Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

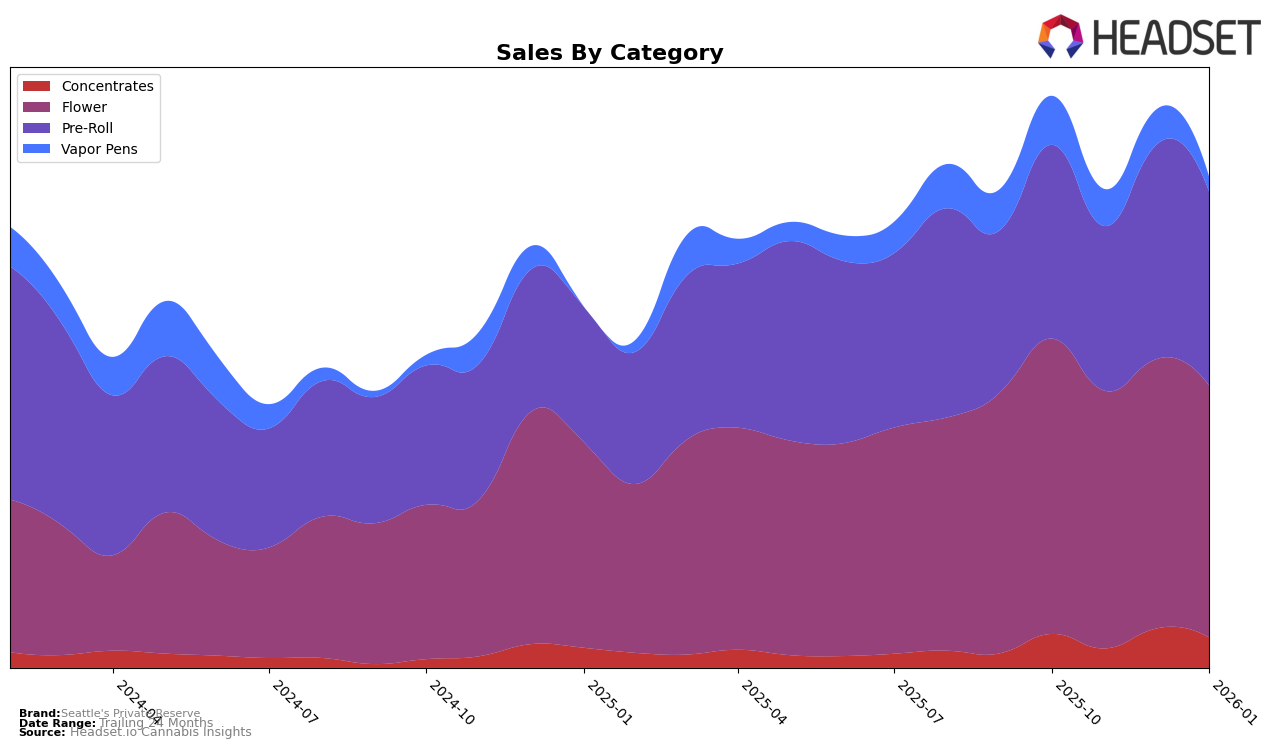

Seattle's Private Reserve has demonstrated varied performance across its product categories in Washington. In the Concentrates category, the brand has shown a slight upward trend, moving from rank 42 in October 2025 to 38 by January 2026, despite a dip in November. This suggests a growing acceptance or preference for their concentrates, although they are still outside the top 30. In the Flower category, Seattle's Private Reserve consistently maintained a position within the top 30, fluctuating slightly between ranks 27 and 29 over the observed months. This stability could indicate a steady consumer base or consistent product quality in this category.

The Pre-Roll category has been a stronghold for Seattle's Private Reserve, consistently maintaining a rank of 20 in three out of the four months analyzed. This consistency might reflect a strong brand reputation or consumer loyalty in this segment. However, the Vapor Pens category presents a different picture, with the brand slipping from rank 69 in October 2025 to 88 by January 2026, indicating challenges in maintaining competitiveness or market share. This decline could be attributed to increased competition or shifting consumer preferences away from vapor pens. Overall, while Seattle's Private Reserve has areas of strength, particularly in Pre-Rolls and Flower, the brand faces challenges in expanding its presence in other categories like Concentrates and Vapor Pens.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Seattle's Private Reserve has shown a relatively stable performance, maintaining a rank within the top 30 from October 2025 to January 2026. Despite a slight dip in sales from October to January, Seattle's Private Reserve consistently outperformed Sky High Gardens and WA Grower, which fluctuated in and out of the top 30. Meanwhile, SKÖRD demonstrated a more volatile ranking, dropping from 18th to 27th, yet still managed to surpass Seattle's Private Reserve in sales during the period. Agro Couture also showed a competitive edge, consistently ranking close to Seattle's Private Reserve, but ultimately fell out of the top 30 in January 2026. These dynamics suggest that while Seattle's Private Reserve maintains a stable position, there is a need to strategize for increased sales and rank improvement amidst fluctuating competition.

Notable Products

In January 2026, Seattle's Private Reserve saw Afghan Diesel Pre-Roll 2-Pack (2g) maintain its top position from November 2025, with sales reaching 2630 units, marking it as the leading product. Sour Diesel Pre-Roll 2-Pack (2g) held steady at the second position since its debut in December 2025. Cake Frosting Pre-Roll 2-Pack (2g) improved its ranking to third place from fifth in December 2025, showcasing an upward trend. Blueberry Pie Pre-Roll 2-Pack (2g) dropped from first in December to fourth in January, indicating a shift in consumer preference. Cake Frosting (3.5g) entered the ranking at fifth place, showing a strong presence in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.