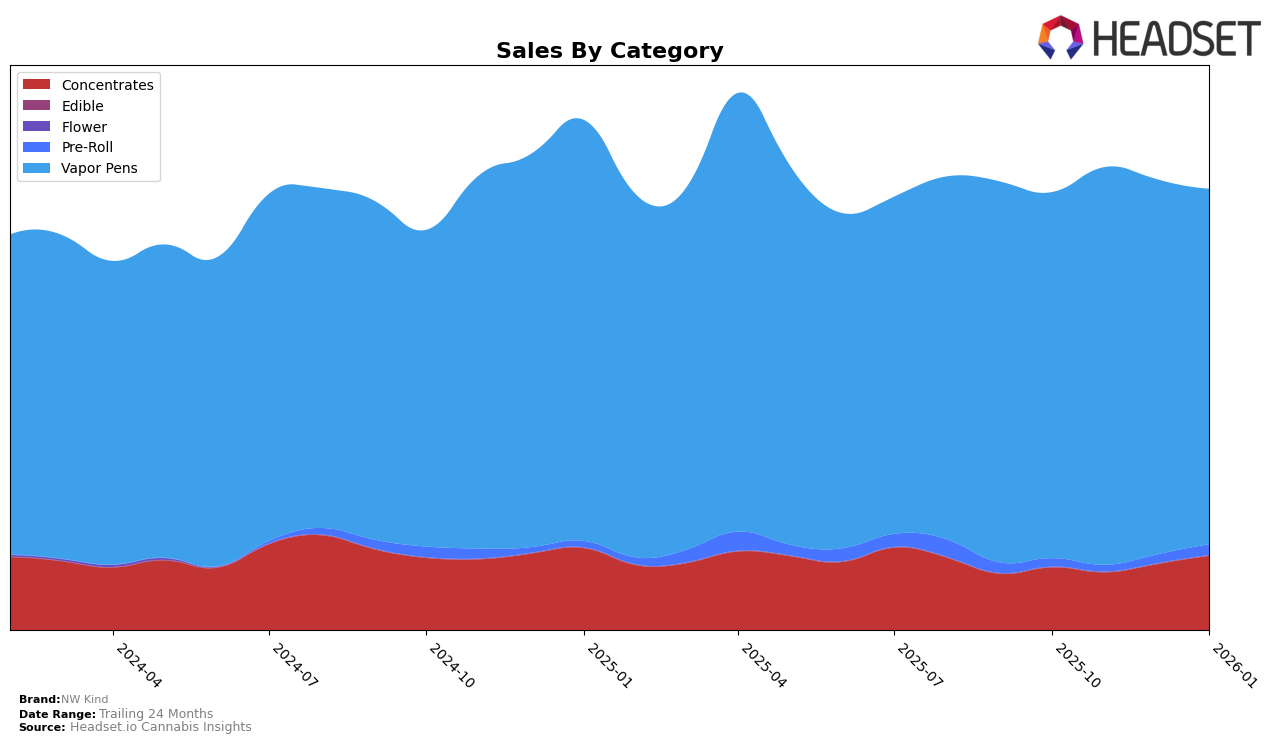

NW Kind has shown a dynamic performance across different product categories, particularly in the state of Oregon. In the Concentrates category, the brand has demonstrated a notable upward trajectory, moving from a rank of 13 in November 2025 to 7 in January 2026. This positive movement is mirrored by an increase in sales, culminating in a strong start to the year. Conversely, in the Pre-Roll category, NW Kind did not make it into the top 30 rankings until January 2026, when it secured the 58th position. This absence from the top rankings over several months could indicate challenges in market penetration or competition in this specific category.

The Vapor Pens category has been a consistent area of strength for NW Kind in Oregon. The brand has maintained a position within the top 10, fluctuating slightly between the 6th and 7th ranks over the observed months. This stability suggests a strong consumer base and a reliable product performance in this segment. While the sales figures show a slight decrease from November to January, the overall ranking stability indicates that NW Kind has effectively sustained its market presence. The data suggests that NW Kind's strategic focus on Vapor Pens and Concentrates has been beneficial, although there may be opportunities to further enhance their position in the Pre-Roll category.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, NW Kind has demonstrated a consistent performance, maintaining a steady rank of 6th or 7th from October 2025 to January 2026. This stability is noteworthy, especially when compared to competitors like Oregrown, which saw a significant leap from 10th to 5th place in January 2026, indicating a potential threat to NW Kind's market position. Meanwhile, Farmer's Friend Extracts mirrored NW Kind's rank fluctuations, suggesting a close rivalry. Hellavated consistently outperformed NW Kind, holding a top 4 position throughout the period, which highlights the competitive pressure from higher-ranked brands. Loot Bar maintained a stable 8th place, posing less of a competitive threat. NW Kind's sales peaked in November 2025, but the subsequent decline by January 2026 suggests a need for strategic adjustments to regain momentum and counteract the rising competition from brands like Oregrown.

Notable Products

In January 2026, the top-performing product for NW Kind was the Wedding Cake Distillate BHO Cartridge (1g) in the Vapor Pens category, achieving the highest sales with 1346 units sold. Following closely were the Grape Pie Live Resin BHO Cartridge (1g) and Devil's Den Live Resin Cartridge (1g), ranked second and third respectively. Notably, Blue Dream Distillate BHO Cartridge (1g), which held the top rank in both November and December 2025, dropped to fourth place in January 2026. Francos Lemon Liquid Live Resin Cartridge (1g) secured the fifth position, marking its entry into the top five. This shift in rankings highlights a dynamic change in consumer preferences within the Vapor Pens category over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.