Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

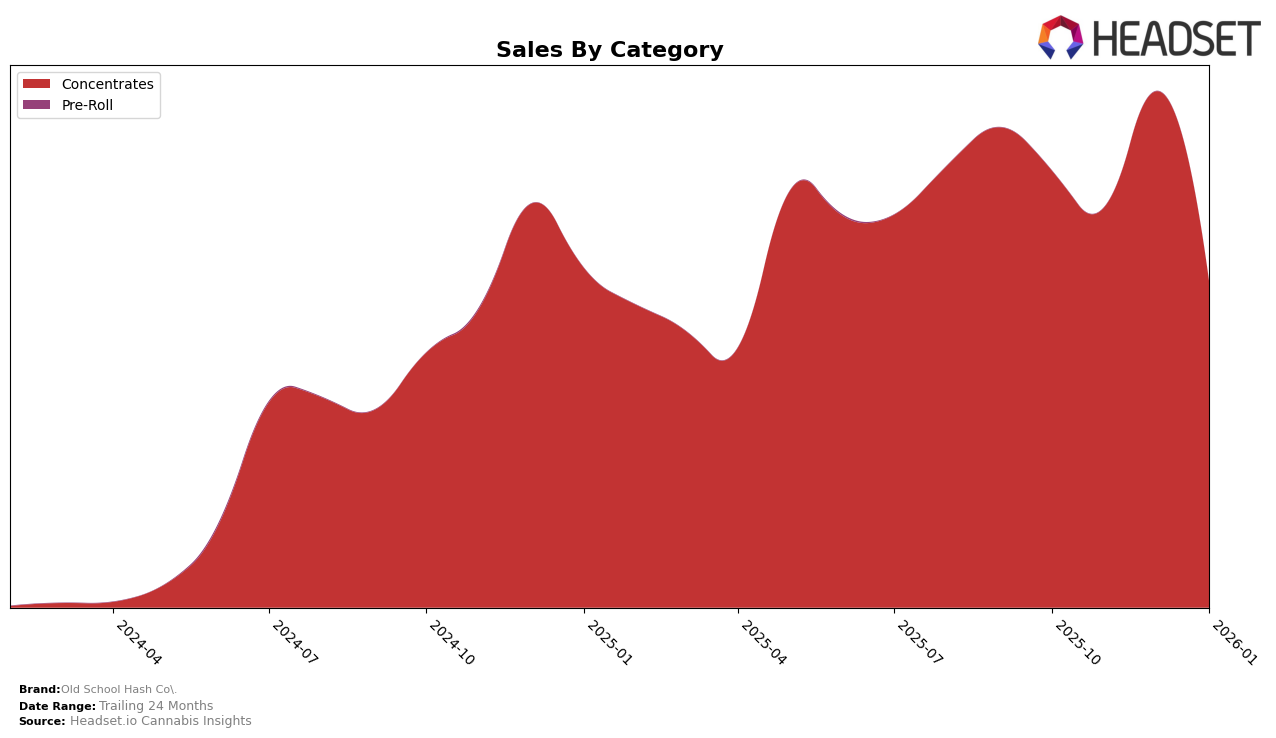

Old School Hash Co. has shown a dynamic performance in the Michigan concentrates category over the past few months. In October 2025, the brand held a solid 6th place, demonstrating a strong presence in the market. However, by November, they slipped to 7th place, indicating a slight decline in their competitive standing. The brand rebounded in December, climbing back to 5th place, which suggests a positive reception to their products or possible strategic adjustments. Unfortunately, by January 2026, Old School Hash Co. dropped to 9th place, which could be a cause for concern as it reflects a downward trend that may need addressing.

It's noteworthy that Old School Hash Co. has consistently remained within the top 10 brands in the concentrates category in Michigan, which underscores their resilience and appeal in this particular market. Despite the fluctuations in their rankings, their sales figures reveal interesting patterns. For instance, December 2025 saw a significant increase in sales, which might have contributed to their temporary rise in ranking. The brand's absence from the top 30 in other states or categories could be viewed as a potential area for growth or a strategic decision to focus on their core strengths in Michigan. This concentrated presence in one state might offer insights into their market strategy and consumer preferences.

Competitive Landscape

In the Michigan concentrates market, Old School Hash Co. has experienced notable fluctuations in its ranking and sales over the past few months. Starting from a strong position in October 2025, ranked 6th, the brand saw a slight dip to 7th in November, a rise to 5th in December, and then a drop to 9th by January 2026. This volatility suggests a competitive landscape where brands like 710 Labs and The Fresh Canna have maintained more consistent rankings, with The Fresh Canna consistently holding the 7th position from November through January. Meanwhile, High Minded showed a remarkable improvement, climbing from 16th in November to 8th by January, indicating a potential threat to Old School Hash Co.'s market share. Despite these challenges, Old School Hash Co. achieved its highest sales in December, suggesting that while its rank fluctuated, the brand still managed to capture consumer interest effectively during the holiday season. As the market evolves, Old School Hash Co. will need to strategize to maintain its competitive edge against these dynamic competitors.

Notable Products

In January 2026, the top-performing product from Old School Hash Co. was Grape Gas Temple Ball Hash 1g, which rose to the number one rank, showcasing a strong sales figure of 1061 units. Blue Dream Brick Hash 1g, although previously ranked first in December 2025, moved to the second position with a notable decrease in sales to 808 units. Frosted Cherry Cookies Brick Hash 1g maintained its third-place ranking from December 2025, indicating consistent performance with 768 units sold. Hash Plant Brick Hash 1g remained stable in the fourth position from the previous month, while Bananaconda Bubble Hash 1g entered the rankings at fifth place, marking its presence in the market. This shift in rankings highlights Grape Gas Temple Ball Hash's growing popularity amidst changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.