Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

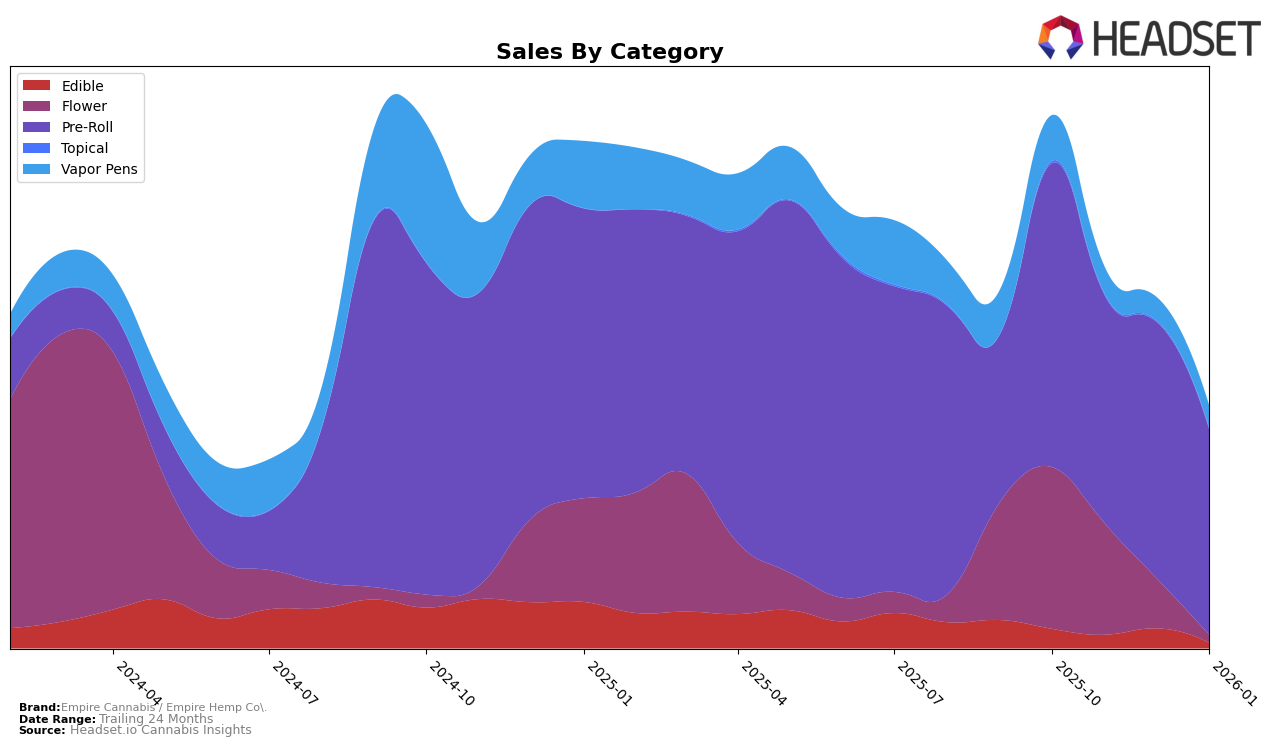

Empire Cannabis / Empire Hemp Co. has shown varied performance across different categories and states, with notable activity in the New York market. In the Pre-Roll category, the brand did not make it into the top 30 rankings from October 2025 to January 2026, indicating a challenging competitive landscape. The absence of a ranking in this category suggests that the brand may need to reassess its strategy or offerings to better capture market share. Despite this, the brand's sales figures in October and November 2025 hint at some level of consumer interest, although there's a noticeable decline in sales from October to November.

While Empire Cannabis / Empire Hemp Co. did not secure a top 30 position in the Pre-Roll category, the sales data suggests a potential opportunity for growth if strategic adjustments are made. The brand's performance highlights the importance of understanding regional market dynamics and consumer preferences. Without visibility into the December 2025 and January 2026 sales figures, it remains uncertain if the downward trend continued or if there was a rebound. However, the lack of a ranking in the top 30 during these months underscores the competitive pressures the brand faces in New York and possibly other markets.

Competitive Landscape

In the competitive landscape of the pre-roll category in New York, Empire Cannabis / Empire Hemp Co. has experienced a notable decline in both rank and sales over the observed months. Starting at rank 91 in October 2025, Empire Cannabis / Empire Hemp Co. fell to rank 100 by November 2025 and was absent from the top 20 by December 2025, indicating a significant drop in market presence. In contrast, competitors such as Matter. and P3 maintained more stable positions, with Matter. consistently ranking in the high 80s and P3 improving to rank 86 by December 2025. This suggests that Empire Cannabis / Empire Hemp Co. may need to reassess its market strategies to regain its competitive edge, as its sales figures also reflect a downward trend, contrasting with the upward sales trajectory seen in competitors like P3 during the same period.

Notable Products

In January 2026, Empire Cannabis / Empire Hemp Co. saw Mount'N Dew Haze Infused Pre-Roll (2g) rise to the top as the best-performing product, claiming the number one rank with sales of 562 units. Cherry Galaxy Infused Pre-Roll (2g) followed closely as the second-best seller, maintaining its position from December 2025. Lemon Cherry Head Infused Pre-Roll (2g), which previously held the top spot in December, slipped to third place. Trap Queen Infused Pre-Roll (2g) also experienced a drop, moving from second to fourth place. Notably, Strawberry Cough Distillate Cartridge (0.5g) entered the rankings in fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.