Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

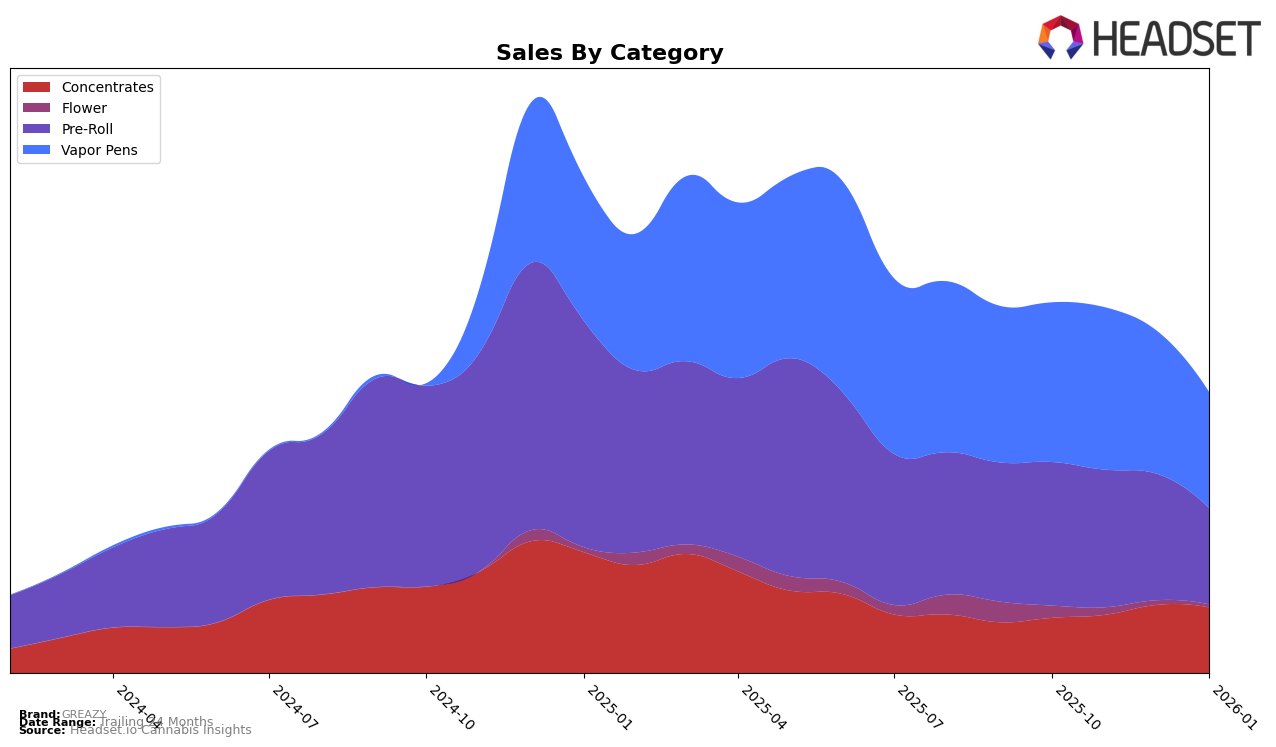

In the Canadian cannabis market, GREAZY has shown varied performance across different provinces and product categories. Notably, in Ontario, the brand has maintained a strong presence in the Concentrates category, consistently ranking within the top 30 brands. From October 2025 to January 2026, GREAZY improved its ranking from 22nd to 18th, indicating a positive trajectory. This upward movement is supported by a steady increase in sales during this period. However, the brand's performance in the Pre-Roll category in Ontario tells a different story, as it slipped from 54th to 63rd place by January 2026, suggesting challenges in maintaining market share in this segment.

Meanwhile, in Alberta, GREAZY's Vapor Pens have struggled to break into the top 30, with rankings hovering in the mid-60s to mid-70s. This indicates a challenging market environment or possibly a need for strategic adjustments to boost their presence. Sales figures in this category have shown a downward trend, culminating in a significant drop by January 2026. In contrast, Ontario's Vapor Pens segment saw GREAZY maintaining a relatively stable position within the top 35, although a slight decline was observed by the end of the period. These insights suggest that while GREAZY has strengths in certain categories and regions, there are areas where the brand needs to focus on improvement to enhance its market position.

Competitive Landscape

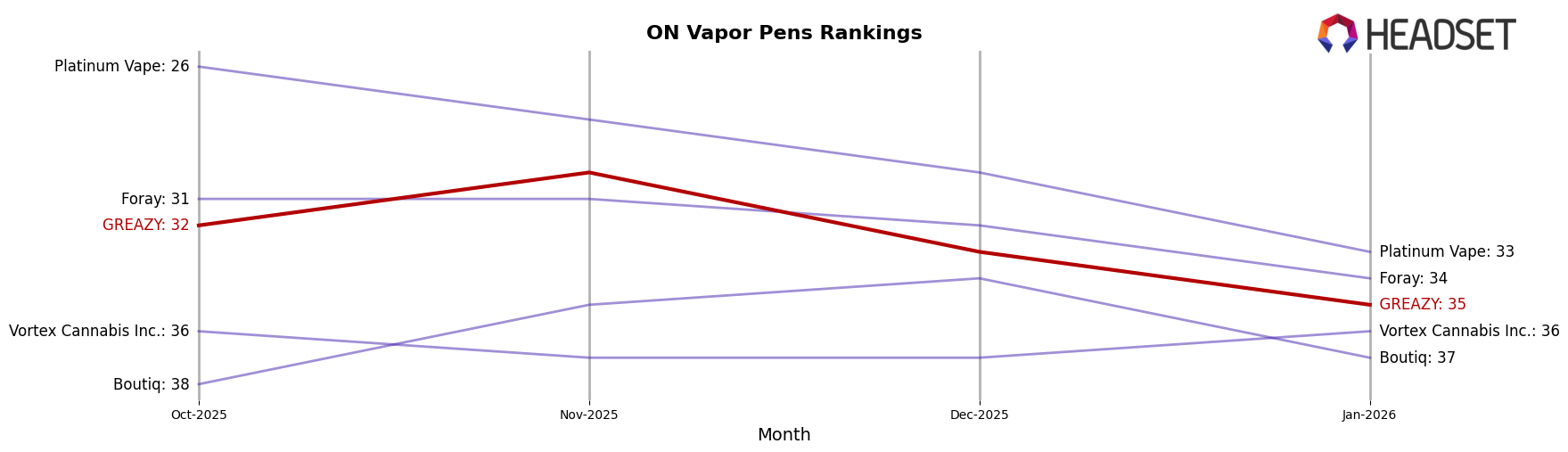

In the Ontario Vapor Pens category, GREAZY has experienced a fluctuating performance in terms of rank and sales over the past few months. As of January 2026, GREAZY is ranked 35th, a decline from its peak at 30th in November 2025. This downward trend in rank is mirrored by its sales, which have decreased from November's high. Notably, competitors such as Platinum Vape and Foray have also seen declining sales and rank, with Platinum Vape dropping from 26th to 33rd and Foray from 31st to 34th over the same period. Meanwhile, Vortex Cannabis Inc. and Boutiq have shown more stability, with Boutiq even improving its rank slightly from 38th to 37th. This competitive landscape suggests that while GREAZY faces challenges in maintaining its position, the overall market dynamics are affecting multiple brands, indicating potential opportunities for strategic adjustments to regain momentum.

Notable Products

For January 2026, the top-performing product for GREAZY was the Grape God Liquid Diamonds Cartridge (1g) in the Vapor Pens category, maintaining its top rank from the previous months with sales of 3622 units. The MAC10 Diamonds & Sauce Infused Pre-Roll (1g) held steady in the second position, consistent with its ranking in December 2025. Orange Kush CK Double Infused Pre-Roll (1g) remained in third place, showing a stable performance across the months. The Bling Infused Blunt (1.5g) improved to fourth place from its previous fifth-place ranking in November 2025. Notably, Afghan Black Hash (2g) debuted in the rankings at fifth place, indicating a new entry in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.