Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

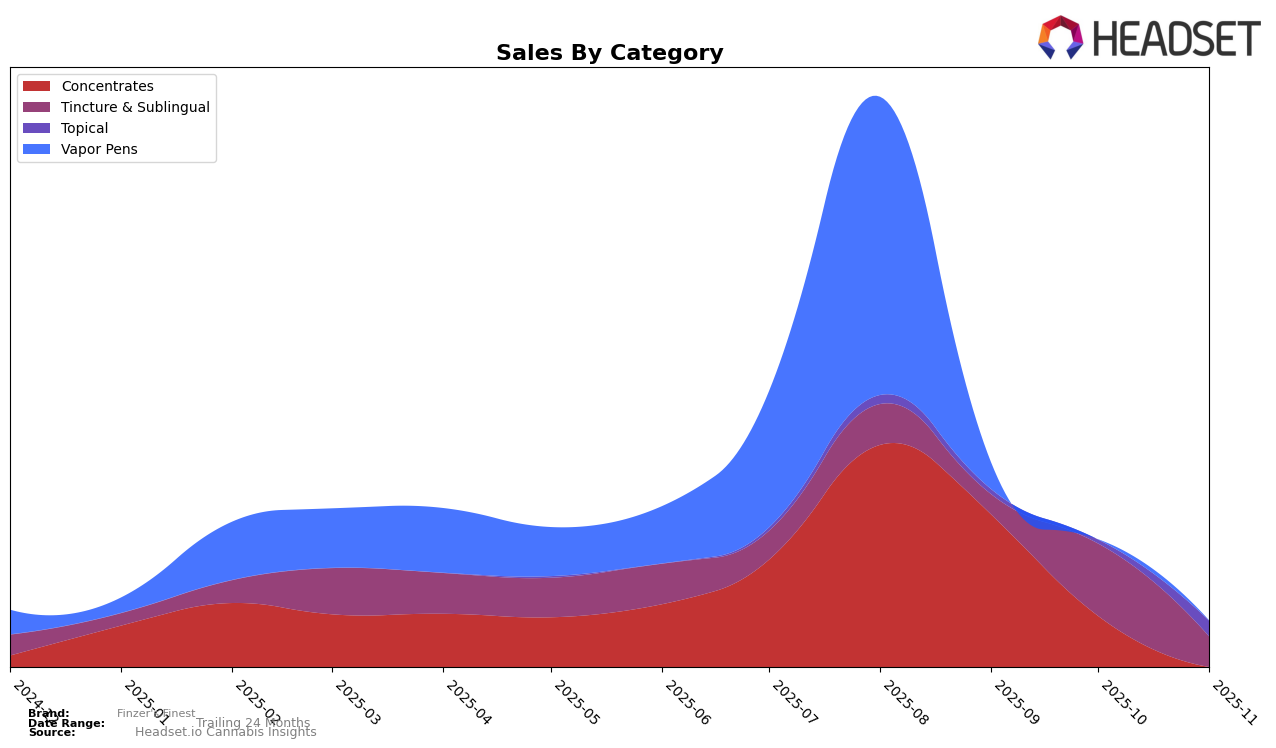

In Ohio, Finzer's Finest has shown a varied performance across different product categories. In the concentrates category, the brand was ranked 33rd in August 2025, indicating a presence but not a strong foothold in the top tier. However, it did not maintain this ranking in subsequent months, suggesting a possible decline in market share or increased competition. Similarly, in the vapor pens category, Finzer's Finest was ranked 72nd in August 2025, but again did not appear in the top 30 in the following months, highlighting challenges in maintaining competitive positioning in this segment. This absence from the top rankings in both categories for the remaining months could signal a need for strategic adjustments to improve market penetration and visibility.

The absence of Finzer's Finest from the top 30 rankings in both the concentrates and vapor pens categories in Ohio after August 2025 might reflect broader market dynamics or internal challenges. The brand's initial appearance in the rankings indicates potential, but the subsequent drop-off suggests that either consumer preferences have shifted or competitors have strengthened their positions. Notably, the sales figures in August 2025 for both categories show a starting point that could be built upon with targeted marketing strategies or product innovations. Understanding these trends and responding effectively could be crucial for Finzer's Finest to regain or enhance its standing in the Ohio market.

Competitive Landscape

In the Ohio concentrates market, Finzer's Finest has faced significant competitive pressure, particularly from brands like Main Street Health and Buckeye Relief. As of August 2025, Finzer's Finest was ranked 33rd, indicating a struggle to break into the top tier. Meanwhile, Buckeye Relief, which was ranked 12th in August, has maintained a strong presence, suggesting a stable consumer base and possibly higher brand loyalty. Main Street Health, although not in the top 20, has shown consistent rankings around the 28th to 30th positions from August to October, with a slight decline in sales, which might indicate a potential opportunity for Finzer's Finest to capture market share if they can address consumer needs more effectively. The absence of Finzer's Finest in the rankings from September onwards highlights the need for strategic adjustments to improve visibility and sales performance in this competitive landscape.

Notable Products

In November 2025, Finzer's Finest saw the CBN/THC 1:1 Indica Moon Full Spectrum RSO Spray leading the sales as the top product in the Tincture & Sublingual category, maintaining its position from October. The CBG/THC 1:1 Sun Full Spectrum RSO Spray Tincture climbed to second place, showing an improvement from its third position in October. The CBD/THC 1:1 Hybrid Eclipse Full Spectrum RSO Spray Tincture, which was the top seller in October, ranked third in November. Notably, the Full Spectrum RSO Lip Balm 2-Pack entered the rankings at fourth place, highlighting its growing popularity. The Eclipse Full Spectrum RSO Luster Pod, previously holding the top spot in August, did not appear in the rankings for November, indicating a shift in consumer preference towards the RSO spray products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.