Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

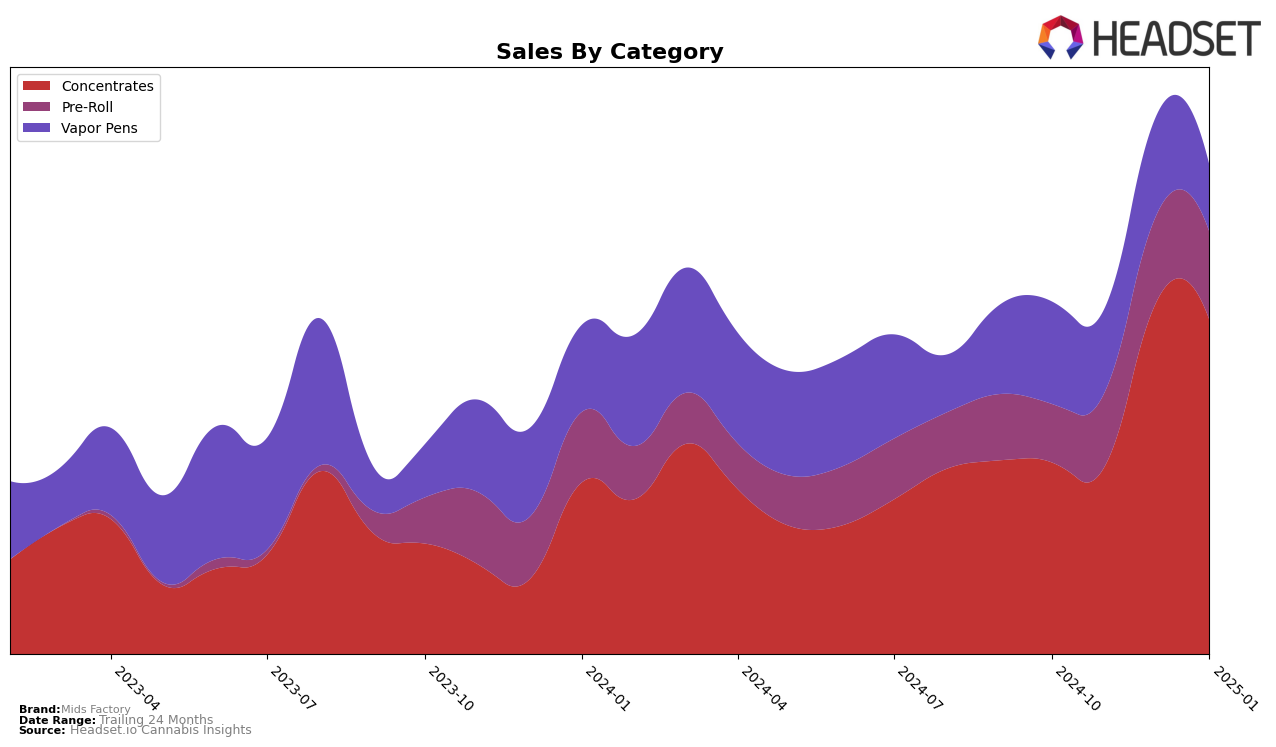

Mids Factory has shown a notable improvement in its performance within the Concentrates category in California. After not making it into the top 30 brands in October and November 2024, they broke through to rank 25th in December 2024 and maintained a solid presence by ranking 28th in January 2025. This upward trend is underscored by a significant increase in sales, with December 2024 sales nearly doubling from the previous month. Such a leap in rankings and sales suggests a successful strategic adjustment or market response that has resonated well with consumers in the state.

The absence of Mids Factory from the top 30 in the earlier months indicates challenges or competitive pressures they faced in California. However, their resurgence in the latter months points to an effective recovery or adaptation to market demands. Despite not being consistently in the top 30, their ability to climb the ranks and sustain a position in December and January is a promising sign of their potential to strengthen their market foothold further. Observing how Mids Factory navigates these dynamics in the coming months will be crucial in understanding their long-term trajectory in the Concentrates market.

Competitive Landscape

In the California concentrates market, Mids Factory has shown a dynamic shift in its competitive positioning from October 2024 to January 2025. Initially ranked 49th in October, Mids Factory climbed to 25th by December, demonstrating a significant improvement in its market presence. However, by January 2025, the brand experienced a slight decline to 28th. This fluctuation suggests a competitive landscape where brands like Cali Buds and Errl Hill also made notable gains, with Cali Buds advancing from 58th to 26th and Errl Hill from 56th to 27th over the same period. Meanwhile, The Fight and UP! maintained relatively stable positions, indicating a robust competitive environment. The sales trajectory for Mids Factory, peaking in December, underscores the brand's potential to capitalize on market opportunities, although the slight dip in January suggests the need for strategic adjustments to maintain momentum against rising competitors.

Notable Products

In January 2025, Mids Factory's top-performing product was Peach Panther Cured Resin Sugar (1g) in the Concentrates category, securing the number one rank with sales of 1040 units. Following closely, Candied Raisins Cured Resin Badder (1g) claimed the second spot, while Tropical Mix BHO Cured Resin Sugar (1g) took third place. Euphoria Cured Resin Badder (1g) ranked fourth, maintaining a strong presence in the Concentrates category. The Purple Churro x Pink Payton Infused Pre-Roll (1.5g) was the leading product in the Pre-Roll category, ranking fifth overall. This month saw a new lineup of top products as the dataset does not provide rankings or sales figures for the previous months, indicating a fresh surge in these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.