Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

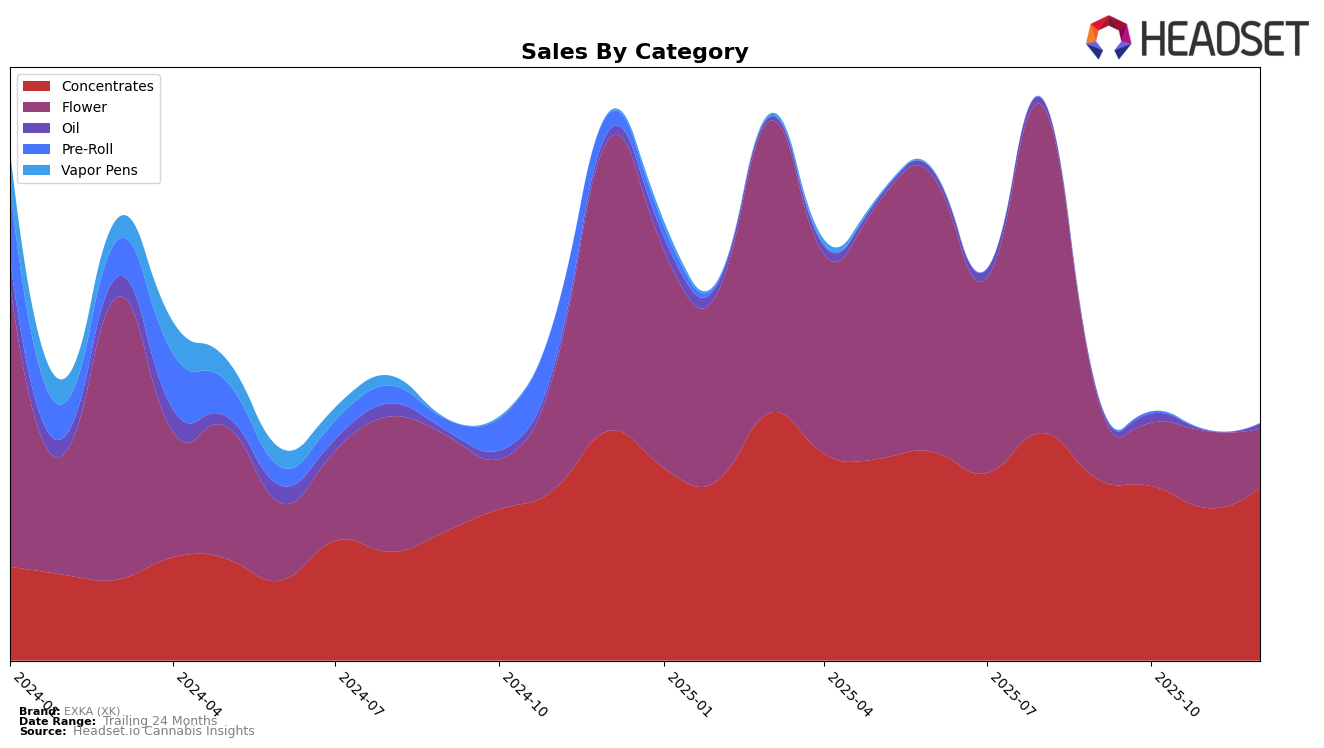

EXKA (XK) has shown a consistent presence in the Ontario concentrates category, although not within the top 30 brands. Over the last few months, their ranking has slightly declined from 33rd in September to 37th by December. This decline might be a concern for the brand, as it indicates a need to strengthen their market presence. Despite the drop in ranking, there was a recovery in sales from November to December, suggesting some positive consumer response or a potential seasonal effect. The performance in Ontario could serve as a benchmark for EXKA (XK) to strategize improvements.

While EXKA (XK) did not make it into the top 30 rankings, their sales trajectory provides insights into their market engagement. The sales figures reveal a dip in October and November, followed by an uptick in December, which could point to a successful marketing campaign or product adjustment. The lack of top 30 rankings in any month suggests that the brand may need to explore new strategies or product innovations to enhance their competitive edge in the concentrates market. Monitoring these trends and making strategic adjustments could help EXKA (XK) improve their standing in the future.

Competitive Landscape

In the competitive landscape of the concentrates category in Ontario, EXKA (XK) has experienced a slight decline in its ranking over the last few months, moving from 33rd place in September 2025 to 37th place by December 2025. This downward trend in rank correlates with a decrease in sales, indicating potential challenges in maintaining market share. Notably, Double J's has consistently outperformed EXKA (XK), maintaining a stable rank of 34th place from October to December 2025, with sales figures showing a positive trajectory. Meanwhile, Lord Jones and The Goo! have shown improvements in their sales, with The Goo! climbing from 43rd to 38th place by December. These shifts suggest a competitive pressure on EXKA (XK) to innovate or adjust its strategy to regain its position in the market. Additionally, Syrup (Canada) has made significant strides, moving up from 52nd to 39th place, further intensifying the competitive environment for EXKA (XK) in Ontario's concentrates market.

Notable Products

In December 2025, Haschtag Strawberry Hash (2g) emerged as the top-performing product for EXKA (XK), climbing from its consistent second-place ranking in the previous months to take the lead with sales of 916 units. Haschtag Premium Hash (2g), which held the top spot from September to November, dropped to second place. Happy Hour (7g) maintained its third-place position throughout the last four months, demonstrating steady performance. Candy Kush (7g) and Happy Hour (3.5g) remained in fourth and fifth positions, respectively, indicating stable but lower sales figures compared to the top concentrates. This shift in rankings highlights a notable increase in popularity for Haschtag Strawberry Hash (2g) during December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.