Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

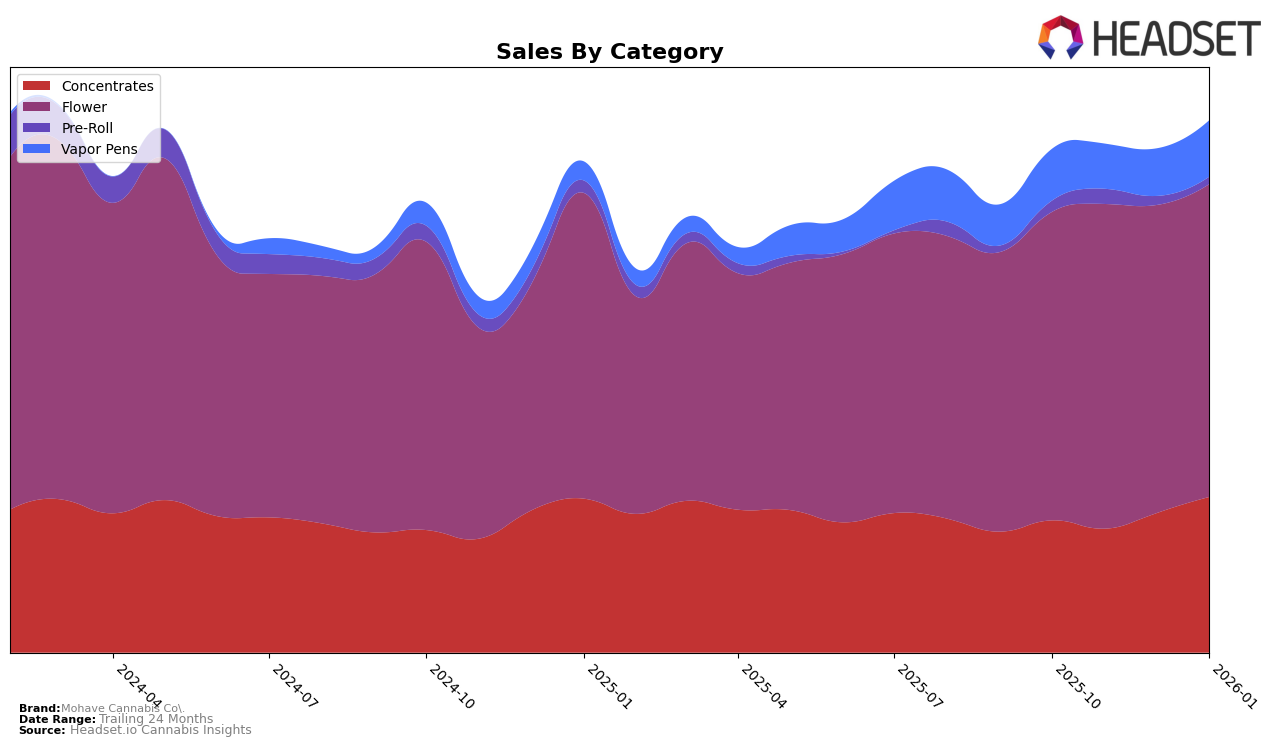

Mohave Cannabis Co. has demonstrated a strong and consistent performance in the Arizona market, particularly in the Concentrates category where it has maintained the top spot from October 2025 through January 2026. This stability highlights the brand's strong foothold and potential customer loyalty in this segment. In the Flower category, Mohave Cannabis Co. has consistently held the second position across the same time period, indicating a robust presence and competitive edge. However, the brand's performance in Pre-Rolls shows some volatility, with rankings appearing only in October and November 2025 at 28th and 23rd positions respectively, suggesting potential challenges or opportunities for growth in this category. Meanwhile, in the Vapor Pens category, Mohave Cannabis Co. has maintained a steady 12th place ranking, which could indicate a stable but possibly untapped potential for improvement.

The sales trajectory for Mohave Cannabis Co. in Arizona reveals interesting insights. For Concentrates, there has been a noticeable increase in sales from November 2025 to January 2026, suggesting a growing market demand or effective promotional strategies. Despite the consistent second-place ranking in Flower, sales figures have shown fluctuations, which might be attributed to seasonal trends or competitive market dynamics. The absence of rankings for Pre-Rolls in December 2025 and January 2026 could be a concern, signaling a potential need for strategic adjustments to regain market presence. Meanwhile, the Vapor Pens category experienced a sales uptick in January 2026, which might indicate a positive response to product innovations or marketing efforts. These movements across categories and time periods provide a nuanced picture of Mohave Cannabis Co.'s performance and strategic positioning in the Arizona market.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Mohave Cannabis Co. consistently holds the second rank from October 2025 to January 2026, demonstrating a stable market presence. Despite this consistency, JustFLOWR (MA) maintains a firm grip on the top position, with sales figures significantly higher than Mohave Cannabis Co., indicating a strong brand preference among consumers. Meanwhile, Find. and Brown Bag show fluctuations in their rankings, with Find. briefly dropping to fourth place in December 2025 before recovering. This volatility among competitors suggests potential opportunities for Mohave Cannabis Co. to capitalize on any shifts in consumer loyalty or market dynamics. The consistent sales performance of Mohave Cannabis Co., despite the competitive pressure, highlights its robust brand positioning and potential for growth if strategic marketing efforts are enhanced.

Notable Products

In January 2026, Mohave Cannabis Co.'s top-performing product was Mixed Strain RSO (1g) in the Concentrates category, maintaining its number one rank for four consecutive months with sales reaching 11,910 units. Dosi Cot (3.5g) in the Flower category showed significant improvement, climbing from fifth place in December 2025 to second place in January 2026. Motorhead (3.5g) entered the ranking at third place, while Mohave Sour (3.5g) followed closely at fourth. Permanent Marker (3.5g) experienced a decline, moving from second place in November 2025 to fifth in January 2026. This shift in rankings highlights a dynamic change in consumer preferences within the Flower category over recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.