Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

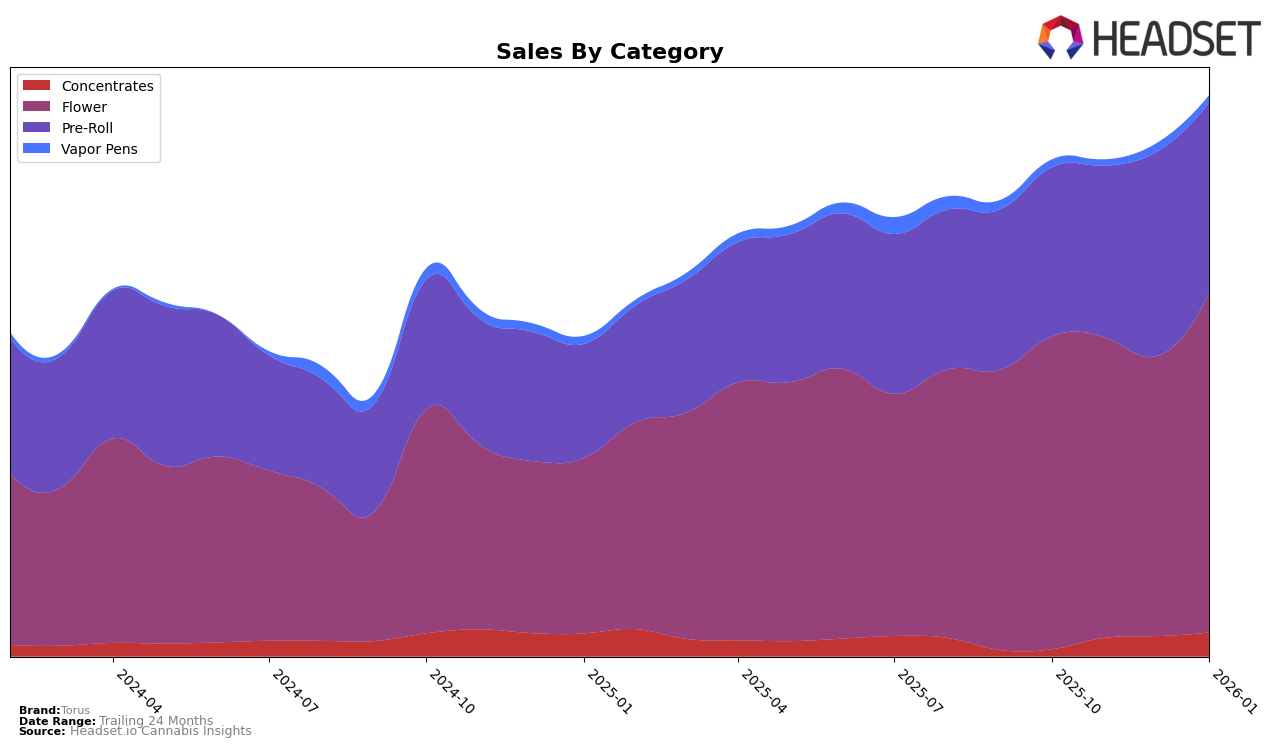

In the Washington market, Torus has shown a noteworthy performance across several cannabis categories. In the Concentrates category, Torus did not make it to the top 30 brands in October 2025, but it climbed to rank 70 in November, 65 in December, and further improved to 55 by January 2026. This upward trajectory indicates a positive reception and growing consumer interest in their concentrate products. In the Flower category, Torus maintained a strong presence, starting at rank 11 in October, slightly dropping to 12 and 14 in November and December, respectively, but then rebounding to an impressive rank 9 in January. This fluctuation suggests a competitive market with Torus managing to regain momentum towards the end of the period.

In the Pre-Roll category within Washington, Torus exhibited consistent performance, maintaining its position within the top 20 brands. Starting at rank 16 in October, it improved to rank 15 in November, and further climbed to rank 13 in December, sustaining this position into January 2026. This stability in rankings, alongside a notable peak in sales during December, reflects a steady consumer demand and possible seasonal influences. However, the absence of Torus in the top 30 for Concentrates in October 2025 highlights a potential area for growth, as they have since demonstrated capability to ascend the rankings in subsequent months.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Torus has demonstrated a notable shift in its market position over the past few months. Starting from a rank of 11th in October 2025, Torus experienced a slight decline, dropping to 14th by December 2025. However, by January 2026, Torus made a significant comeback, climbing to 9th place. This upward movement in rank coincides with a substantial increase in sales, indicating a positive reception of their product offerings or marketing strategies. In contrast, Fifty Fold and Viking Cannabis have shown more stable rankings, with Viking Cannabis consistently outperforming Torus in terms of sales, particularly in January 2026. Meanwhile, EZ Flower / EZ Puff / EZ-Joint, despite a drop in rank from 4th to 7th, maintains a significant lead in sales over Torus. These dynamics suggest that while Torus is gaining ground, it faces stiff competition from established brands that continue to dominate the market in both rank and sales.

Notable Products

In January 2026, Mint Milkshake (3.5g) reclaimed its top position as the leading product for Torus, with impressive sales of 3510 units. Following closely, Mint Milkshake Pre-Roll 2-Pack (1g) dropped to the second rank despite strong performance in previous months. Gas Face Pre-Roll 2-Pack (1g) emerged as a new contender, achieving the third rank with notable sales. Guava Peach Pre-Roll 2-Pack (1g) maintained a steady presence, ranking fourth, while White Lobster (3.5g) secured the fifth spot, marking its entry into the rankings. The shifts in rankings highlight the dynamic nature of consumer preferences within Torus's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.