Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

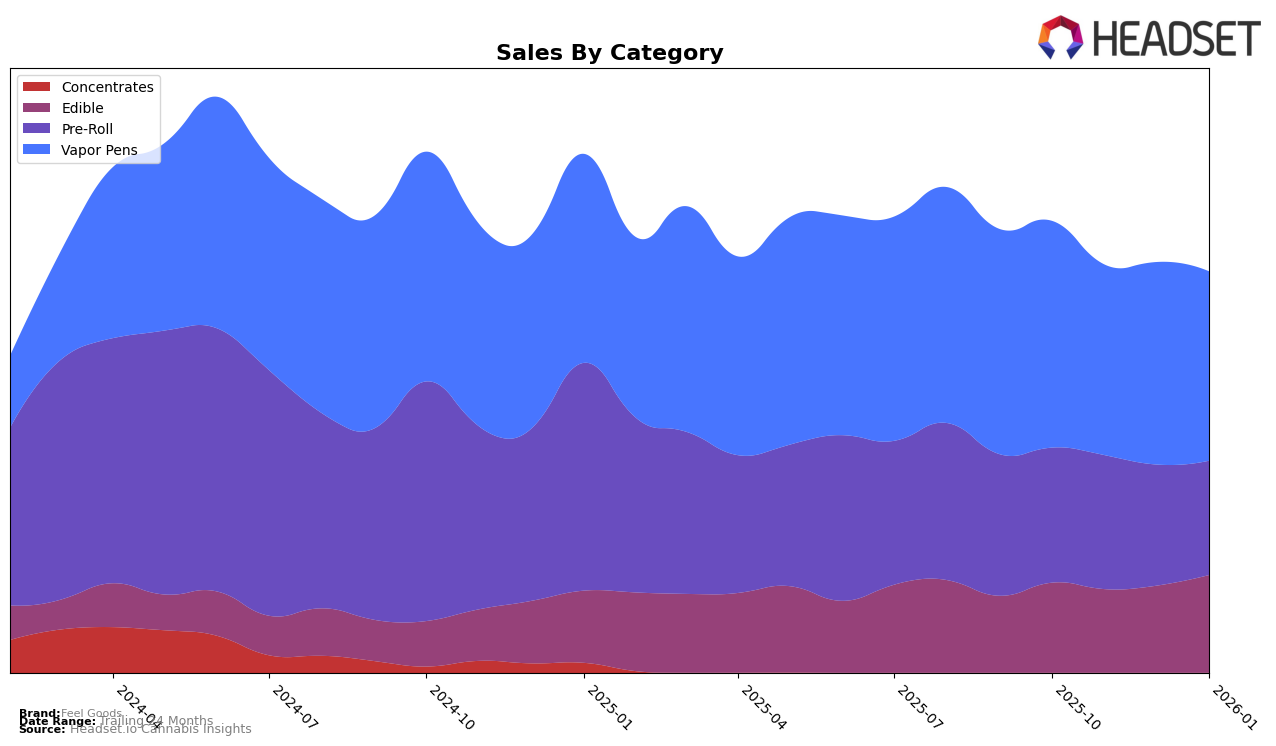

Feel Goods has demonstrated varied performance across different product categories in Oregon. In the Edible category, the brand maintained a steady position, hovering around the 13th to 14th rank over the last few months and climbing to 12th in January 2026. This upward movement is indicative of a positive reception and possibly increased consumer demand, as evidenced by a notable increase in sales from November to January. Meanwhile, the Pre-Roll category saw Feel Goods slipping slightly in rankings, moving from 17th in October to 18th by January, accompanied by a slight decline in sales. This suggests potential challenges in maintaining market share within this competitive segment.

In the Vapor Pens category, Feel Goods experienced a decline in its standing, dropping from the 20th position in October to 23rd in January. This downward trend could be a concern for the brand, as it indicates a struggle to compete against other brands in this category. The reduction in rankings is mirrored by a decrease in sales from October to January, pointing to possible shifts in consumer preferences or increased competition. It's worth noting that in none of these categories did Feel Goods fall out of the top 30, which is a positive sign of the brand's resilience and established presence in the Oregon market.

Competitive Landscape

In the competitive landscape of Vapor Pens in Oregon, Feel Goods has experienced fluctuating rankings over the past few months, indicating a dynamic market position. Starting in October 2025, Feel Goods held the 20th rank, but by December 2025, it had slipped to 25th before slightly recovering to 23rd in January 2026. This volatility in rank suggests that while Feel Goods remains a notable player, it faces stiff competition from brands like Beehive Extracts and Elysium Fields, which have consistently maintained or improved their standings. For instance, Beehive Extracts improved from 28th to 21st between October and November, while Elysium Fields hovered around the 20th rank, showing stronger stability. Despite Feel Goods' sales peaking in October 2025, they have since experienced a downward trend, contrasting with Kaprikorn, which saw a sales increase from November to January. This analysis underscores the need for Feel Goods to strategize effectively to regain and sustain a higher rank amidst fierce competition in the Oregon Vapor Pens market.

Notable Products

In January 2026, the top-performing product for Feel Goods was the Blueberry Straw Gummy (100mg) in the Edible category, maintaining its leading position from December with sales reaching 10,110 units. The Watermelon Straw Gummy (100mg) remained steady in the second position, while the Razzleberry Straw Gummy (100mg) continued to hold the third spot. Notably, the Strawberry Straw Gummy (100mg) climbed to fourth place from fifth in the previous months, showing a positive trend in sales. The Citrus Twist Straw Gummy (100mg) dropped to fifth place, continuing its gradual decline in rankings since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.