Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

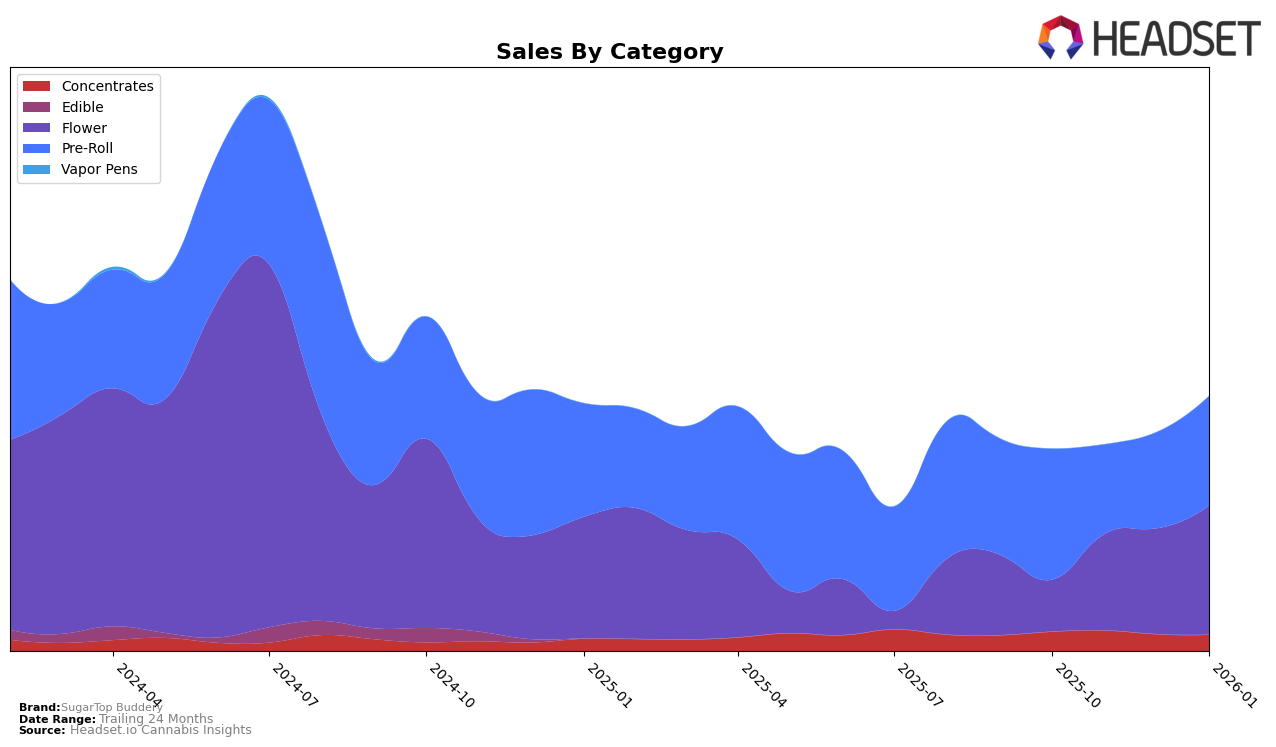

SugarTop Buddery has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand has struggled to break into the top 30, with rankings slipping from 56th in October 2025 to 64th by January 2026. This decline in ranking is accompanied by a decrease in sales, indicating a potential area for improvement. On the other hand, the Flower category has seen a positive trajectory, with the brand climbing from 96th to 50th place over the same period. This upward movement suggests a strengthening position in the market, possibly due to successful product offerings or strategic marketing efforts.

The Pre-Roll category presents a mixed picture for SugarTop Buddery in Oregon. The brand maintained a consistent presence within the top 30, closing January 2026 in the same 29th position it held in October 2025. Despite fluctuations in sales figures, this stability in ranking may indicate a loyal customer base or effective distribution channels. However, the absence of top 30 rankings in the Concentrates category highlights a gap in market penetration that could be addressed to enhance overall performance. Further analysis could uncover the strategies behind the brand's success in the Flower category, which might be applied to improve standings in other segments.

Competitive Landscape

In the Oregon flower category, SugarTop Buddery has shown a remarkable upward trajectory in its rankings and sales over the past few months, indicating a growing presence in the market. Starting from a rank of 96 in October 2025, SugarTop Buddery climbed to 50 by January 2026, showcasing a significant improvement. This upward movement is notable when compared to competitors like Avitas, which maintained a relatively stable rank around the 40s, and Earl Baker, which experienced fluctuations, dropping from 31 in November to 62 in January. Meanwhile, Derby's Farm consistently held a strong position in the top 30s, indicating a robust market presence. The absence of Mana Extracts from the top 20 until January suggests a late but strong entry into the competitive landscape. SugarTop Buddery's consistent sales growth, from October's lower figures to a notable increase by January, highlights its potential to continue climbing the ranks and capturing market share from established brands.

Notable Products

In January 2026, SugarTop Buddery's top-performing product was Narnia (Bulk) in the Flower category, maintaining its first-place rank from December 2025 with sales of 1882 units. Following closely, Narnia (1g) also in the Flower category, moved up to the second position from the third in December, demonstrating significant growth with 1638 units sold. Mondo Bat - Smackdown Pie Pre-Roll (1g) secured the third spot, returning to the rankings with 1561 units sold. Mondo Bat - Narnia Pre-Roll (1g) debuted in the rankings at fourth place, indicating a strong market entry. Good Smoke - Smackdown Pie x Lemon Cherry Gelato Pre-Roll 10-Pack (5g) rounded out the top five, showing a promising start in its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.