Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

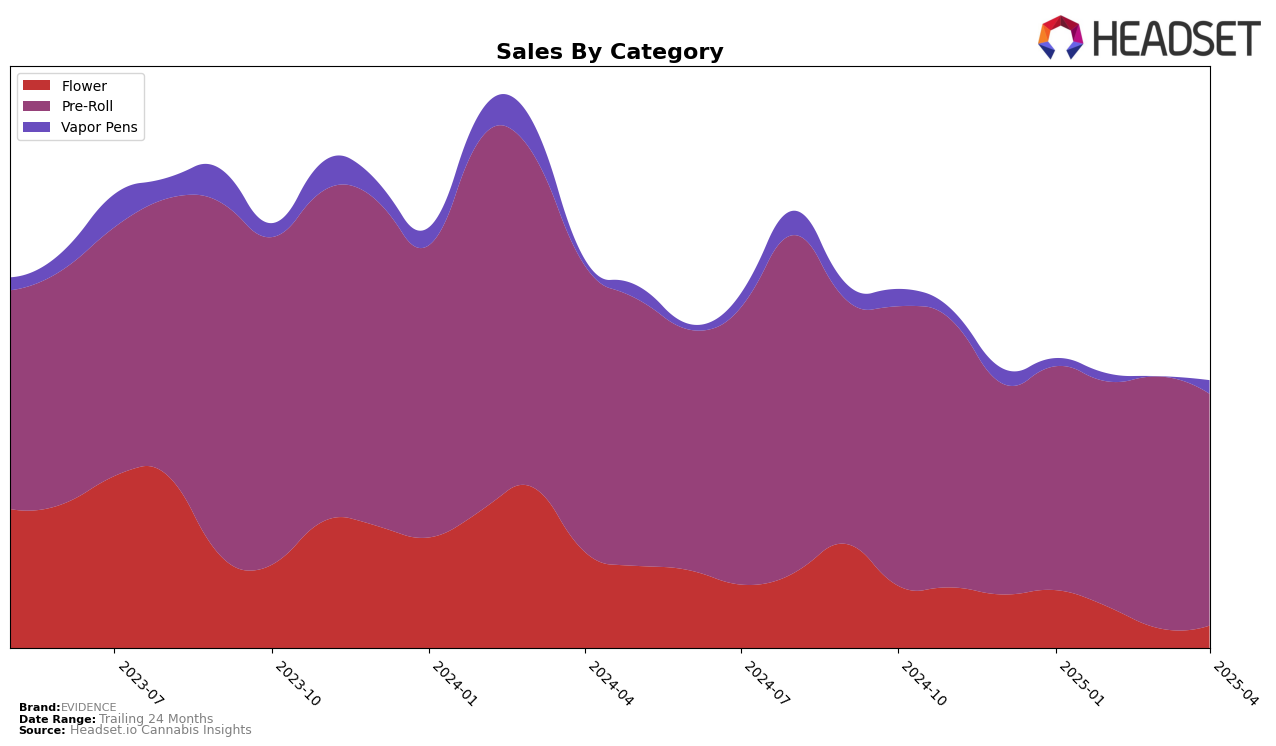

In the California market, EVIDENCE has shown a consistent presence in the Pre-Roll category, maintaining a position within the top 30 brands throughout the first four months of 2025. The brand's ranking has fluctuated slightly, starting at 28th in January, moving up to 26th in February and March, and then returning to 28th in April. This indicates a stable performance in a competitive category, with a notable peak in sales during March. Despite the slight drop in rank in April, the brand managed to sustain a healthy sales figure, suggesting resilience in the face of market dynamics.

The consistency in EVIDENCE's rankings in California highlights the brand's ability to maintain its market share in the Pre-Roll category. However, the absence of rankings in other states or categories might suggest limited reach or focus outside of California, or it could indicate that EVIDENCE is not yet a top contender in those other markets. This could present an opportunity for growth, should the brand decide to expand its footprint. The steady performance in California could serve as a strong foundation for exploring new markets and categories in the future.

Competitive Landscape

In the competitive landscape of the California Pre-Roll market, EVIDENCE has shown a dynamic performance from January to April 2025. While EVIDENCE maintained a steady rank of 26th in February and March, it experienced a slight drop to 28th in April, indicating a potential challenge in maintaining its competitive edge. This fluctuation is notable when compared to brands like UpNorth Humboldt, which consistently ranked higher, peaking at 22nd in March before dropping back to 26th in April. Meanwhile, Sublime Canna showed a positive trend, climbing from 34th in January to 29th in April, potentially threatening EVIDENCE's position. Additionally, Clsics maintained a stable presence, slightly outperforming EVIDENCE in April with a rank of 27th. These shifts underscore the competitive pressures EVIDENCE faces, highlighting the need for strategic marketing efforts to bolster its market position amidst fluctuating ranks and sales dynamics.

Notable Products

In April 2025, the top-performing product from EVIDENCE was Prison Shortys - Purple Punch Infused Pre-Roll 5-Pack (3.5g), which secured the first rank with sales reaching 1293 units. This product made a significant leap, as it was not ranked in the previous months. Strawberry Shortcake (3.5g) followed closely in the second position, maintaining a strong presence after previously being ranked third in January. Prison Shortys - Berry Pie Infused Pre-Roll 5-Pack (3.5g) dropped to the third position from its peak as the top seller in March. Prison Shortys - Bubba Gum OG Infused Pre-Roll 5-Pack (3.5g) improved its rank to fourth, while Prison Shortys - Strawberry Shortcake Infused Pre-Roll 5-Pack (3.5g) saw a decline to fifth place after being consistently ranked higher in earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.