Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

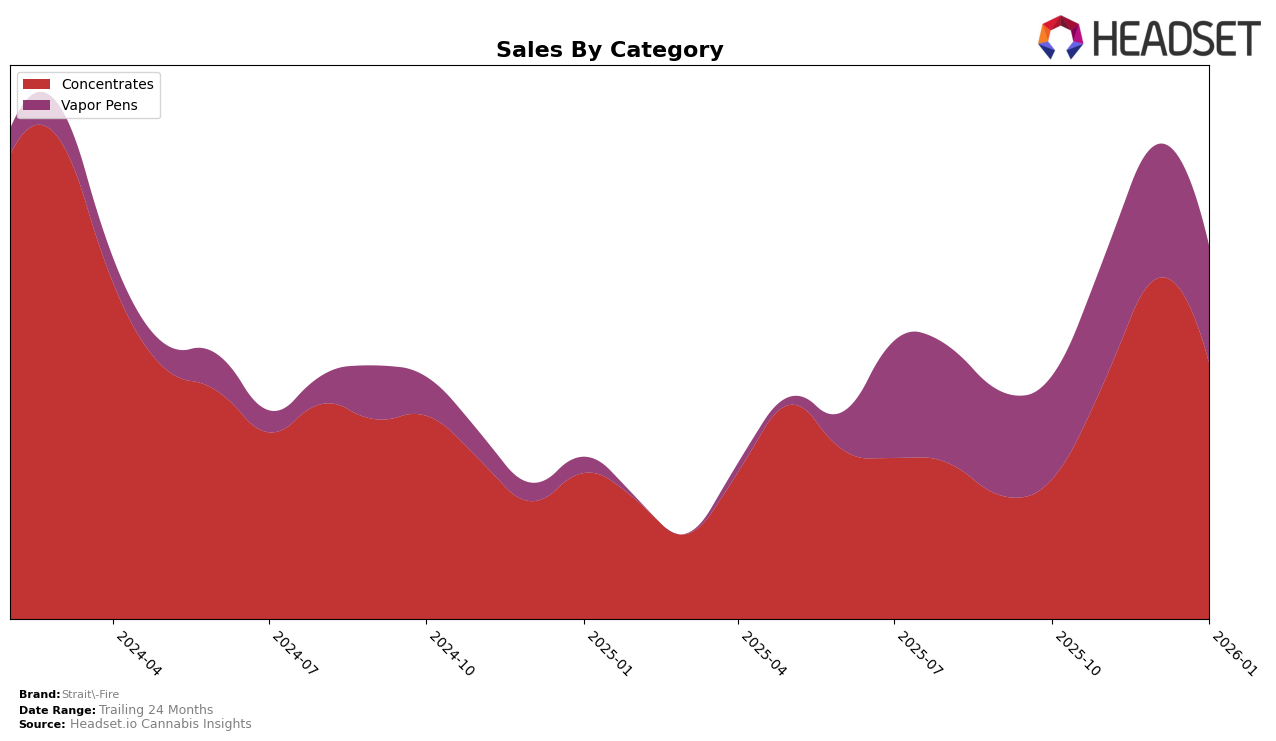

Strait-Fire has demonstrated a notable upward trajectory in the Michigan market, particularly within the Concentrates category. Starting with a rank of 29 in October 2025, the brand swiftly climbed to the 14th position by November and further improved to the 12th position in December, maintaining a strong presence at 13th in January 2026. This consistent upward movement is indicative of a robust strategy in product offerings or market engagement in the Concentrates category. Such a leap in rankings, especially breaking into the top 15, underscores a significant gain in consumer preference and market share, reflecting positively on the brand's overall performance in Michigan.

In contrast, Strait-Fire's performance in the Vapor Pens category within Michigan presents a different narrative. Despite a slight improvement from 75th to 66th position from October to November 2025, the brand remained stagnant at the 66th rank through to January 2026. This plateau suggests challenges in gaining traction or differentiating within this competitive category. The absence of a top 30 ranking here highlights a potential area for strategic refinement or innovation. Such insights into category-specific performance can guide future efforts to bolster Strait-Fire's presence across diverse product lines.

Competitive Landscape

In the Michigan concentrates category, Strait-Fire has shown a dynamic shift in its market position over the past few months. Starting from a rank of 29 in October 2025, it made a significant leap to 14 in November and further improved to 12 in December, before slightly dropping to 13 in January 2026. This upward trajectory in rank is mirrored by a substantial increase in sales, particularly from November to December, indicating a strong market presence and consumer preference. However, competition remains fierce with brands like 710 Labs and Ice Kream Hash Co. consistently ranking higher, although 710 Labs experienced a decline from 8 to 11 by January. Meanwhile, Rocket Fuel and Humblebee are also notable competitors, with Rocket Fuel showing a significant jump from 23 to 12 in January, closely matching Strait-Fire's position. This competitive landscape suggests that while Strait-Fire is gaining traction, maintaining its growth will require strategic efforts to outperform these established brands.

Notable Products

In January 2026, Strait-Fire's top-performing product was NYC Chem Live Rosin (1g) in the Concentrates category, achieving the number one rank with sales of 1283 units. Following closely, Sakura Live Rosin (1g) secured the second position, while Jet Fuel Gelato Live Rosin (1g) held the third spot, both in the Concentrates category. Notably, Golden Cherry Live Rosin Disposable (1g) in the Vapor Pens category dropped from third in December 2025 to fourth in January 2026. Headie Tropper Live Rosin (1g) maintained a strong presence in the top five, ranking fifth in Concentrates. These rankings highlight a slight shift in consumer preference towards more traditional concentrate products over vapor pens for this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.