Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

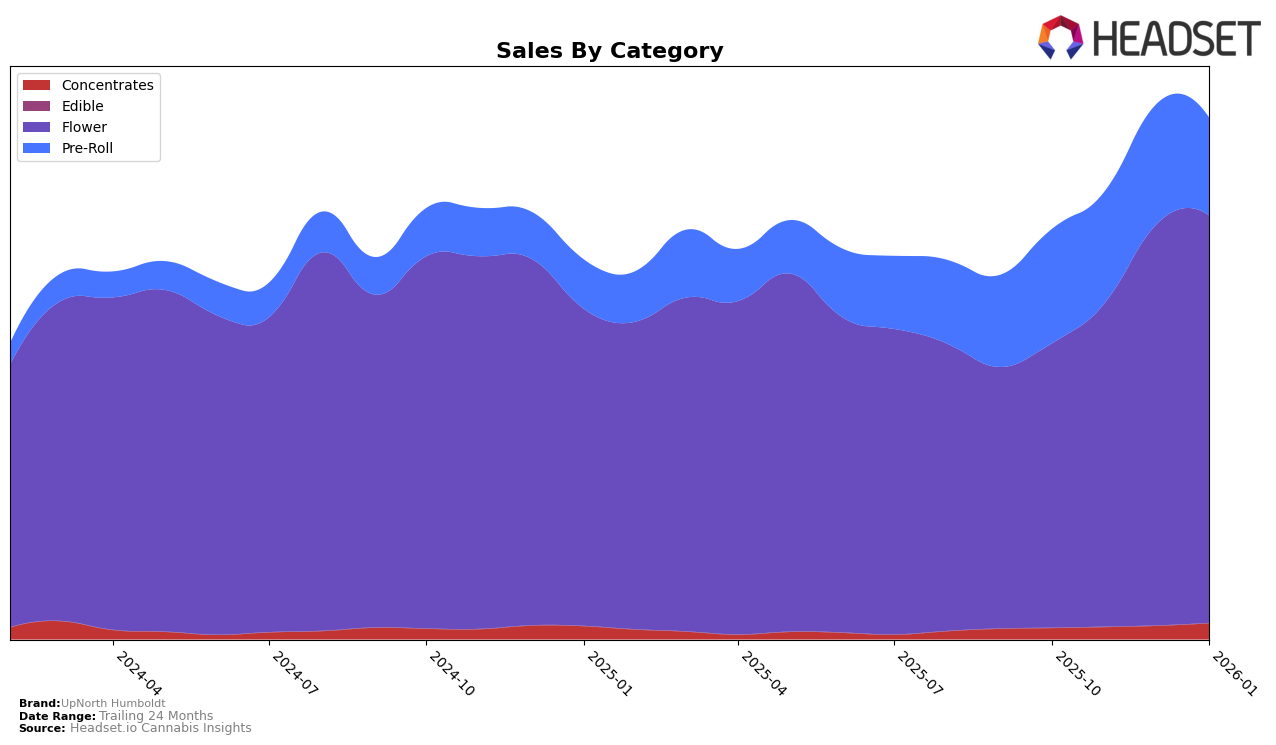

In California, UpNorth Humboldt has shown a strong performance in the Flower category, improving its rank from 15th in October 2025 to 8th by December 2025 and maintaining this position in January 2026. This upward movement is indicative of a growing consumer base and suggests that their Flower products are resonating well with the market. On the other hand, their performance in the Pre-Roll category in California has seen a slight decline, moving from 14th in October and November 2025 to 17th by January 2026. This drop might reflect increased competition or changing consumer preferences in this specific category.

In Illinois, UpNorth Humboldt's Flower category also witnessed an improvement, climbing from 15th in October and November 2025 to 10th in December 2025 and maintaining this rank in January 2026. This consistency suggests a robust foothold in the Flower market within the state. However, in the Concentrates category, while they remained at 15th for three consecutive months, they managed to improve slightly to 14th by January 2026. This indicates a positive, albeit slow, growth trajectory in this segment. Their Pre-Roll category in Illinois, however, did not make it into the top 30, which could be a point of concern for the brand as it may indicate a need for strategic adjustments to enhance visibility and market share in this category.

Competitive Landscape

In the competitive landscape of the California flower category, UpNorth Humboldt has shown a promising upward trajectory in its rankings, moving from 15th place in October 2025 to a consistent 8th place by January 2026. This improvement in rank is accompanied by a steady increase in sales, indicating a strengthening market position. Notably, Fig Farms has maintained a close competition with UpNorth Humboldt, with ranks fluctuating around the same positions. Meanwhile, Alien Labs and Oakfruitland have experienced more volatility in their rankings, with Alien Labs dropping to 10th place in January 2026, while Oakfruitland surged to 7th. Claybourne Co. consistently outperformed UpNorth Humboldt, maintaining a top 6 position throughout the period. These dynamics suggest that while UpNorth Humboldt is gaining ground, it faces stiff competition from both stable and fluctuating rivals in the California market.

Notable Products

In January 2026, Platinum Afghani (3.5g) reclaimed its position as the top-performing product for UpNorth Humboldt, with sales reaching $7,291. Durban Poison (3.5g) rose to second place, up from fifth in December 2025, indicating a significant increase in popularity. NF1 (3.5g) made its debut in the rankings at third place, showcasing strong initial sales performance. Bubba Kush (3.5g) maintained its position at fourth, while Sour Diesel (3.5g) saw a drop to fifth place from its consistent second position in the previous months. This reshuffling highlights a dynamic shift in consumer preferences for the brand's flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.