Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

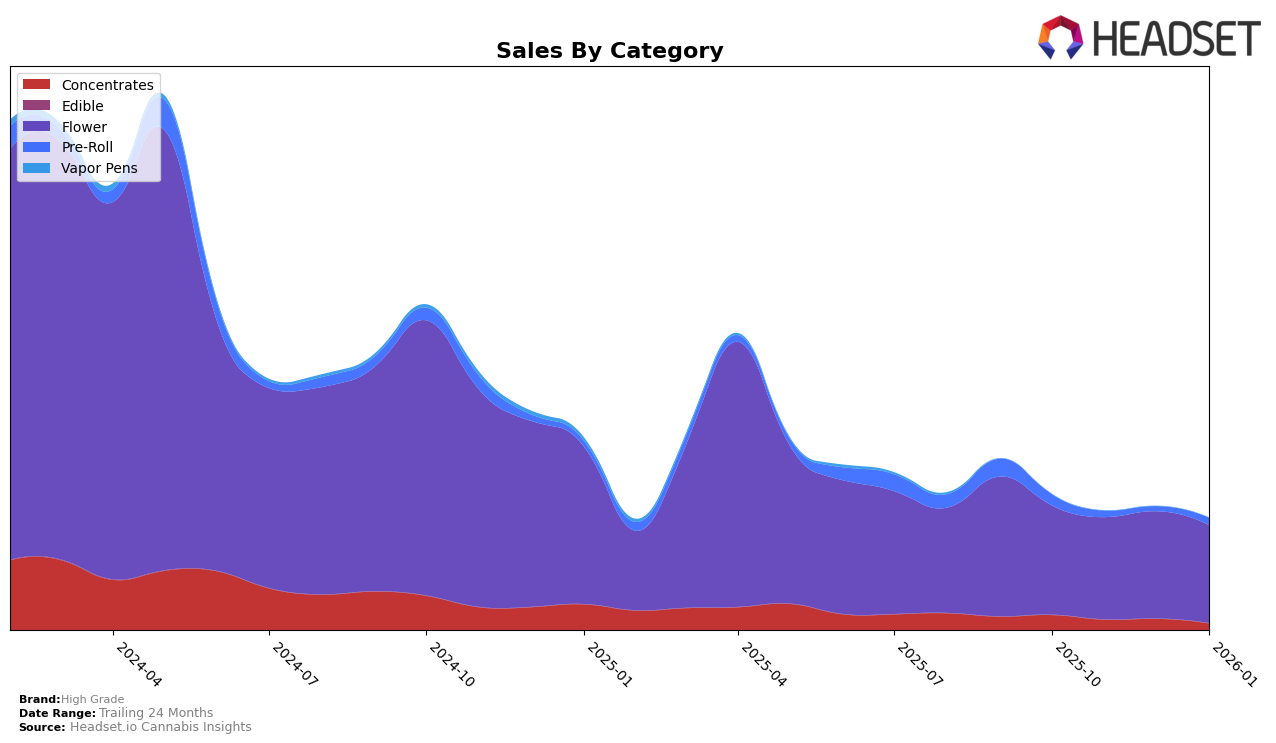

High Grade's performance in the Arizona market showcases some interesting dynamics across different product categories. In the Concentrates category, the brand experienced a slight dip in its ranking from 20th in October 2025 to 31st in November, before climbing back to 26th by January 2026. This fluctuation is mirrored in their sales figures, which saw a notable recovery in January. Meanwhile, in the Flower category, High Grade maintained a relatively strong position, moving from 12th in October to 13th in January, with sales consistently improving over this period. However, the Pre-Roll category tells a different story, with the brand's ranking dropping out of the top 30 in November and December, only to re-enter at 41st in January. This suggests a challenging environment in the Pre-Roll segment, possibly due to increased competition or shifting consumer preferences.

In Michigan, High Grade's presence in the Concentrates category highlights some challenges. The brand's ranking remained outside the top 30 throughout the observed months, with a peak position of 73rd in December 2025. This consistently lower ranking compared to Arizona indicates a tougher competitive landscape or perhaps differing consumer tastes in Michigan. Despite these challenges, the brand's sales figures in Michigan show a slight but steady decline from October to December, pointing to potential areas for strategic improvement. The absence of a January 2026 ranking suggests that High Grade may have fallen further behind, emphasizing the need for a focused approach to regain traction in this market.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, High Grade has experienced notable fluctuations in its rankings over the past few months. Starting at 12th place in October 2025, High Grade saw a dip to 18th in November, before recovering to 12th in December and slightly dropping to 13th in January 2026. This pattern suggests a competitive struggle, especially against brands like Grassroots, which maintained a relatively stable position, only dropping from 13th to 15th before climbing back to 12th. Meanwhile, 22Red showed a strong upward trajectory, moving from 18th to 14th, potentially posing a threat to High Grade's market share. Additionally, Drip Oils + Extracts consistently outperformed High Grade, securing a top 10 position by December. These dynamics indicate that while High Grade remains a key player, it faces significant competition from brands that are either stabilizing or improving their market positions, which could impact its sales momentum if not addressed strategically.

Notable Products

In January 2026, Astro Kush (3.5g) emerged as the top-performing product for High Grade, climbing from fourth place in December 2025 to secure the number one spot with sales of 8,216 units. Fam 95 (3.5g) followed closely in second place, dropping from its previous first-place position in December. Vice City (3.5g) maintained a strong presence, ranking third despite a slight decrease from its earlier second-place ranking in December. Singapore Sling Pre-Roll (0.6g) made a notable entry at fourth place, while Melonade (Bulk) experienced a significant drop, falling from third in December to fifth in January. This shift in rankings highlights the dynamic changes in consumer preferences within High Grade's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.