Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

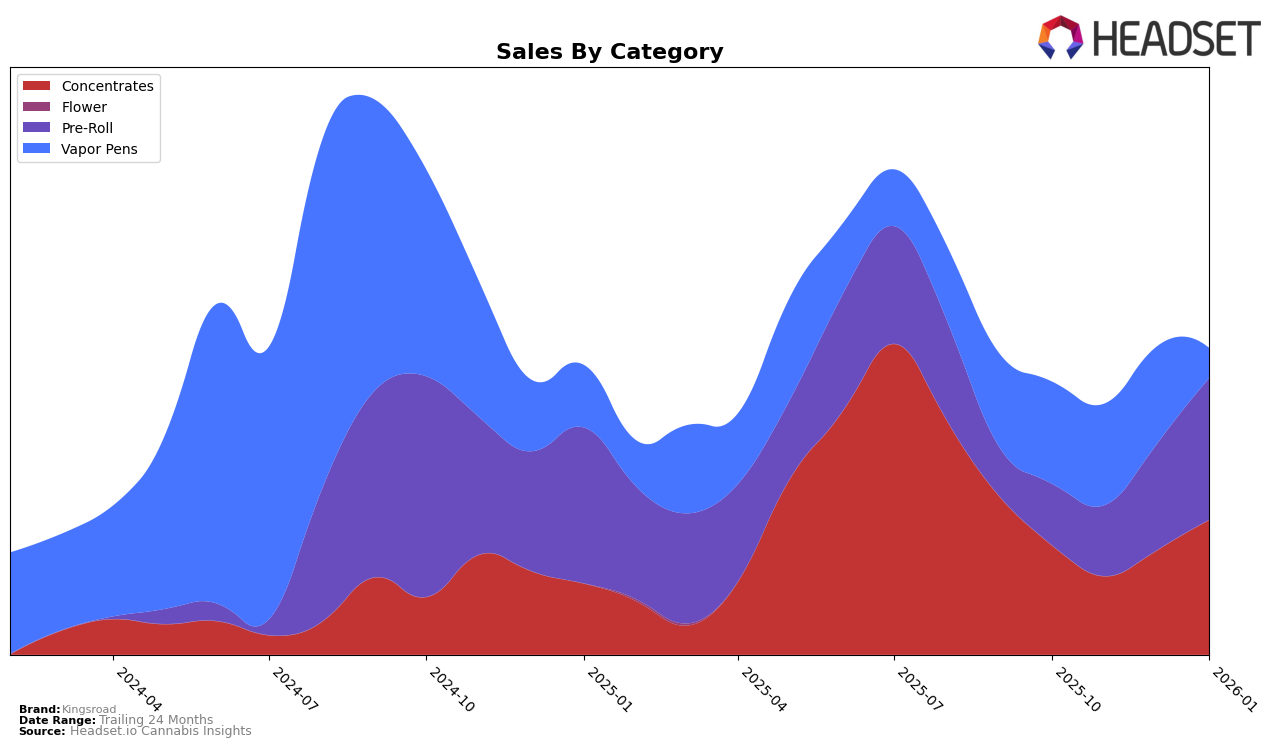

In the state of New York, Kingsroad has shown a dynamic performance across various cannabis categories. In the Concentrates category, the brand experienced notable fluctuations in its rankings, starting at 13th place in October 2025 and ending at 12th place in January 2026. This upward trend, particularly evident in January, suggests a positive reception in this segment. Meanwhile, in the Vapor Pens category, Kingsroad faced challenges, with a declining trajectory from 60th place in October to 87th place in January. This indicates potential hurdles in maintaining consumer interest or competition pressures in this category.

On the other hand, Kingsroad's journey in the Pre-Roll category is quite intriguing. The brand did not place in the top 30 in October, indicating a less competitive position initially. However, by January, Kingsroad made significant strides, climbing to 59th place. This improvement could reflect successful marketing strategies or product enhancements that resonated well with consumers over the months. Despite these gains, Kingsroad's absence from the top 30 brands in October highlights areas for potential growth and market penetration. These insights into Kingsroad's performance provide a snapshot of its strategic positioning and the competitive landscape in New York.

Competitive Landscape

In the competitive landscape of the New York pre-roll market, Kingsroad has shown a notable upward trajectory in rankings over recent months. Starting from a position outside the top 20 in October 2025, Kingsroad climbed to 91st in November, 75th in December, and reached 59th by January 2026. This positive trend in rank suggests a growing consumer interest and potential increase in market share. In contrast, Old Pal consistently maintained higher ranks, improving from 65th to 51st over the same period, indicating strong brand loyalty and sales performance. Meanwhile, House of Sacci experienced fluctuations, peaking at 58th in October and January but dipping in between, which may suggest volatility in consumer preferences. Platinum Reserve and Pot & Head showed less consistent performance, with Platinum Reserve missing from the top 20 in November and December, and Pot & Head's rank varying slightly but remaining relatively stable. Kingsroad's upward momentum, despite starting from a lower position, highlights its potential to capture a larger market share if the trend continues.

Notable Products

In January 2026, Kingsroad's top-performing product was the Mango x Gummiez Live Resin Infused Pre-Roll 14-Pack, which claimed the number one spot with sales of 390 units. The Gelato 41 x LA Runtz Live Resin Infused Pre-Roll 14-Pack rose to second place, showing a notable increase from fourth place in December 2025. The Ztardust Live Resin Cartridge dropped from first in December to third, indicating a decline in popularity. Ice Cream Mintz Live Resin Cartridge also saw a decrease, moving from second to fourth place. Lastly, the Sour Tangie x Sour Diesel Live Resin Infused Pre-Roll 14-Pack debuted in the rankings at fifth place, highlighting its growing demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.