Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

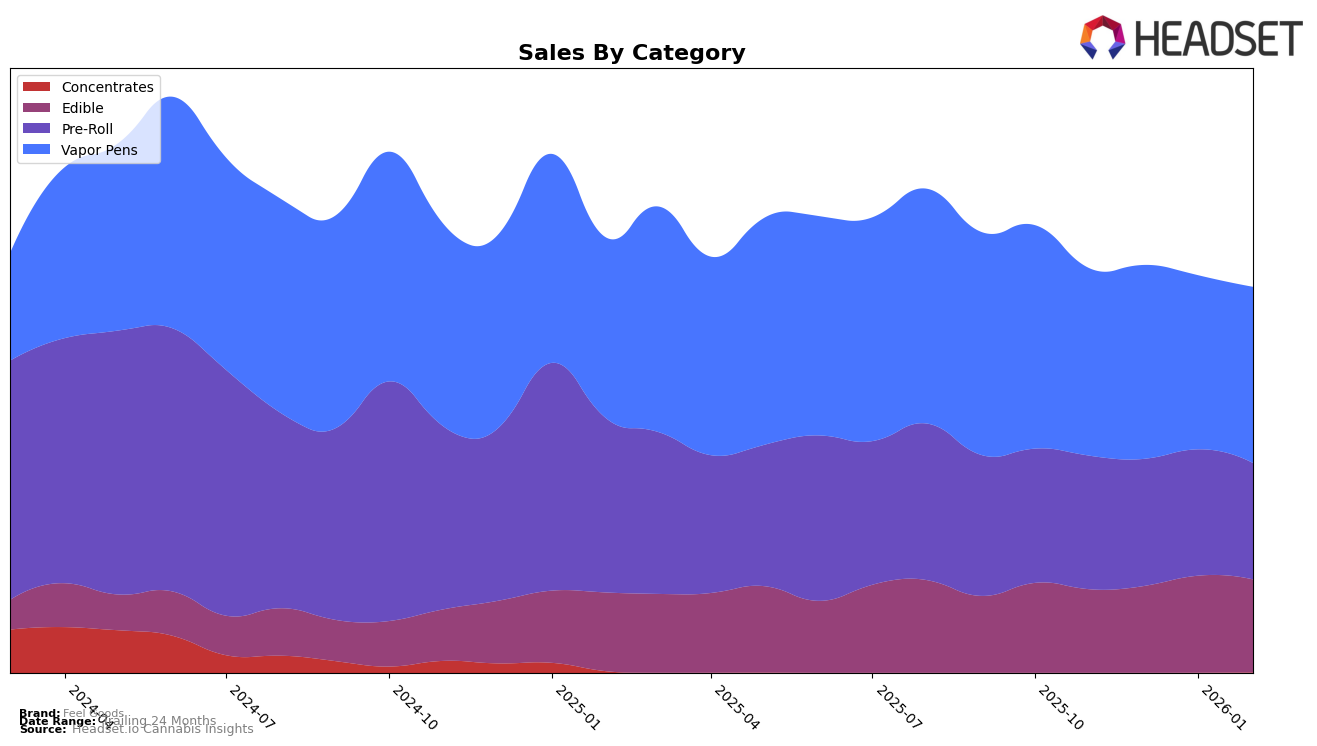

Feel Goods has demonstrated notable performance across different product categories in Oregon. In the Edible category, the brand has maintained a relatively strong position, holding steady at rank 12 in both January and February 2026 after a slight dip to rank 14 in December 2025. This consistent ranking indicates a stable demand for their edible products, supported by a sales increase from November to January. Conversely, the Vapor Pens category saw Feel Goods bouncing back to rank 22 in February 2026 after dropping to rank 26 in December 2025, suggesting some recovery in their market presence despite fluctuating sales figures.

The Pre-Roll category reflects a different trajectory for Feel Goods in Oregon. The brand experienced a gradual decline from rank 16 in November 2025 to rank 19 in December, before slightly recovering to rank 17 by February 2026. This downward trend in rankings, coupled with decreasing sales, highlights potential challenges in maintaining their foothold in the Pre-Roll market. Such movements across categories indicate varying consumer preferences and competitive pressures that Feel Goods faces within the state, providing a snapshot of the brand's current market dynamics.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Feel Goods has experienced notable fluctuations in its ranking over the past few months, impacting its market positioning. In November 2025, Feel Goods was ranked 22nd, but it slipped to 26th in December before recovering slightly to 25th in January 2026 and returning to 22nd in February. This volatility contrasts with the performance of competitors like Rogue Gold, which surged from 25th in November to 15th in December, indicating a significant increase in sales during that period. Meanwhile, Beehive Extracts maintained a consistent presence at the 20th position until February, when it dropped out of the top 20, suggesting a decline in sales. Punch Bowl showed a strong upward trend, moving from 31st in November to 20th by February, reflecting a steady increase in consumer preference. These dynamics suggest that while Feel Goods has managed to stabilize its position, it faces strong competition from brands that are either rapidly gaining market share or maintaining a steady presence, highlighting the need for strategic adjustments to enhance its competitive edge in the Oregon vapor pen market.

Notable Products

In February 2026, the top-performing product from Feel Goods was the Blueberry Straw Gummy (100mg) in the Edible category, maintaining its number one rank for four consecutive months with sales of 9,539 units. Following closely, the Watermelon Straw Gummy (100mg) held steady in second place, although its sales dipped from January. The Razzleberry Straw Gummy (100mg) also retained its third position, showing consistent performance across the months. The Strawberry Straw Gummy (100mg) moved up to fourth place in January and maintained that position in February, surpassing the Citrus Twist Straw Gummy (100mg) which remained in fifth place. Overall, these products have shown remarkable stability in their rankings over the months, with no changes in the top five positions from January to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.