Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

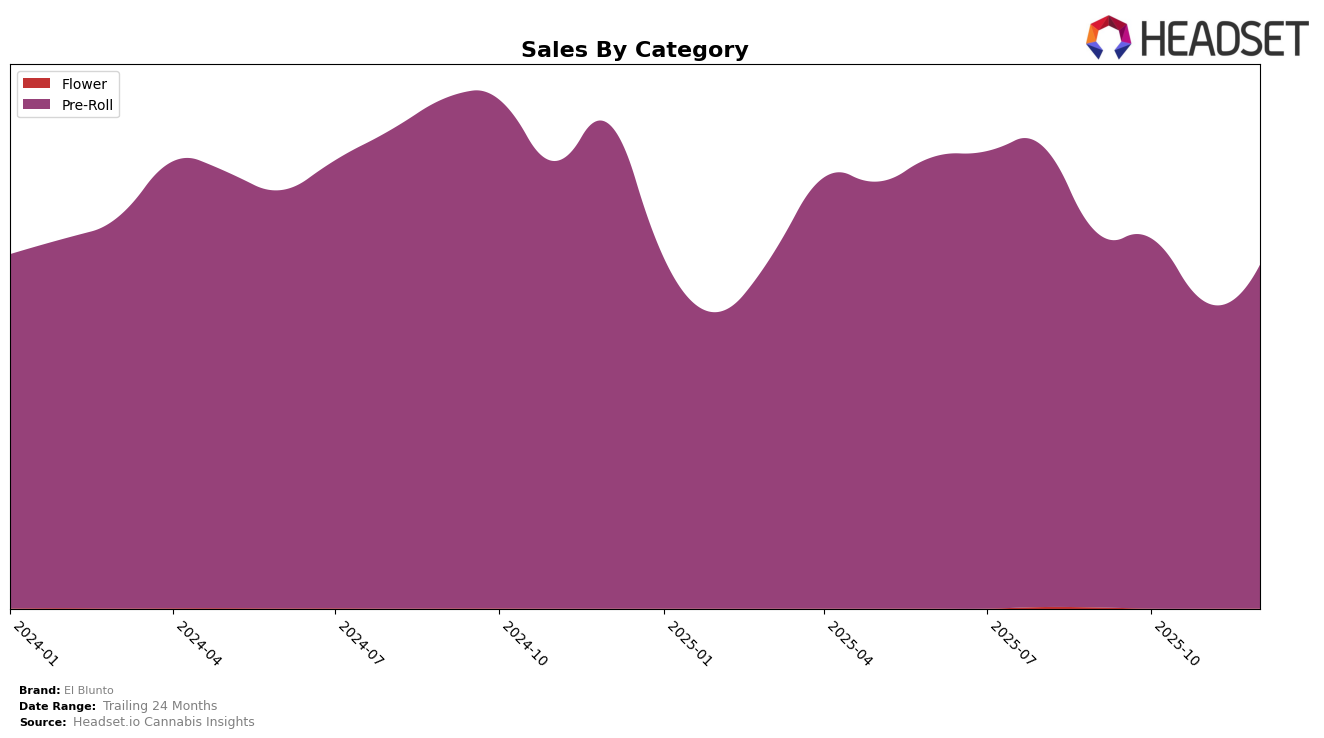

El Blunto's performance in the Pre-Roll category shows a varied trajectory across different states and provinces. In Alberta, the brand managed to re-enter the top 30 rankings in December 2025, after slipping out in November. This resurgence indicates a positive trend, although the brand's position remains on the edge of the top 30. In contrast, Arizona reflects a more encouraging upward movement, with El Blunto improving its ranking from 51st in November to 43rd in December. This notable jump suggests a growing market presence in Arizona, despite not being in the top 30. Meanwhile, British Columbia saw El Blunto climb from 64th in October to 44th by December, indicating a significant upward trajectory in this region as well.

In California, El Blunto's ranking has seen a downward trend, falling from 48th in September to 60th by December 2025. This decline highlights challenges in maintaining a competitive edge in a highly saturated market. On the other hand, Ontario presents a more stable performance, with El Blunto consistently ranking around the mid-40s, showing resilience despite fluctuations in sales. These movements across different markets underscore the varying dynamics El Blunto faces in different regions, with some areas showing promising growth potential while others indicate room for strategic improvement.

Competitive Landscape

In the competitive landscape of the Ontario pre-roll market, El Blunto has experienced fluctuating rankings, reflecting a dynamic market environment. As of December 2025, El Blunto holds the 49th rank, a slight improvement from November but still a drop from its 46th position in September and October. This indicates a competitive pressure from brands like Jonny Chronic, which, despite a dip, maintains a stronger presence with a December rank of 48. Meanwhile, Color Cannabis is showing a consistent upward trend, moving from 52nd in September to 46th in December, potentially threatening El Blunto's market share. Additionally, Sheeesh! and Nugz (Canada) are also notable competitors, with Sheeesh! closely trailing El Blunto at 50th rank in December. These dynamics suggest that while El Blunto remains a key player, it faces significant competition that could impact its sales trajectory if not addressed strategically.

Notable Products

In December 2025, El Blunto's top-performing product was Cullinan Diamond Infused Blunt (2g), maintaining its number one rank for the fourth consecutive month with sales of 6,794 units. Yacht Master Punch Hash Diamond Infused Pre-Roll (2g) held steady in the second position, showing a notable increase in sales from the previous month. Pink Legacy Diamond Infused Blunt (2g) remained in the third spot, continuing its consistent performance since October. Yacht-Master Punch Hash Infused Blunt (2g) also retained its fourth place, showing an upward trend in sales. El Bluntito - Viva Blunt (0.75g) stayed in fifth position, indicating a slight decline in sales compared to prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.