Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

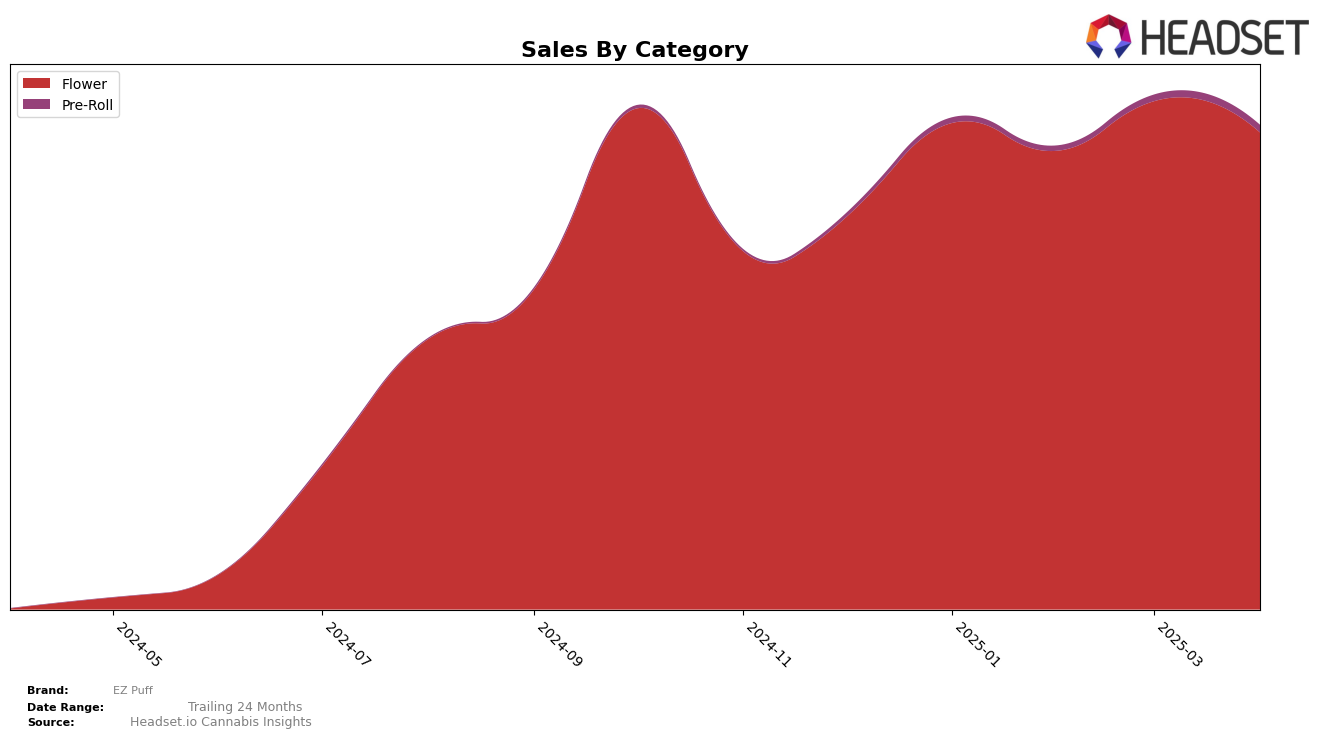

EZ Puff has demonstrated variable performance across different states and categories, with notable fluctuations in rankings. In Washington, the brand's presence in the Flower category has been somewhat volatile. Starting the year ranked 14th in January, EZ Puff improved its position to 12th in February and further to 10th in March. However, by April, the brand slipped back to 16th, indicating a need for strategic adjustments to maintain a consistent upward trajectory. Such movement suggests that while EZ Puff has the potential to climb the ranks, sustaining a top position requires addressing competitive pressures and possibly enhancing their product offerings or marketing strategies.

Despite the ranking fluctuations, EZ Puff's financial performance in Washington's Flower category reflects a resilient market presence. Sales figures show a slight dip from January to February, but a notable increase in March, followed by a decrease in April. This pattern highlights the brand's ability to recover and boost sales, though maintaining this momentum remains a challenge. The absence of EZ Puff from the top 30 in other states and categories might indicate untapped opportunities or areas where the brand could enhance its market penetration. Overall, while EZ Puff has shown promise, particularly in Washington's Flower category, there is room for growth and expansion across different regions and product lines.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, EZ Puff experienced notable fluctuations in its ranking from January to April 2025. Starting at rank 14 in January, EZ Puff climbed to 12th in February and further improved to 10th in March, showcasing a positive trend in its market positioning. However, by April, EZ Puff slipped to 16th, indicating a potential challenge in maintaining its upward momentum. In contrast, SKÖRD showed a significant rise, moving from 37th in January to 14th by April, suggesting a strong competitive push. Similarly, Torus and Ooowee demonstrated consistent improvements, with both brands securing better ranks by April, potentially impacting EZ Puff's market share. Momma Chan Farms also showed resilience, despite a dip in February, maintaining a competitive edge close to EZ Puff's ranking. These dynamics highlight the competitive pressures EZ Puff faces in sustaining its sales growth amidst aggressive market movements by its rivals.

Notable Products

In April 2025, Georgia Pie (3.5g) maintained its position as the top-performing product for EZ Puff, with sales reaching 2044 units, showcasing a consistent lead from January through April. Gary Payton (3.5g) held steady in second place, although its sales dropped to 1337 units from previous months. Georgia Pie (7g) improved its ranking to third, indicating a steady increase in popularity since March. The Georgia Pie (14g) entered the rankings in April at fourth place, demonstrating a new interest in larger quantities. Lastly, Gary Payton (7g) dropped to fifth place, reflecting a decline in sales compared to March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.