Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

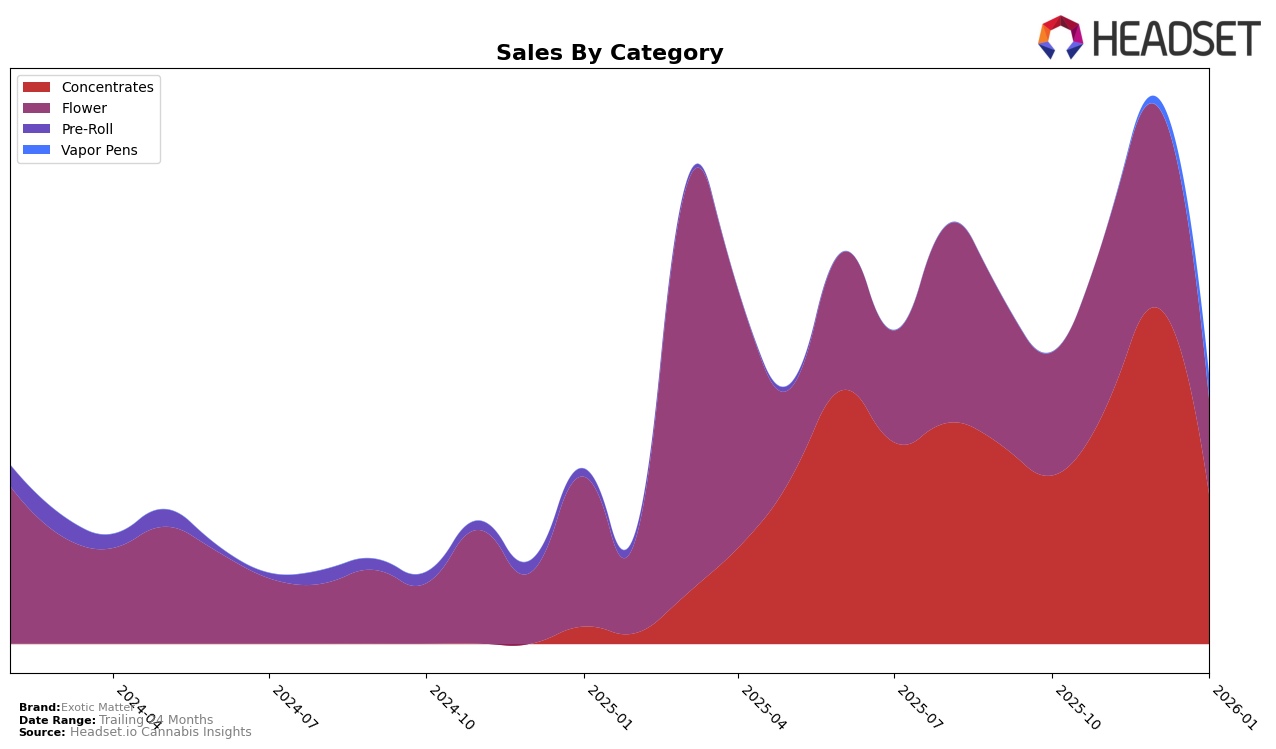

Exotic Matter has shown notable variability in its performance across the Concentrates category in Michigan. The brand experienced a significant climb in rankings from October to December 2025, moving from 21st to 10th place. This upward trajectory was accompanied by a marked increase in sales, peaking in December. However, January 2026 saw a dramatic drop to the 30th position, which could be a concern for stakeholders monitoring their market competitiveness. The fluctuations suggest a dynamic market presence, where maintaining momentum could be challenging.

It is important to note that Exotic Matter's absence from the top 30 rankings in January 2026 might indicate a need for strategic adjustments to recapture market share. Despite this setback, the brand demonstrated strong performance in the preceding months, hinting at potential opportunities for growth if they can stabilize their position. Observers might find it valuable to explore what factors contributed to their December peak and subsequent January decline, as understanding these elements could provide insights into market trends and consumer preferences in Michigan's competitive concentrates market.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Exotic Matter experienced significant fluctuations in its ranking and sales from October 2025 to January 2026. Initially ranked 21st in October, Exotic Matter climbed to an impressive 10th place by December, showcasing a strong upward trend in sales. However, January 2026 saw a notable drop to 30th place, indicating a potential challenge in maintaining its competitive edge. During this period, Fresh Coast also experienced a decline, dropping from 9th to 29th, while Rise (MI) improved its position from 44th to 34th, suggesting a dynamic market environment. Meanwhile, Light Sky Farms and Monopoly Melts showed varying performances, with the former slightly improving its rank in January and the latter making a significant leap from 50th to 32nd. These shifts highlight the competitive pressures Exotic Matter faces, emphasizing the importance of strategic adjustments to sustain its market presence.

Notable Products

In January 2026, Papaya Rosin (2g) maintained its position as the top-performing product for Exotic Matter, despite a decrease in sales to 606 units from the previous month's peak of 1256. Galactic Warheadz Rosin (2g) climbed to the second position, showing its first ranking since October 2025 when it was the leader. The new entry, Exotic Matter x Yeti Stash - Banana Candy Rosin (2g), secured the third spot, indicating a strong market introduction. Purple Drank Rosin Disposable (0.5g) and Papaya Rosin Disposable (0.5g) followed, ranking fourth and fifth, respectively, as new entries in the Vapor Pens category. This shift in rankings highlights the dynamic nature of consumer preferences and the successful introduction of new products in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.