Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

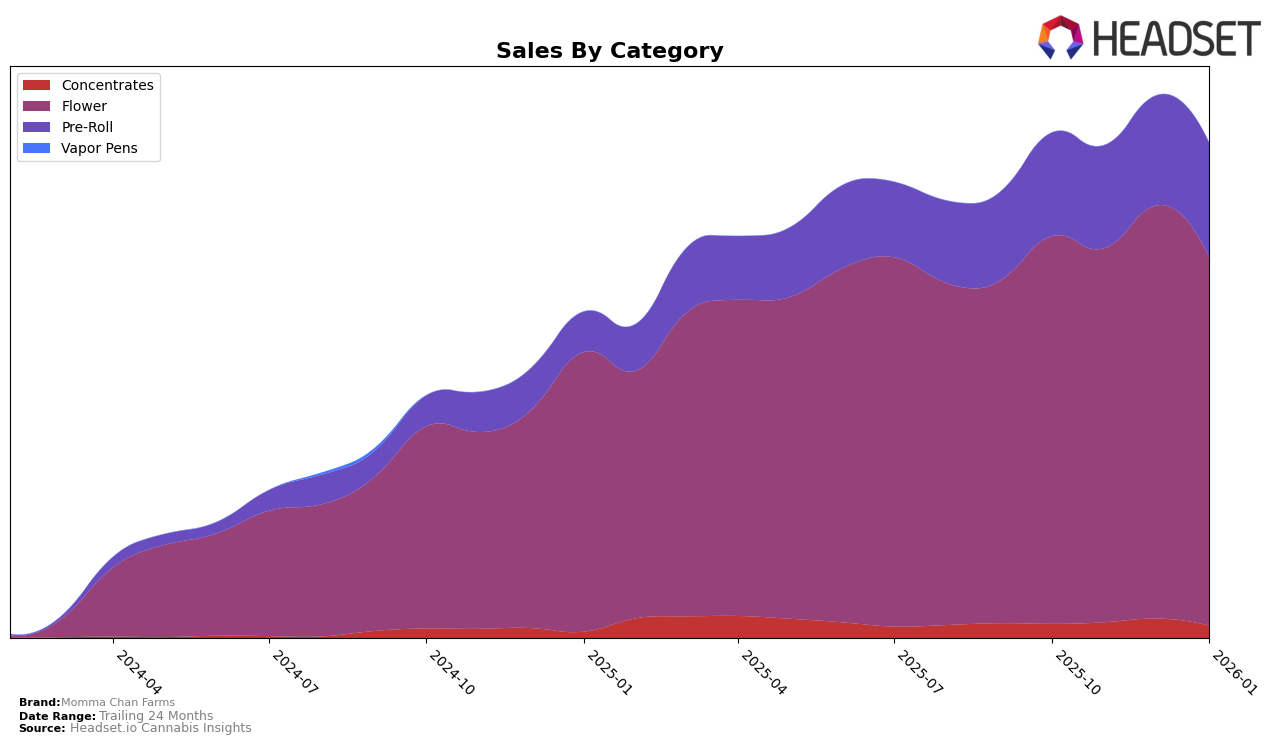

Momma Chan Farms has shown a varied performance across different product categories in Washington. In the Flower category, the brand maintained a strong presence, consistently ranking within the top 15, with a peak at the 8th position in December 2025. This indicates a robust demand for their Flower products, although a slight dip to the 13th position in January 2026 suggests potential competition or market changes. On the other hand, their performance in the Concentrates category has been less impressive, as they were not ranked in the top 30 for October 2025, only making an entry in November 2025 at the 96th position and improving slightly to 87th by December. This could be indicative of growth potential in this segment, albeit from a lower base.

The Pre-Roll category presents a more optimistic outlook for Momma Chan Farms in Washington. Starting at the 38th position in October 2025, the brand showed a positive trajectory, climbing to the 26th spot by January 2026. This upward movement suggests increasing consumer preference or effective brand strategies in this segment. While sales figures are not disclosed, the ranking improvements offer a promising glimpse into the brand's potential to capture more market share in the Pre-Roll category. The absence of data for certain months in specific categories highlights areas that may require strategic focus or could represent untapped opportunities for the brand.

Competitive Landscape

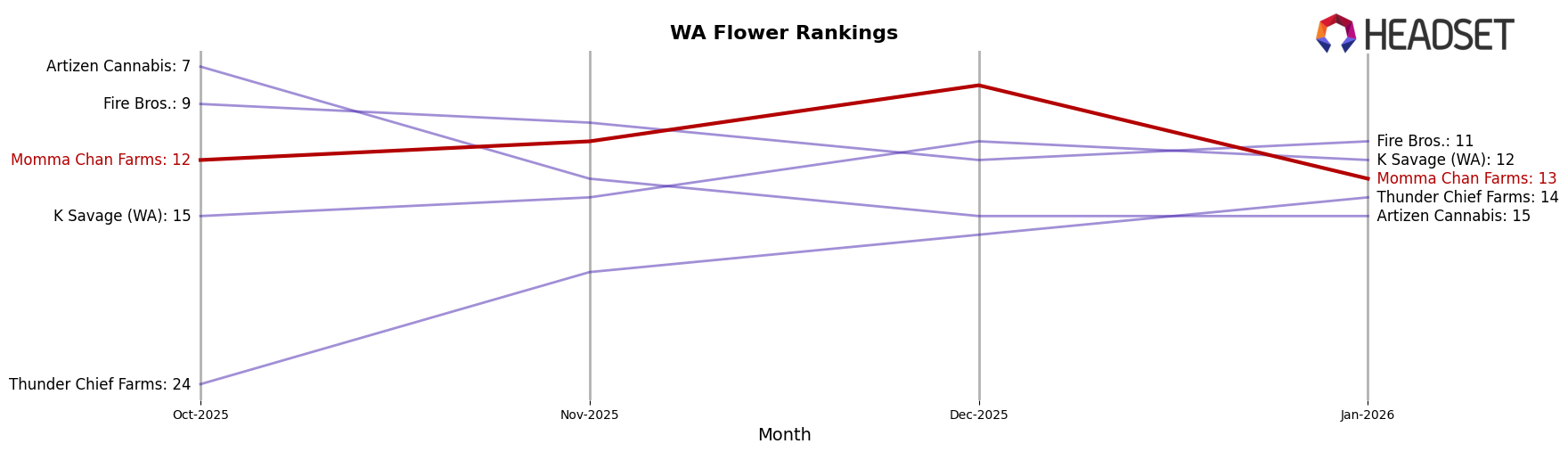

In the competitive landscape of the Washington flower market, Momma Chan Farms has experienced notable fluctuations in its rank over the past few months, reflecting a dynamic market environment. Starting from a rank of 12 in October 2025, Momma Chan Farms improved to 8 by December, before slipping back to 13 in January 2026. This suggests a temporary surge in sales performance, potentially driven by seasonal demand or successful marketing initiatives. In comparison, Artizen Cannabis consistently ranked lower than Momma Chan Farms, ending January at rank 15, indicating a downward trend in sales. Meanwhile, Fire Bros. maintained a stable position, hovering around the 10-12 rank range, showcasing steady sales figures. K Savage (WA) showed an upward trend, surpassing Momma Chan Farms in December but then falling slightly behind in January. Thunder Chief Farms, although starting outside the top 20, has been climbing steadily, reaching rank 14 by January. These dynamics highlight the competitive pressures and opportunities for Momma Chan Farms to leverage its strengths and address any market challenges to maintain and enhance its market position.

Notable Products

In January 2026, the top-performing product from Momma Chan Farms was Hallie Berry Pre-Roll 2-Pack (1g), maintaining its consistent first-place ranking from the previous months, albeit with a notable decrease in sales to 3748 units. Popsicles Pre-Roll 2-Pack (1g) also held steady in the second position, showing an increase in sales compared to December 2025. Rainier Cherry Gelato Pre-Roll 2-Pack (1g) made a significant leap to third place, marking its first appearance in the rankings since October 2025. Crazy 88 Pre-Roll 2-Pack (1g) returned to the charts in fourth place, after being unranked in December, while Gas Face OG Pre-Roll 2-Pack (1g) rounded out the top five, slipping one spot from December. This reshuffling highlights some dynamic changes in consumer preferences, with new entries making a mark in the top positions.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.