Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

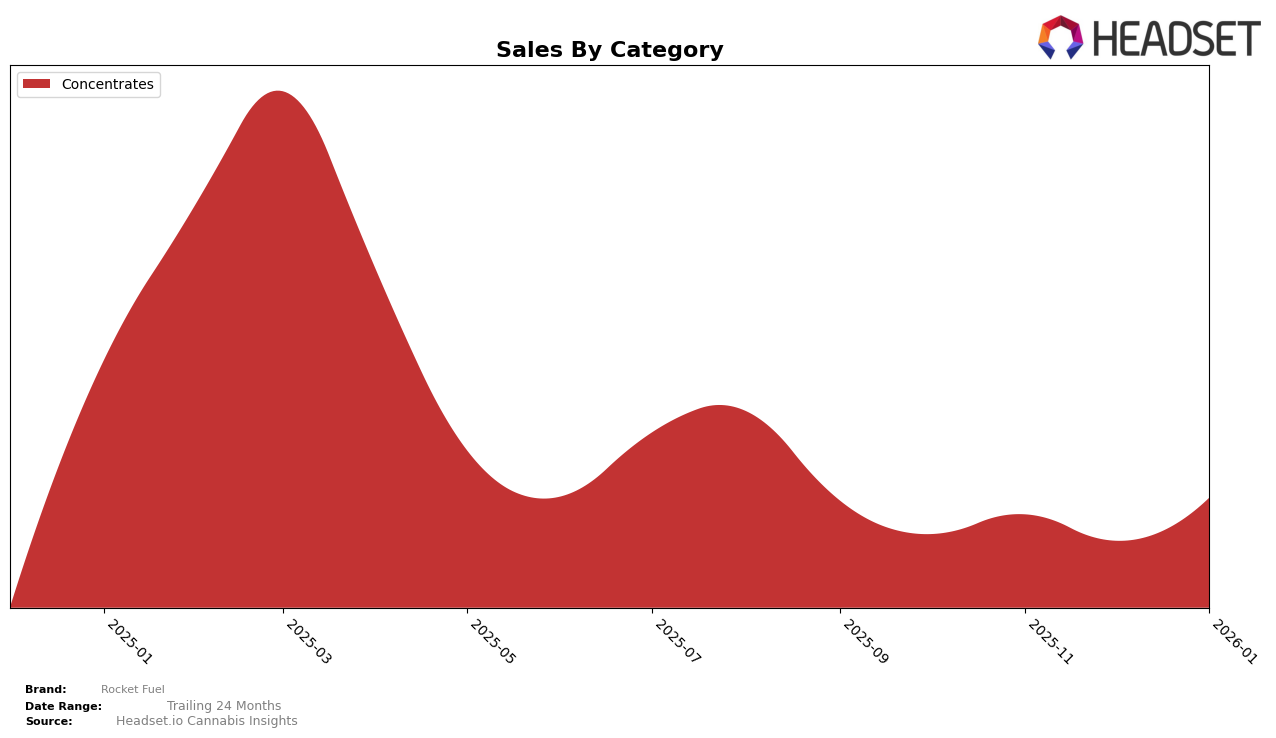

Rocket Fuel has demonstrated notable performance in the Michigan market within the Concentrates category. Over the span from October 2025 to January 2026, the brand has shown a significant upward trajectory, particularly in January 2026, when it climbed to the 12th position from the 23rd spot in December 2025. This improvement reflects a strategic strengthening in their market presence, as their sales in January 2026 reached $223,107, marking a recovery from a dip in December. However, the brand's absence from the top 30 in other states or provinces during this period highlights potential areas for expansion or increased focus.

In terms of category rankings, Rocket Fuel's performance in the Concentrates category in Michigan has been relatively stable, with a remarkable leap in January 2026. Despite a drop in December, the brand's ability to rebound quickly suggests strong consumer loyalty or effective marketing strategies. The absence of rankings in other states or provinces could signal untapped potential or the need for strategic adjustments to penetrate new markets. This performance in Michigan might serve as a blueprint for Rocket Fuel to replicate success across other regions, although the specifics of their strategy remain to be seen.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Rocket Fuel has experienced notable fluctuations in its ranking and sales performance. From October 2025 to January 2026, Rocket Fuel's rank improved from 16th to 12th, despite a dip to 23rd in December. This upward trajectory in January is indicative of a potential recovery in market positioning. In comparison, 710 Labs maintained a relatively stable position, although it dropped out of the top 10 by January 2026. Meanwhile, Strait-Fire showed a remarkable climb from 29th in October to 13th in January, suggesting a strong competitive threat. Ice Kream Hash Co. also demonstrated resilience, consistently ranking within the top 15, although it slipped slightly in January. Stickee maintained a strong presence, peaking at 10th in January. Rocket Fuel's sales saw a positive trend, particularly in January, where it outperformed its previous months, indicating a potential strategic adjustment that could bolster its competitive edge in the coming months.

Notable Products

For January 2026, Cap Junky Live Resin (1g) emerged as the top-performing product for Rocket Fuel, reclaiming its first-place rank after briefly dropping to second in December 2025, with sales reaching 5610 units. Banana Daddy Live Resin (1g) maintained a strong performance, holding the second position, slightly behind the leader. Cherrylicious Live Resin (1g) showed significant improvement, climbing from fourth place in previous months to third in January 2026. Permanent Marker Live Resin (1g) experienced a slight dip, moving from third to fourth position compared to December 2025. Melonade Live Resin (1g) remained consistent in fifth place, maintaining its rank from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.