Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

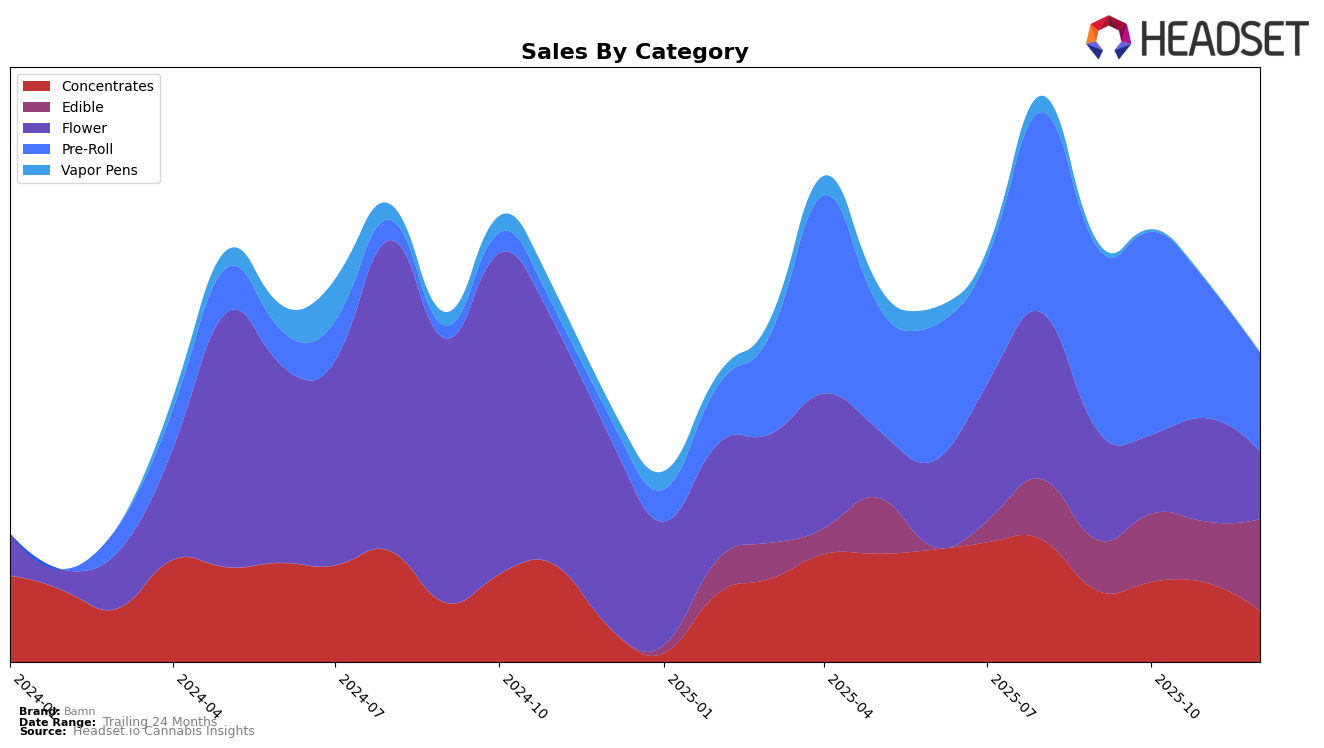

In the state of Michigan, Bamn has shown varied performance across different product categories. In Concentrates, the brand had a strong presence, maintaining a consistent position in the top 15 for September and October before dropping to 26th place by December. This decline suggests a potential shift in consumer preferences or increased competition. Meanwhile, in the Edible category, Bamn has demonstrated positive growth, climbing from the 38th position in September to 28th in December, indicating a strengthening foothold in this segment. The Flower category, however, presents a challenge, as Bamn was not ranked in the top 30 for October and December, suggesting limited market penetration or a need for strategic adjustments in this area.

The Pre-Roll category in Michigan also reflects a dynamic landscape for Bamn. The brand experienced a slight decline from 17th place in September to 32nd by December. This downward trend might be attributed to shifting market dynamics or increased competition from other brands. Despite this, Bamn's sales figures in the Edible category have been notably robust, with a significant increase in December, indicating strong consumer demand and effective distribution strategies. Such trends highlight the importance of continuous market analysis and adaptation to maintain competitive advantage across various product categories.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, Bamn has experienced notable fluctuations in its ranking and sales performance over the last few months of 2025. Starting in September, Bamn was ranked 17th, showing a slight improvement to 16th in October, which was accompanied by a sales increase. However, by November, Bamn's rank dropped to 26th, and further declined to 32nd in December, indicating a significant decrease in market presence. This downward trend in rank and sales could be attributed to the competitive pressure from brands like Sapphire Farms and Road Trip, which, despite their own fluctuations, maintained a stronger hold in the top 20 rankings. Giggles and Wojo Co also showed varying performances, with Giggles overtaking Bamn in December. These dynamics suggest that Bamn needs to strategize effectively to regain its competitive edge and stabilize its market position in the coming months.

Notable Products

In December 2025, the top-performing product for Bamn was the Guava Rainbow Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from October 2025 and reclaiming the top spot from November. It achieved notable sales of 28,712 units. The Watermelon Gummy (200mg) emerged as the second best-seller in the Edible category, marking its first appearance in the rankings. Following closely were the Green Apple Gummy (200mg) and Grape Gummy (200mg), securing the third and fourth positions respectively. The Candy Cream Puff Pre-Roll (1g) rounded out the top five, showcasing a strong debut in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.