Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

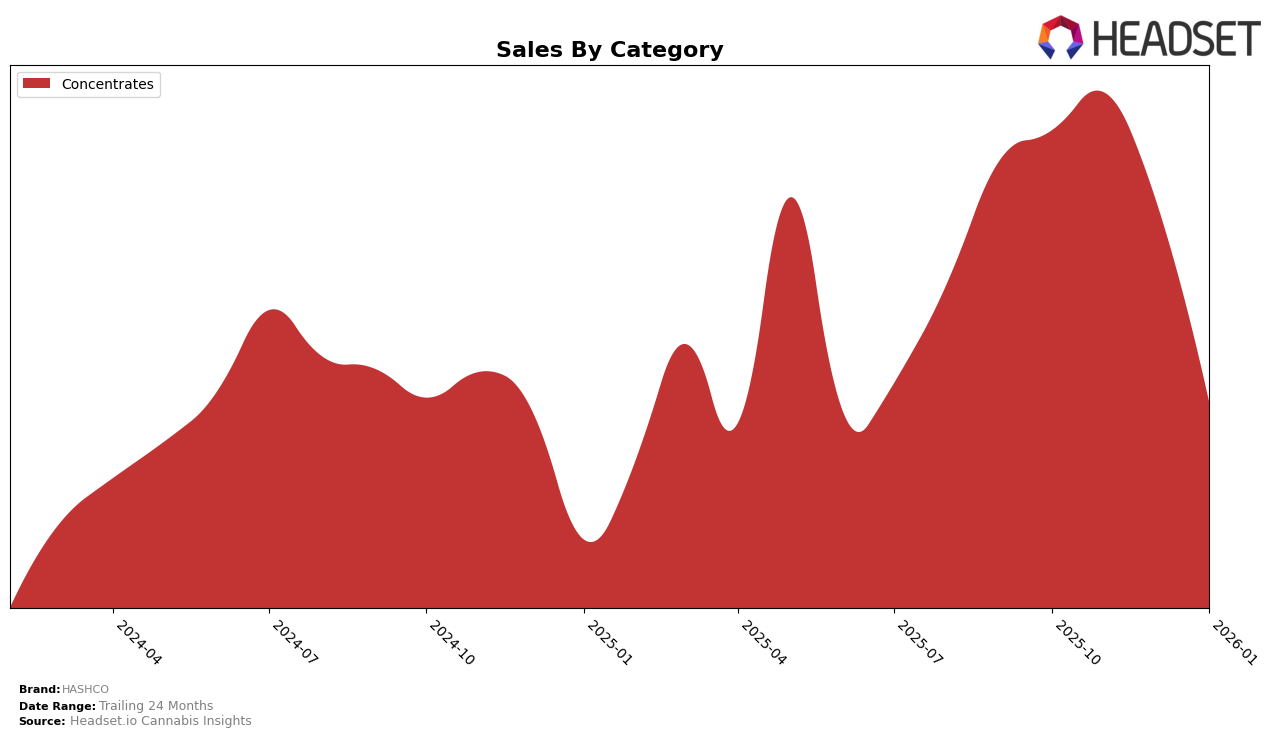

HASHCO has demonstrated fluctuating performance in the Concentrates category in the province of Ontario. The brand maintained a presence in the top 30 rankings from October 2025 through January 2026, but there was a noticeable decline over this period. Starting at rank 21 in October, HASHCO improved slightly to rank 20 in November, before slipping to rank 23 in December and further down to rank 26 by January. This downward trend may indicate increased competition or changing consumer preferences within the Ontario market, which HASHCO might need to address to regain its higher standing.

From a sales perspective, HASHCO's performance in Ontario reflects the ranking movements, with sales peaking in November 2025 at $104,489 before declining to $70,991 by January 2026. This drop in sales could be a concern for the brand, as it suggests a potential loss of market share or a decrease in consumer demand for their products. The absence of HASHCO from the top 30 rankings in other states or provinces during this period could imply a limited geographical reach or focus within Ontario. Understanding the underlying factors contributing to these trends is crucial for HASHCO to strategize effectively and potentially expand its market presence beyond Ontario.

Competitive Landscape

In the Ontario concentrates market, HASHCO has experienced notable fluctuations in its ranking and sales over the past few months. Starting in October 2025, HASHCO held a solid position at rank 21, climbing to 20 in November, but then slipping to 23 in December and further down to 26 by January 2026. This downward trend in rank coincides with a decrease in sales from November to January. In contrast, The Loud Plug showed a strong performance, entering the top 20 by December and maintaining a higher rank than HASHCO in January. Meanwhile, RAD (Really Awesome Dope) and Purple Hills have shown gradual improvements in their rankings, with RAD moving up to 25 and Purple Hills to 27 by January, both experiencing sales growth. These competitive dynamics suggest that HASHCO may need to reassess its market strategies to regain its earlier momentum and counter the rising competition from these brands.

Notable Products

In January 2026, Blonde Hash (2g) from HASHCO maintained its top position in the Concentrates category, consistently ranking first since October 2025, despite a decrease in sales to 1492 units. Gold Seal Hash (2g) also retained its second-place ranking, showing stability in its performance over the past months. Gold Seal Hash (1g) remained in third place, demonstrating consistent sales figures throughout the period. CBD/THC 1:1 Hybrid Blonde Hash (2g) held its position in fourth place, indicating steady demand. Hybrid Single Source Kief (1g) reappeared in the rankings at seventh place, suggesting a resurgence in interest or availability.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.