Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

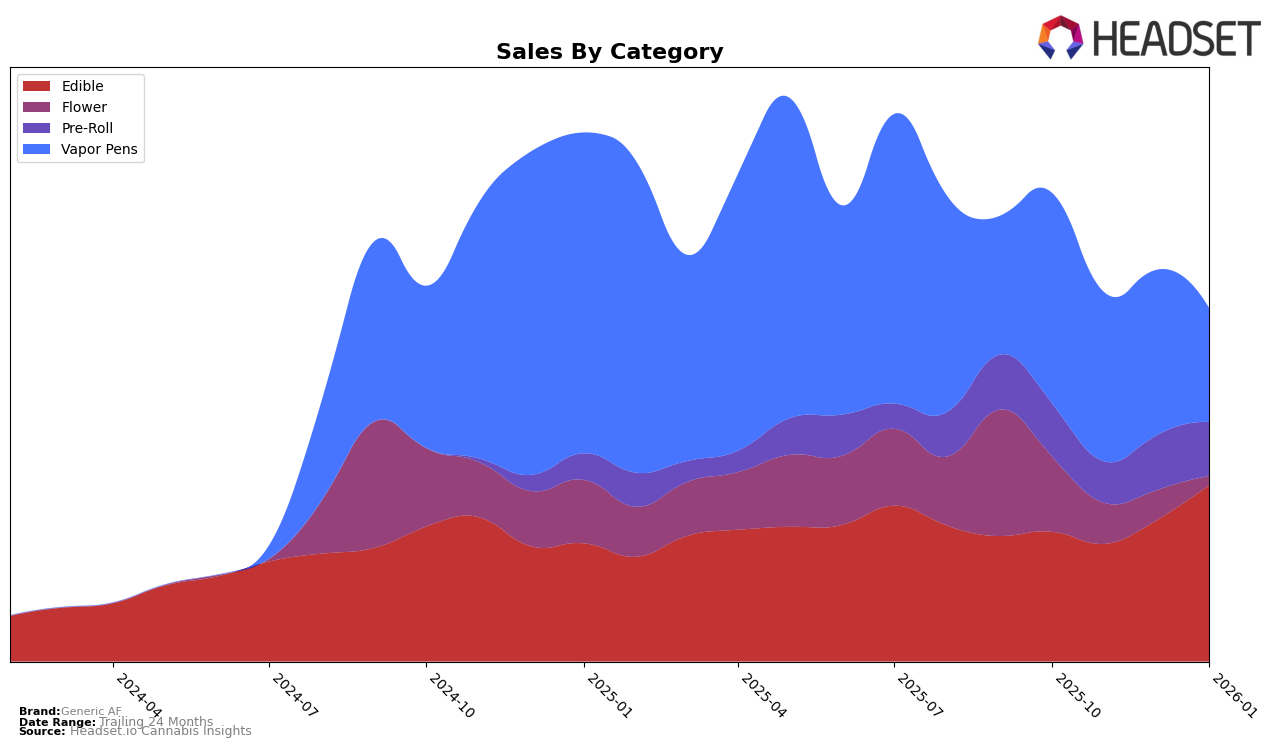

Generic AF's performance in the Illinois market for Vapor Pens has shown a notable decline over the past few months. Starting from October 2025, where they ranked 34th, they have gradually fallen out of the top 30, reaching the 46th position by January 2026. This downward trend is mirrored by a significant drop in sales, from $236,185 in October 2025 to $125,756 in January 2026. Such a decline suggests challenges in maintaining competitive positioning in Illinois, possibly due to increased competition or market saturation.

In contrast, New York presents a more mixed scenario for Generic AF. Their Edible category has shown consistent performance, maintaining a solid 21st rank through the last quarter of 2025 and improving to 19th in January 2026, indicating a strengthening position in this segment. However, their Flower category did not make it into the top 30 rankings, suggesting a weaker presence or lower consumer demand in this category. Meanwhile, their Vapor Pens in New York have seen fluctuations, dropping from 73rd to 91st before slightly recovering to 83rd. This inconsistency highlights potential volatility in consumer preferences or marketing strategies that could be impacting their standing in the Vapor Pens category. Overall, while there are areas of growth, Generic AF faces significant challenges in maintaining a strong foothold across various categories and states.

Competitive Landscape

In the competitive landscape of the New York edible cannabis market, Generic AF has demonstrated a noteworthy upward trajectory, particularly evident in its rank improvement from 21st to 19th place between December 2025 and January 2026. This positive shift contrasts with the performance of Kushy Punch, which slightly declined from 20th to 21st place during the same period, despite having higher sales figures. Meanwhile, Punch Extracts / Punch Edibles made a significant leap from 31st to 20th, indicating a strong recovery in sales. Snoozy maintained a stable position at 18th, consistently outperforming Generic AF in sales. However, Generic AF's ability to climb the ranks suggests effective strategies in capturing market share, even as it competes with brands like Foy, which held a steady 17th position with significantly higher sales. This analysis highlights Generic AF's potential for growth amidst a competitive environment.

Notable Products

In January 2026, the top-performing product for Generic AF was the Blue Raspberry Gummies 20-Pack (100mg) in the Edible category, maintaining its first-place rank from December 2025 with a sales figure of 3311 units. Cherry Gummies 20-Pack (100mg) rose to the second position, up from third in the previous three months, with 1989 units sold. Strawberry Gummies 20-Pack (100mg) fell to third place, despite a slight increase in sales to 1920 units. Blood Orange Gummies 20-Pack (100mg) moved up to fourth place, showing a consistent increase from its debut at fifth place in December. Fruit Punch Gummies 20-Pack (100mg) entered the rankings at fifth place, indicating a growing interest in new flavors within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.