Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

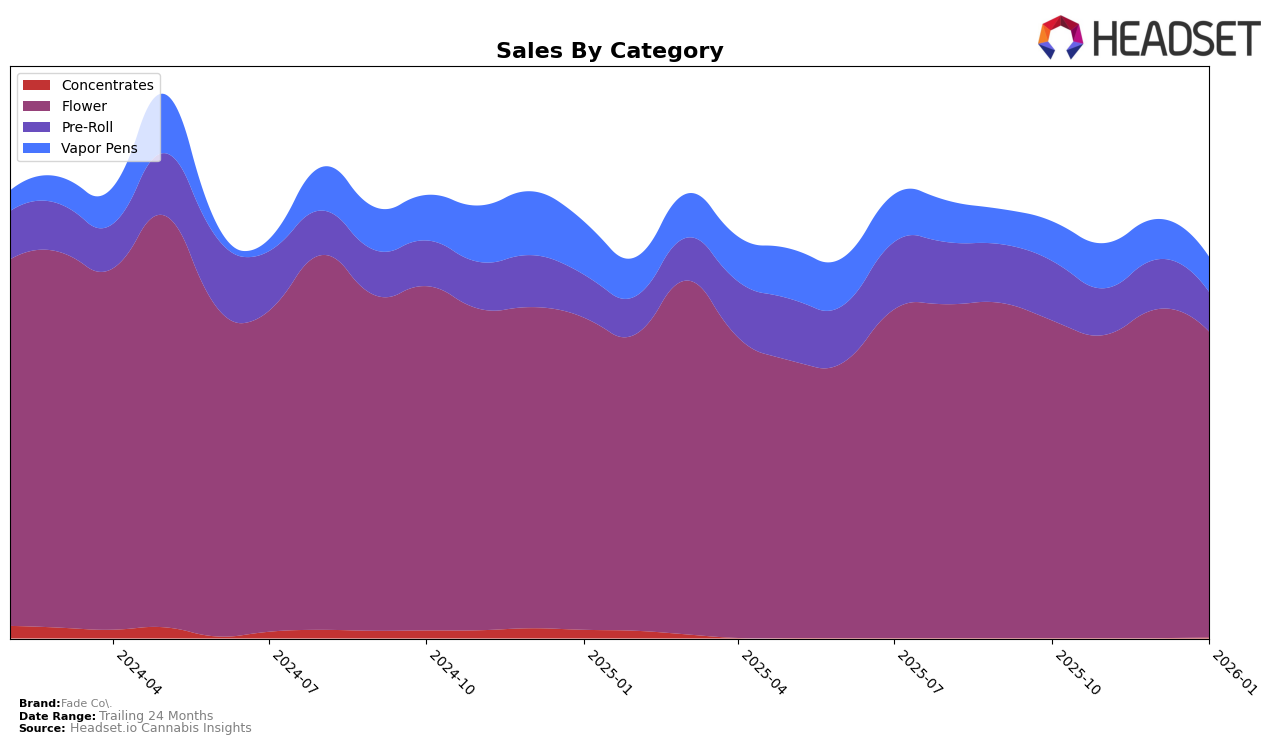

Fade Co. has shown a steady performance in the Arizona market, particularly in the Flower category. Over the past few months, their rank has slightly declined from 6th in October 2025 to 8th by January 2026. Despite this small drop in ranking, their sales figures have demonstrated resilience, peaking in December 2025. However, in the Pre-Roll category, Fade Co. faced more significant challenges. They were ranked 18th in October 2025 but dropped out of the top 20 in November and December before slightly recovering to 22nd in January 2026. This fluctuation highlights potential areas for improvement or strategic shifts to regain market share in this category.

In Maryland, Fade Co. has maintained a strong presence in the Flower category, consistently ranking in the top three positions, with a notable second place in both October 2025 and January 2026. This stability underscores their strong foothold and consumer preference in the state. The Pre-Roll category, however, presents a more volatile picture, with rankings oscillating between 7th and 9th place over the same period. Meanwhile, their performance in the Vapor Pens category has remained consistent, holding the 11th position throughout the months analyzed. This consistency in Vapor Pens, despite some fluctuations in sales, indicates a stable niche for Fade Co. within the Maryland market.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Fade Co. has demonstrated resilience and adaptability, maintaining a strong position despite fluctuations in the market. From October 2025 to January 2026, Fade Co. consistently ranked within the top three, peaking at the second position in October 2025 and January 2026. However, it faced stiff competition from SunMed, which held the top spot for three out of the four months, and RYTHM, which briefly overtook Fade Co. in November 2025. Notably, SunMed's sales figures were consistently higher, indicating a strong market presence and customer loyalty. Meanwhile, District Cannabis remained a steady competitor, though it did not surpass Fade Co. in rank. These dynamics highlight the competitive pressure Fade Co. faces, emphasizing the need for strategic marketing and product differentiation to maintain and improve its market position.

Notable Products

In January 2026, the top-performing product for Fade Co. was Ice Widow Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number one rank from December 2025 with sales of 5183 units. Glitter Bomb Pre-Roll 2-Pack (1g) climbed to the second position from fourth in October 2025, showcasing a strong performance with 4519 units sold. Lemon Cherry Pie Pre-Roll 2-Pack (1g) entered the rankings at the third position, while Shaved Monkey Pre-Roll 2-Pack (1g) debuted at fourth place. Super Boof (3.5g) in the Flower category slipped to fifth place from its previous fourth position in December 2025, indicating a decrease in sales momentum. Overall, Pre-Roll products dominated the top ranks, reflecting a shift in consumer preference within this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.