Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the state of Illinois, Legends has experienced fluctuating performance in the Flower category. Despite a notable increase in rank from 40th in November 2025 to 33rd in December 2025, the brand was unable to maintain this momentum, dropping back to 44th in both January and February 2026. This indicates a struggle to consistently penetrate the top 30 brands in this highly competitive market. The sales figures reflect this volatility, with a peak in December 2025 followed by a decline in the subsequent months. This suggests that while there was a brief surge in popularity, sustaining that growth has proven challenging.

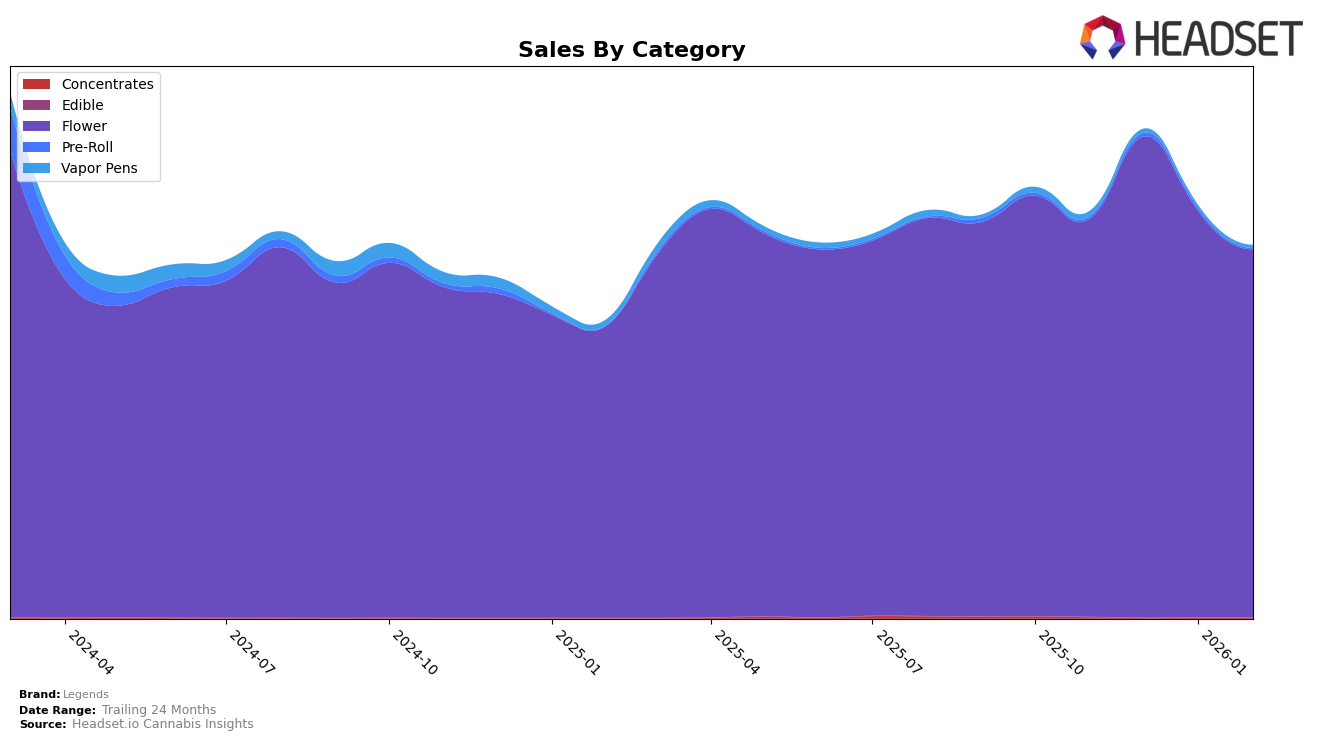

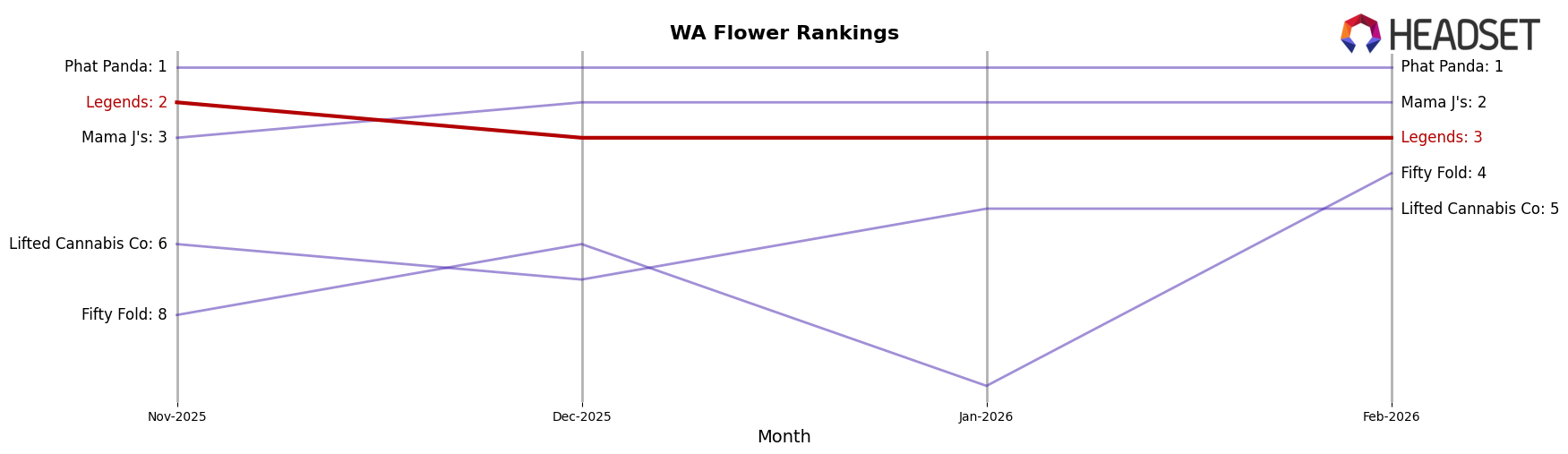

In contrast, Legends has shown a more stable performance in Massachusetts, with a steady climb in the Flower category rankings from 40th in November 2025 to 23rd by February 2026. This upward trend indicates a growing acceptance and preference for the brand among consumers in this state. Meanwhile, in Washington, Legends has consistently maintained a top-tier position, ranking 2nd or 3rd throughout the observed months. Despite a gradual decrease in sales, their strong market position suggests a well-established brand presence and consumer loyalty. These contrasting performances highlight the brand's varying levels of success and challenges across different regional markets.

Competitive Landscape

In the Washington flower category, Legends consistently held the third rank from December 2025 through February 2026, after dropping from second place in November 2025. This shift in rank is notably influenced by the consistent performance of Mama J's, which maintained a strong second position throughout the same period. Despite a slight decline in sales from November 2025 to February 2026, Legends remains a formidable competitor, with sales figures closely trailing those of Mama J's. Meanwhile, Phat Panda dominates the market, holding the top rank consistently, which underscores the competitive pressure Legends faces. Additionally, the fluctuating ranks of Fifty Fold and Lifted Cannabis Co highlight the dynamic nature of this market, where Legends must continuously strategize to maintain and improve its position.

Notable Products

In February 2026, the top-performing product for Legends was Dosi-Punch 14g, maintaining its number one ranking from the previous month with sales of 1874 units. Planet Sherb 1g made a significant leap to the second position, having not been ranked in January 2026, with sales reaching 1715 units. Layer Cake 3.5g held steady in the third spot, showing a slight increase in sales to 1690 units. The Scrooge 3.5g remained in fourth place, experiencing a decline in sales from January to 1137 units. Washington Apple 3.5g re-entered the rankings at fifth place, after not being ranked since November 2025, with sales of 1078 units, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.