Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

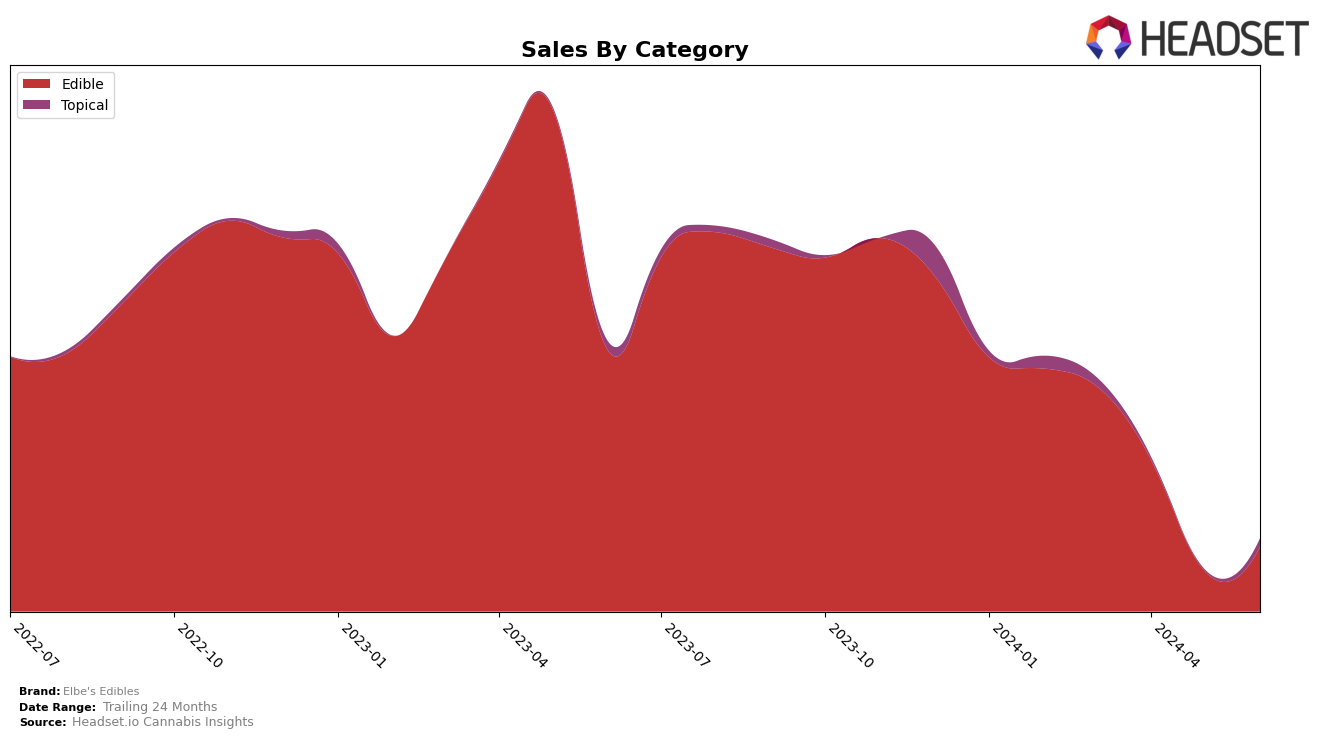

Elbe's Edibles has shown a varied performance across different states and categories over the past few months. In Oregon, the brand ranked 29th in the Edible category in March 2024, but subsequent months did not see them in the top 30. This indicates a potential decline or increased competition in the market that has affected their visibility. The sales figure for March 2024 was $14,045, but without further data for the following months, it's difficult to ascertain whether this was a one-time dip or part of a larger trend. The absence from the top 30 in the following months could be viewed as a negative indicator, suggesting that the brand needs to reassess its strategies in Oregon.

While the data from Oregon provides some insight, it’s important to consider that Elbe's Edibles may have different performances in other states or categories which are not highlighted here. The lack of rankings in April, May, and June 2024 might suggest that the brand is facing challenges in maintaining its position in a highly competitive market. However, without data from other states or categories, it's premature to draw a comprehensive conclusion. Observing the brand's movements in other regions and categories would provide a more holistic view of its overall market performance.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, Elbe's Edibles has experienced notable fluctuations in rank and sales. As of March 2024, Elbe's Edibles was ranked 29th, but it did not appear in the top 20 brands in the subsequent months, indicating a potential decline in market presence. In contrast, Green State of Mind showed a positive trend, moving from outside the top 20 to 31st in May and 29th in June 2024. Similarly, SugarTop Buddery entered the rankings at 31st in April 2024. Dirty Arm Farm also demonstrated competitive resilience, ranking 29th in May and 30th in June 2024. The most significant competitor, Verdant Leaf Farms, showed a strong upward trajectory, moving from 28th in April to 24th in May 2024, with substantial sales increases. These shifts suggest that Elbe's Edibles may need to reassess its market strategies to regain its competitive edge in the dynamic Oregon edible cannabis market.

Notable Products

In June 2024, the top-performing product for Elbe's Edibles was the Cold Brew Coffee Hard Candy 10-Pack (50mg), maintaining its number one rank from April and May, with notable sales of 88 units. The CBD:THCa:THC Deep Lotion (80mg CBD, 26mg THCa, 14mg THC) rose to the second position, showing a significant improvement from its fifth place in May. The Orange Dreamsicle Cakeball Bites 10-Pack (100mg) secured the third position, marking a return to the top ranks after being absent in April and May. The Salty Caramel Hard Candy 10-Pack (50mg) dropped to third place from its previous top rank in May. Lastly, the Chocodoodle Cookie (50mg) entered the rankings in fourth place, indicating a strong debut in June.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.