Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

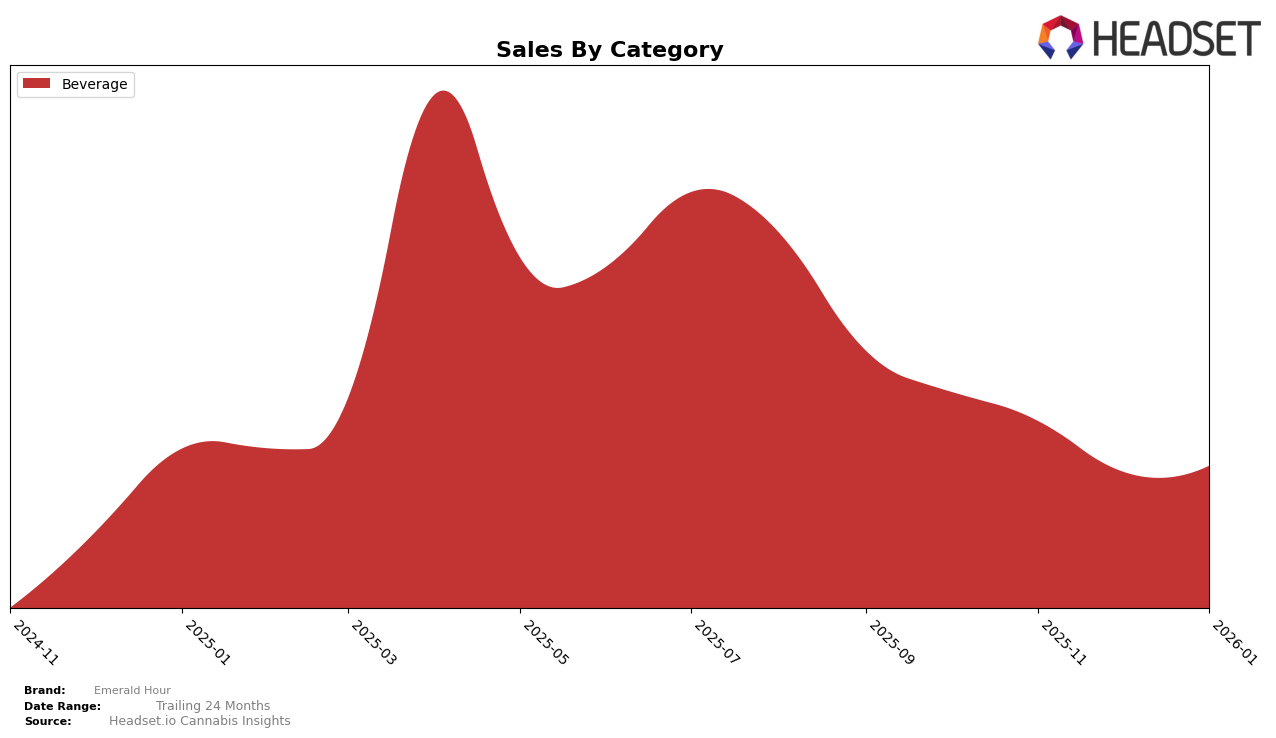

In the Ontario market, Emerald Hour has shown a noteworthy presence in the Beverage category. As of October 2025, the brand was ranked 25th, indicating a solid foothold in this competitive market. However, in the subsequent months of November, December, and January, Emerald Hour did not maintain a position within the top 30 brands. This absence from the rankings could suggest either a decline in market performance or increased competition within the category. The initial ranking in October highlights a potential area of strength for Emerald Hour, but the subsequent lack of ranking calls for a closer examination of market dynamics and brand strategy in Ontario.

Across other states and categories, Emerald Hour's performance remains less visible, as the brand did not appear in the top 30 rankings. This absence might reflect limitations in market penetration or a strategic focus on specific regions and categories. Without additional data, it's challenging to ascertain the exact reasons behind this performance, but it highlights the importance of strategic positioning and market adaptation. The performance in Ontario serves as a key indicator of the brand's potential, yet also underscores the need for diversification and enhanced competitive strategies to improve visibility and performance across a broader range of markets and categories.

Competitive Landscape

In the Ontario beverage category, Emerald Hour has shown a promising start, debuting at rank 25 in October 2025. This initial position is notable given that competitors like Deep Space and CQ (Cannabis Quencher) did not rank in the top 20 for the subsequent months, indicating a potential decline in their market presence. While Emerald Hour's sales figures were higher than those of these competitors in October 2025, the absence of ranking data for the following months suggests a need for strategic marketing efforts to maintain and improve its competitive position. The consistent presence of Emerald Hour in the rankings, albeit only for one month, highlights its potential to capture market share if it can leverage its initial momentum effectively.

Notable Products

In January 2026, Emerald Hour's top-performing product was the Cranberry Citrus Live Rosin Soda (10mg THC, 222ml) in the Beverage category, maintaining its number one rank for four consecutive months with sales of 1,037 units. The Agave Lime Sea Salt Live Rosin Soda (10mg THC, 222ml) also held steady in second place, consistent with its ranking since October 2025, with sales figures showing a slight increase to 634 units. These two sodas have dominated the rankings, indicating a strong preference for Emerald Hour's live rosin beverages. Notably, both products have seen a decrease in sales since October, though they remain the top choices among consumers. The consistent ranking suggests stable consumer loyalty and continued demand for these specific flavors.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.