Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

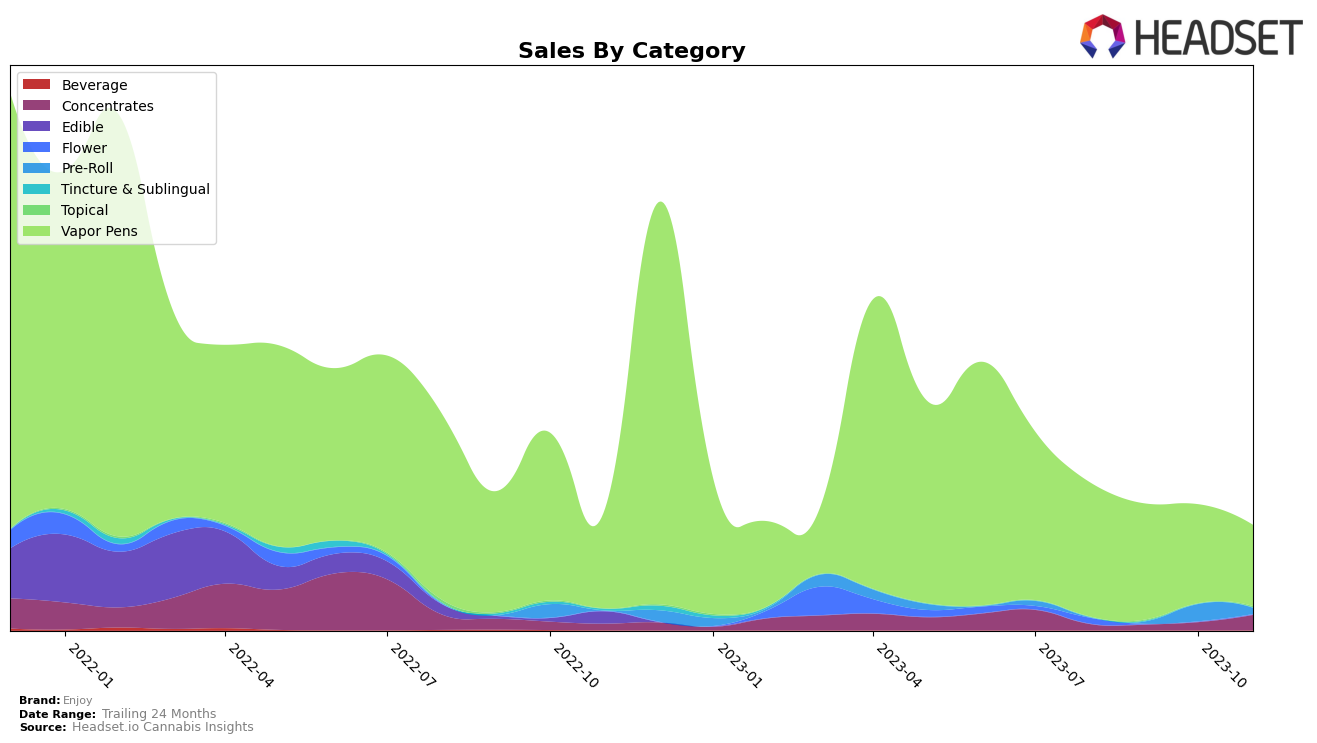

The cannabis brand Enjoy has demonstrated a mixed performance across different categories in the state of Oregon. In the Tincture & Sublingual category, the brand appeared in the top 31 brands in September 2023 but was not in the top 20 in the other months, indicating some volatility. On the other hand, in the Topical category, Enjoy showed a significant improvement, moving from not being in the top 20 in August and September to ranking 15th in November. This suggests a positive trend in this category.

However, in the Vapor Pens category, Enjoy's performance has been consistently declining. The brand ranked 52nd in August and September 2023, but slipped to 56th in October and further to 60th in November. This consistent downward trend suggests a need for the brand to reevaluate its strategy in this category. Despite this, it's worth noting that the brand still managed to generate significant sales in this category, indicating a strong customer base. The detailed sales figures and further insights are available for further analysis.

Competitive Landscape

In the Vapor Pens category within the Oregon market, Enjoy has seen a consistent ranking within the top 60 brands over the period from August to November 2023. However, there has been a slight downward trend in its rank, moving from 52nd in August and September to 60th in November. This is indicative of a slight decrease in sales over the same period. In comparison, Beehive Extracts showed a significant improvement in rank in October, moving up to 40th from 58th, suggesting a substantial increase in sales for that month. Drops has maintained a higher rank than Enjoy throughout the period, although it too has seen a slight drop in rank from 45th to 59th. Legends has seen a significant improvement in rank from 77th to 57th between August and September, but has remained steady at 65th in October and November. White Label did not appear in the top 20 brands until November, when it ranked 68th, indicating a potential increase in sales.

Notable Products

In November 2023, Enjoy's top-performing product was the Watermelon Splash Live Resin Cartridge (1g) from the Vapor Pens category, maintaining its position as the top seller for four consecutive months with sales reaching 838 units. The Cantaloupe Crush Live Resin Cartridge (1g), also in the Vapor Pens category, improved its ranking from third in September to second in November, indicating a growing consumer preference. The Fierce Green Apple Live Resin Cartridge (1g), another Vapor Pens product, secured the third position for two months straight. Surprisingly, the Polynesian Cookie Haze RSO (1g) from the Concentrates category made its debut in the top five, securing the fourth spot. However, the Pineapple x Tangie Pie Infused Pre-Roll 2-Pack (1.5g) from the Pre-Roll category dropped from second in October to fifth in November, indicating a slight decrease in its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.