Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

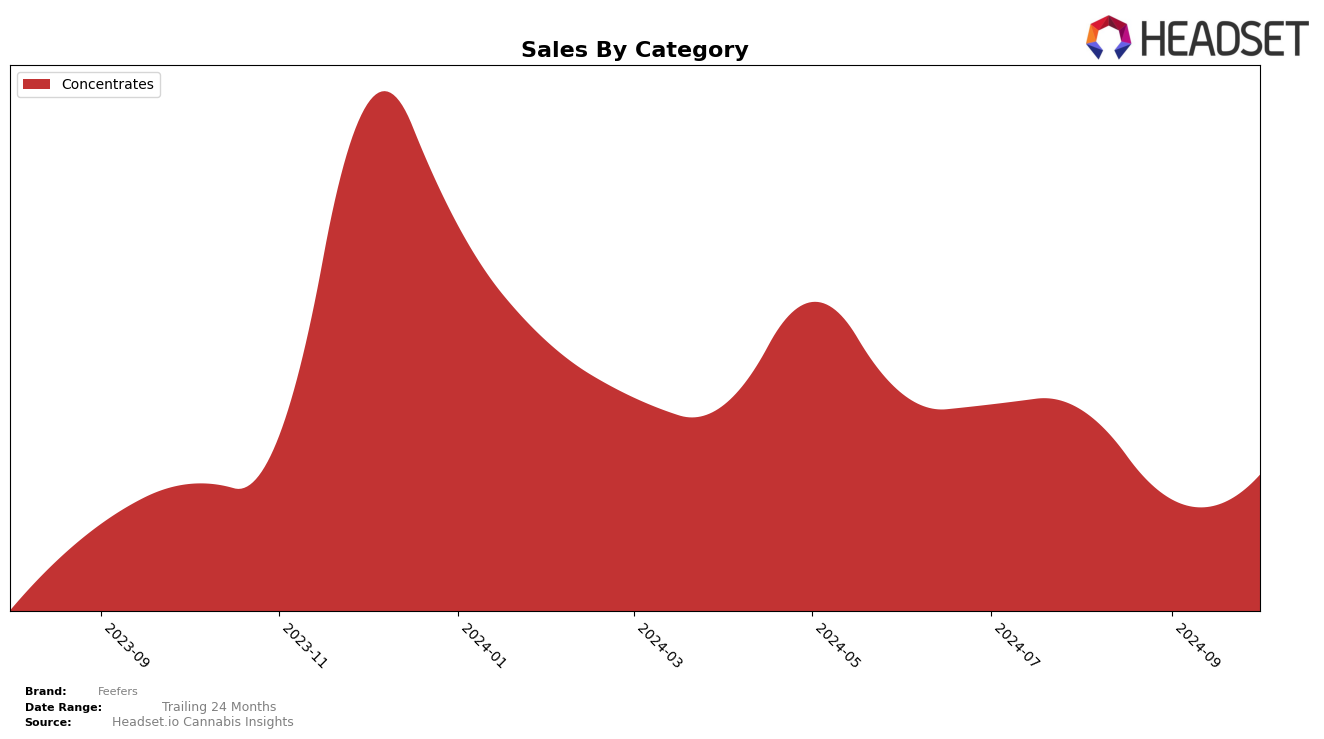

Feefers has shown varied performance across different categories and states, with notable movements in the Concentrates category in Michigan. Starting from July 2024, Feefers ranked 19th but saw a slight decline to 21st in August, followed by a drop to 31st in September. However, the brand managed to recover slightly, moving up to 27th in October. This fluctuation indicates some volatility in their market presence, particularly in September when they fell out of the top 30, which can be seen as a concerning trend. Despite this, the brand's ability to climb back into the rankings in October suggests potential resilience or strategic adjustments.

In terms of sales, Feefers experienced a significant decline from July to September, with sales dropping from $226,260 to $130,041. However, October brought a recovery, with sales increasing to $155,293. This upward trend in October could suggest successful marketing efforts or product innovations that resonated with consumers. The ability to rebound in both rankings and sales in Michigan highlights the brand's potential to adapt to market conditions, although the initial drop in September remains a point of concern for sustained growth.

Competitive Landscape

In the Michigan concentrates market, Feefers experienced notable fluctuations in its ranking over the past few months, which could impact its competitive positioning and sales trajectory. Starting in July 2024, Feefers held a strong position at 19th place, but by September, it had dropped to 31st, before recovering slightly to 27th in October. This decline in rank coincided with a significant dip in sales during September, though sales rebounded in October. Competitors like Strait-Fire and Old School Hash Co. maintained more stable rankings, with Strait-Fire consistently outperforming Feefers in sales. Meanwhile, Rise (MI) and Fresh Coast showed upward trends, with Rise (MI) climbing from 48th to 28th, suggesting increasing competition. Feefers' fluctuating rank and sales highlight the need for strategic adjustments to regain its competitive edge in this dynamic market.

Notable Products

In October 2024, the top-performing product for Feefers was Apple Fritter x Runtz Cured Sugar (1g) in the Concentrates category, maintaining its rank at number one with a notable sales figure of 2213 units. Jungle Sunset Live Badder (1g) held the second position, showing an improvement from its third rank in September with sales of 1492 units. Dirty Taxi Live Badder (1g) climbed to the third position from fifth in the previous month, indicating a positive shift in consumer preference. Black Cherry Punch Live Badder (1g) debuted at the fourth position, while Boreal Bubba Live Badder (1g) entered the rankings at fifth place. Overall, the top products in October demonstrated a dynamic shift in rankings with new entries and improved positions from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.