Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

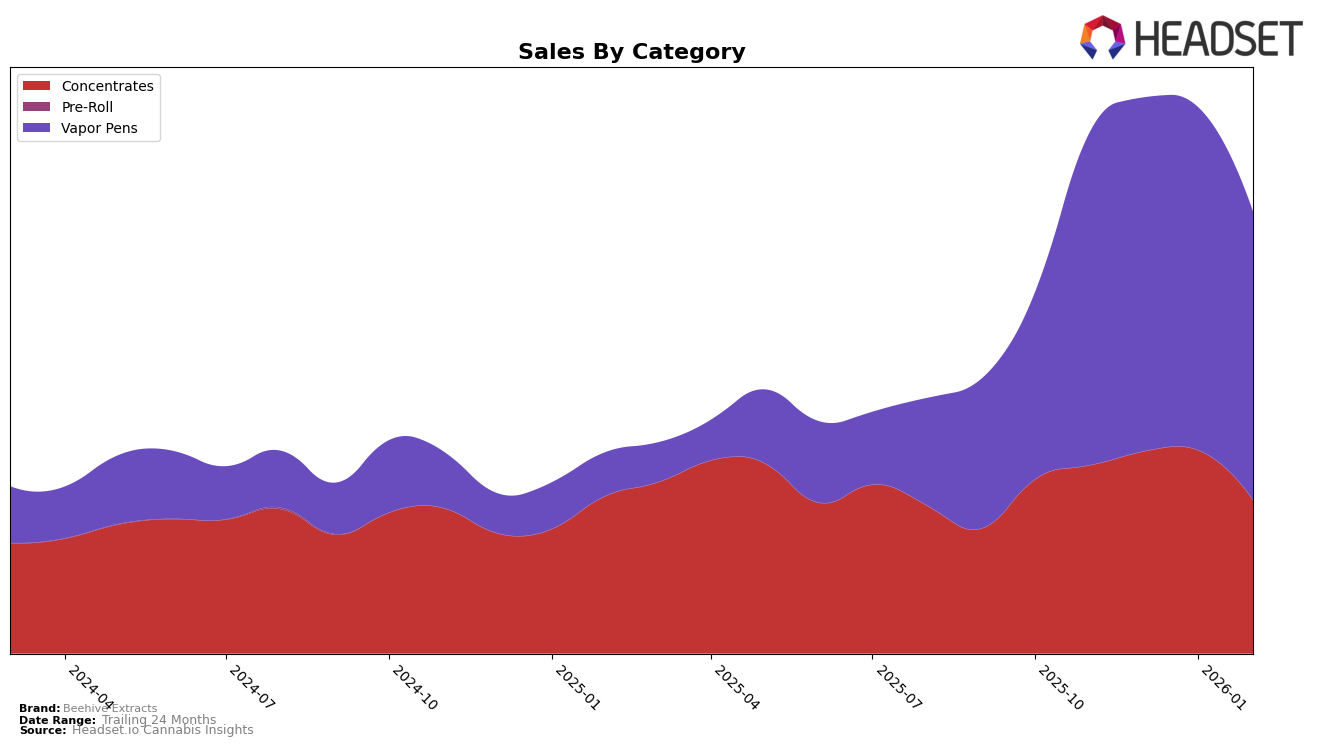

Beehive Extracts has demonstrated consistent performance in the Oregon market, particularly in the Concentrates category. Over the months from November 2025 to February 2026, the brand maintained a steady presence within the top 15, with rankings fluctuating slightly between 10th and 12th place. This pattern indicates a stable consumer base and effective market penetration in this category. However, it's noteworthy that February 2026 saw a dip to 12th place, which could be indicative of increased competition or seasonal variations affecting sales, as evidenced by the sales decrease from January to February.

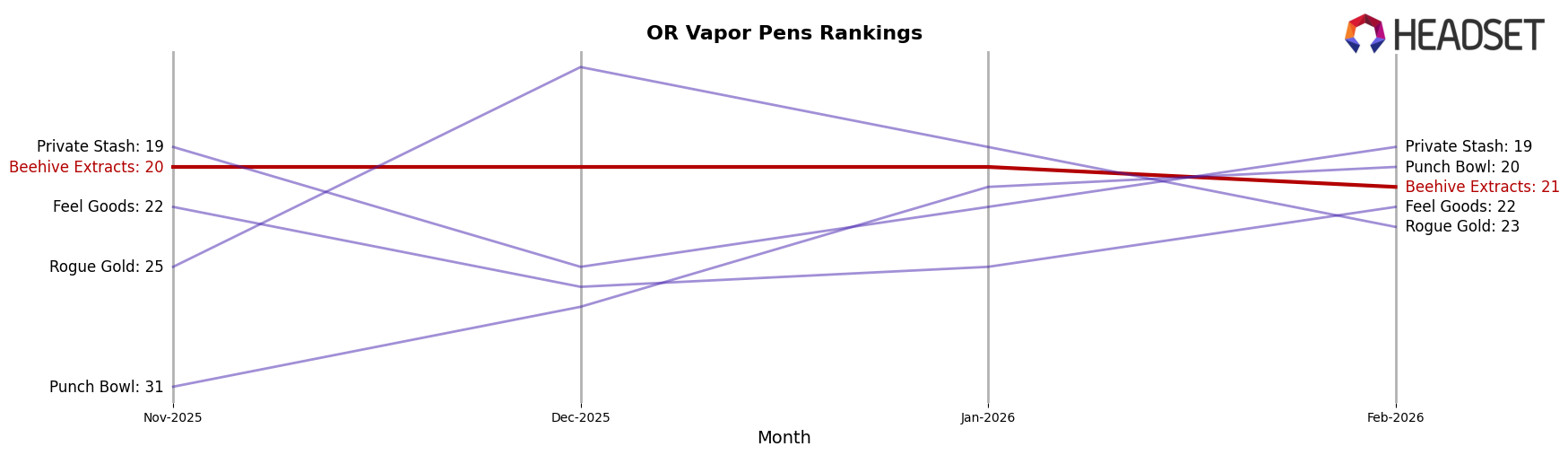

In the Vapor Pens category within Oregon, Beehive Extracts has consistently hovered around the 20th position, showing a slight decline to 21st in February 2026. This consistent ranking suggests a moderate but reliable presence in the market, although the drop in February might warrant further analysis to understand underlying factors. The absence from the top 30 in other states or categories could be seen as a limitation in their market expansion strategy, potentially highlighting areas for growth or diversification. The overall sales trends in both categories suggest a need for strategic adjustments to maintain and improve their market standing.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Beehive Extracts has maintained a consistent presence, ranking 20th from November 2025 through January 2026, before slipping to 21st in February 2026. This slight drop in rank may be attributed to the dynamic shifts among competitors such as Rogue Gold, which saw a significant jump from 25th in November to 15th in December, although it eventually fell to 23rd by February. Meanwhile, Private Stash fluctuated but ended February in 19th place, slightly ahead of Beehive Extracts. Punch Bowl showed a notable upward trend, moving from 31st in November to 20th by February, overtaking Beehive Extracts in the process. These shifts highlight the competitive volatility in the Oregon vapor pen market, emphasizing the need for Beehive Extracts to innovate and adapt to maintain and improve its market position.

Notable Products

In February 2026, Beehive Extracts saw Pineapple Whip Cured Resin Disposable (1g) maintain its top position in the Vapor Pens category, a spot it also held in January 2026, with impressive sales of 699 units. Tropical Express Cured Resin Disposable (1g) emerged as the second-best performer, marking its first appearance in the top rankings. Grape Cured Resin Cartridge (1g) secured the third spot, up from its absence in January, with 633 units sold. Space Jam Cured Resin Cartridge (1g) entered the rankings at fourth place. Notably, Blueberry Cookies Cured Resin Disposable (1g) dropped to fifth from its previous high of third in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.