Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

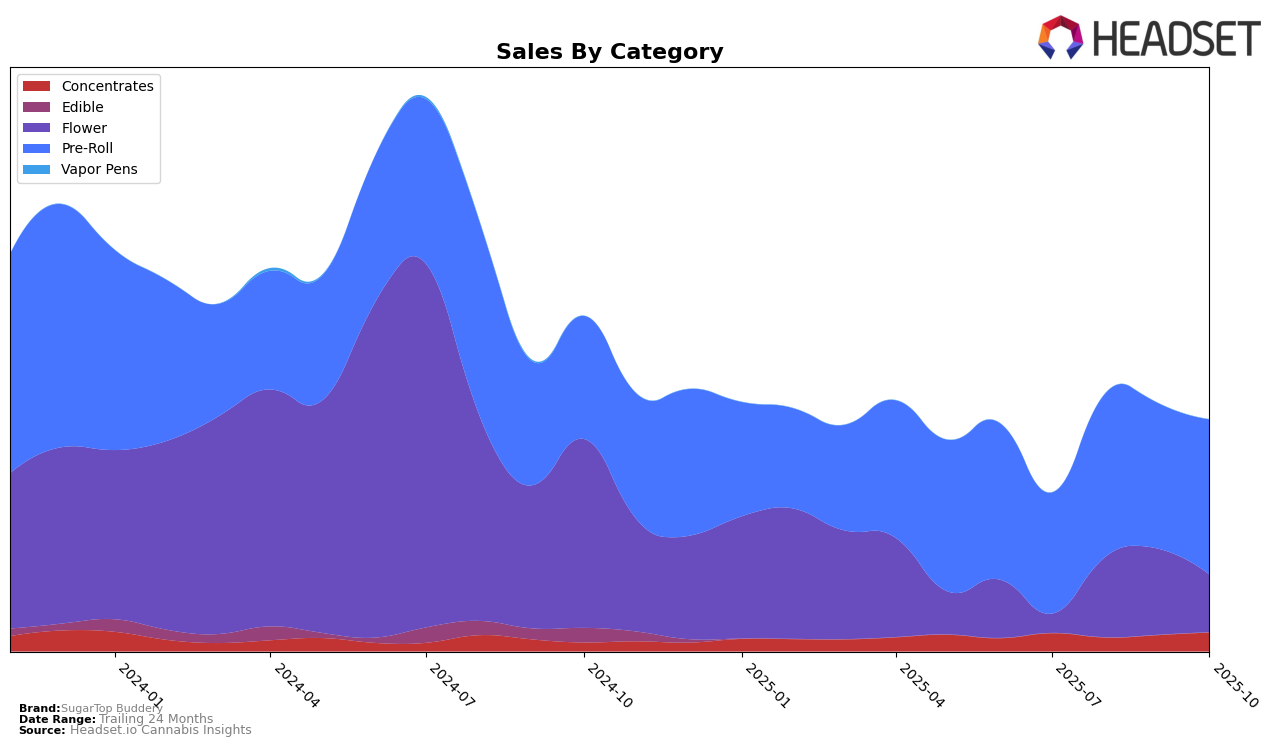

SugarTop Buddery has shown a dynamic performance across various cannabis product categories in Oregon. In the Concentrates category, the brand has experienced a steady improvement in rankings over the past months, climbing from 70th in August 2025 to 57th in October 2025. This upward trend is indicative of a positive reception in the market, potentially driven by an increase in sales from $13,206 in August to $17,987 in October. The Flower category, however, presents a contrasting picture. The brand was not in the top 30 in July and October, indicating fluctuating performance and potential challenges in maintaining a competitive edge in this segment. The August ranking at 82nd and a slight improvement to 63rd in September suggest some recovery, but the drop in October highlights ongoing volatility.

In the Pre-Roll category, SugarTop Buddery has maintained a strong presence in Oregon. The brand consistently ranked within the top 30, peaking at 22nd in August before stabilizing around the 24th position in October. This category appears to be a stronghold for the brand, with sales figures reflecting a robust performance, particularly in August when sales reached $157,538. The consistent ranking in the Pre-Roll category suggests a solid customer base and effective market strategy. However, the absence from the top 30 in the Flower category during July and October underscores the brand's need to address potential gaps in market penetration or product appeal within that segment.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, SugarTop Buddery has demonstrated a notable upward trajectory in its rankings and sales over the past few months. From July to October 2025, SugarTop Buddery improved its rank from 31st to 24th, showcasing a positive trend in market presence. This rise is particularly significant when compared to competitors like Grown Rogue, which saw a decline from 19th to 25th, and East Fork Cultivars, which remained relatively stable but did not surpass SugarTop Buddery's October rank. Meanwhile, Yin Yang made a substantial leap from 33rd to 22nd, indicating fierce competition in the top 20. Additionally, National Cannabis Co. surged from 48th to 23rd, closely trailing SugarTop Buddery. Despite these competitive pressures, SugarTop Buddery's consistent improvement in rank and sales suggests a strong brand performance and growing consumer preference within the Oregon pre-roll market.

Notable Products

In October 2025, the top-performing product for SugarTop Buddery was Stubby Bat - Crash Glow Pre-Roll (1g), maintaining its number one rank from September with notable sales of $1,996. Stubby Bat - Creme de Purps Pre-Roll (0.5g) held steady at the second position, showing a significant increase in sales compared to previous months. Twangie Pre-Roll (0.5g) emerged as the third top product, making its debut in the rankings. Twin Bats - Mango Mintality Pre-Roll 2-Pack (1g) and Twin Bats - Strawberry Sass Pre-Roll 2-Pack (1g) secured the fourth and fifth spots, respectively, both appearing in the top five for the first time. Overall, October saw a reshuffling in rankings with new entries making an impact in the pre-roll category for SugarTop Buddery.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.