Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

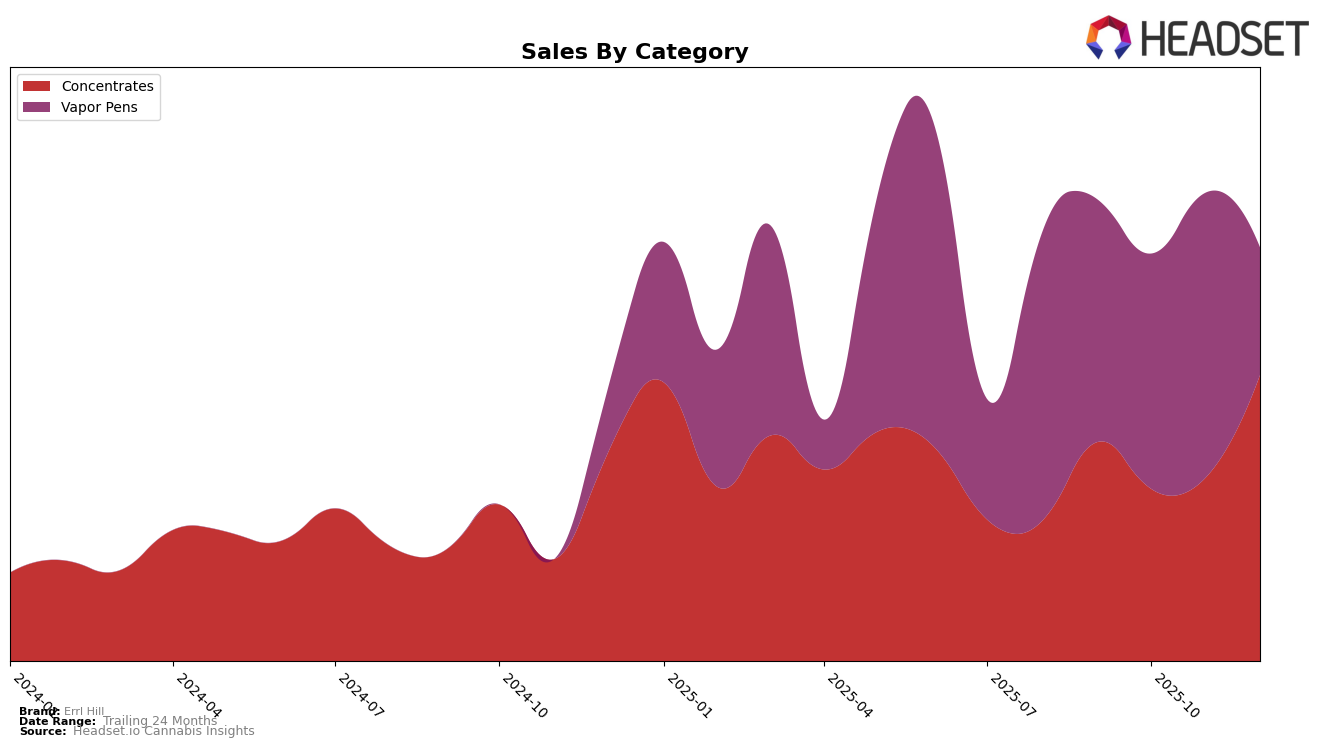

Errl Hill has shown a dynamic performance in the California cannabis market, particularly within the Concentrates category. Over the last few months of 2025, Errl Hill's rank in Concentrates improved significantly, moving from 44th place in October and November to breaking into the top 30 by December. This upward trajectory is underscored by a notable increase in sales, jumping from approximately 73,989 in November to 114,857 in December. This strong finish in December suggests a growing consumer preference for Errl Hill's Concentrates in California, possibly driven by product innovation or increased brand visibility.

In contrast, Errl Hill's performance in the Vapor Pens category in California presents a more mixed picture. The brand hovered around the 90th rank in September and October, showing a slight improvement to 78th in November. However, by December, Errl Hill did not make it into the top 30, indicating a potential struggle to capture a significant share of this competitive market. Despite this, sales figures for Vapor Pens did see an increase from October to November, suggesting some positive movement in consumer interest, though not enough to significantly impact their ranking.

Competitive Landscape

In the competitive landscape of California's concentrates market, Errl Hill has experienced notable fluctuations in its ranking over the last few months of 2025. Starting from a rank of 36 in September, Errl Hill saw a decline to 44 in both October and November, before rebounding to 30 in December. This recovery in December is significant, especially when compared to competitors like Creme De Canna, which fluctuated but ended at rank 36, and Buddies, which improved to rank 28. Meanwhile, Sluggers Hit maintained a relatively stable position, ending at rank 35, while Iced showed a strong upward trend, finishing at rank 29. Errl Hill's December sales surge aligns with its improved ranking, suggesting a positive reception to potential strategic changes or product offerings, contrasting with the earlier months where sales were lower. This dynamic environment underscores the importance of strategic agility in maintaining competitive positioning within the California concentrates market.

Notable Products

In December 2025, Gruntz Live Resin (1g) from Errl Hill emerged as the top-performing product, securing the number one rank with impressive sales of 935 units. Following closely, Tangerine Cream Live Resin (1g) held the second position, having improved from its fourth rank in November. Blueberry Muffin Live Resin Disposable (1g) maintained its third position from November, indicating stable performance in the Vapor Pens category. Garlic Runtz Live Resin Disposable (1g) entered the rankings at fourth place, showing a notable debut. PB N' J Live Resin (1g) rounded out the top five, marking its first appearance in the rankings for December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.