Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

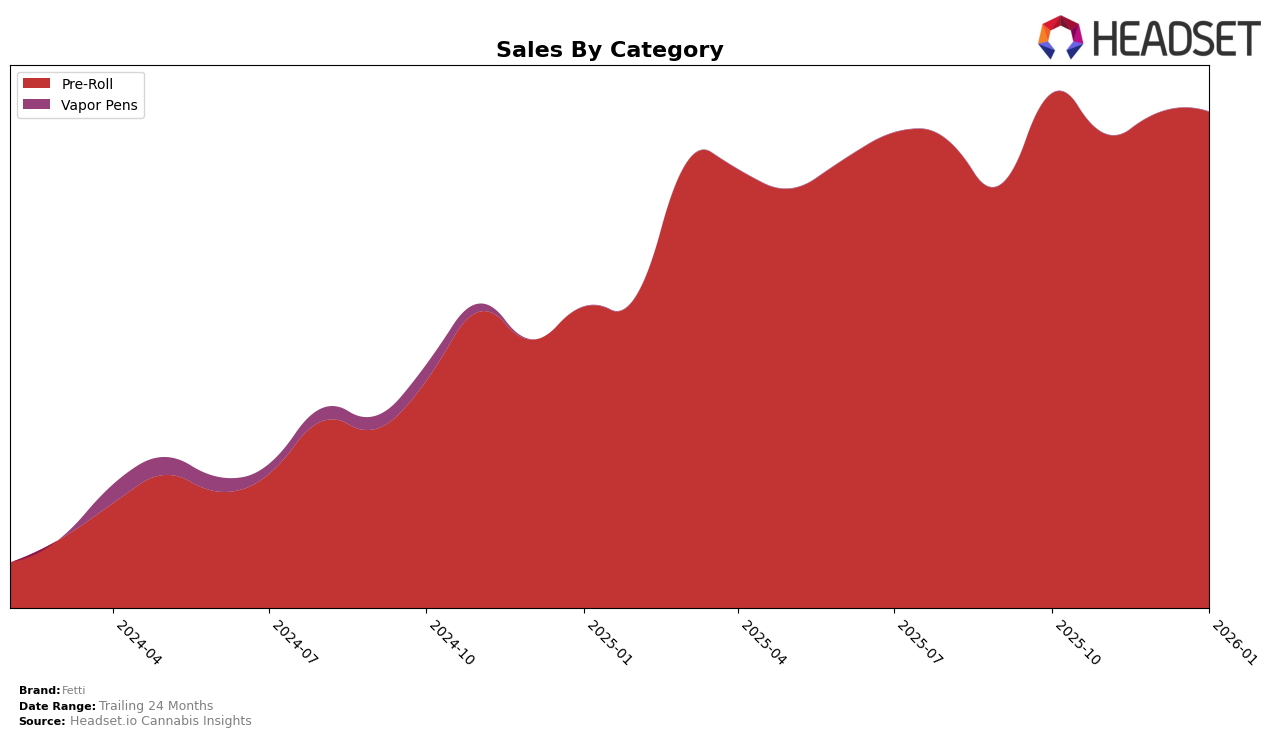

Fetti has shown a consistent presence in the Pre-Roll category within Washington, maintaining a steady climb from 25th to 23rd place between October 2025 and January 2026. This upward trend indicates a strengthening position in the market, even as sales experienced a slight dip in November before recovering in December and January. The brand's ability to inch up the rankings suggests that it is capturing consumer interest and possibly expanding its market share, despite the competitive landscape. It's noteworthy that Fetti's sales figures have remained relatively stable, indicating resilience and potential for further growth.

Interestingly, Fetti's performance in other states or provinces is not mentioned in the top 30 rankings, which could be seen as a missed opportunity or a strategic focus on specific markets like Washington. This absence from the rankings in other regions might suggest that Fetti is either not focusing its efforts beyond Washington or facing stiff competition that prevents it from breaking into the top 30. Understanding the dynamics in these other markets could provide insights into potential areas for expansion or necessary adjustments in strategy to improve Fetti's standing and visibility across more states or provinces.

```Competitive Landscape

In the competitive landscape of the Washington state pre-roll category, Fetti has shown a steady improvement in rank, moving from 25th in October 2025 to 23rd by January 2026. This upward trend is indicative of a positive reception in the market, despite fierce competition. Notably, Falcanna has maintained a consistent 21st rank throughout the same period, suggesting a stable customer base and strong brand loyalty. Meanwhile, Redbird (formerly The Virginia Company) and Dose have fluctuated in their rankings, with Redbird peaking at 19th in November 2025 before slipping to 24th by January 2026, and Dose experiencing a similar pattern. Interestingly, PICC Platform has made a significant leap from 50th to 22nd, surpassing Fetti in January 2026. This competitive movement highlights the dynamic nature of the market, where Fetti's consistent sales performance positions it well against these fluctuating competitors, yet underscores the need for strategic initiatives to further climb the ranks.

Notable Products

In January 2026, Fetti's top-performing product was the Fuzzy Grape THCA Diamonds Infused Pre-Roll 2-Pack in the Pre-Roll category, maintaining its position as the number one seller with sales figures reaching 2558. The Blueberry Pancake Infused Pre-Roll 2-Pack climbed to the second spot, up from third place in December 2025, indicating a rising popularity. Motorbreath Infused Pre-Roll slipped from second in December to third in January, showing a slight decline in sales performance. East Coast Sour Diesel THCA Diamonds Infused Pre-Roll remained consistent in the fourth position, having moved from fifth place in the previous month. Joker Candy Infused Pre-Roll completed the top five, dropping from fourth to fifth, highlighting a shift in consumer preference within the brand's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.