Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

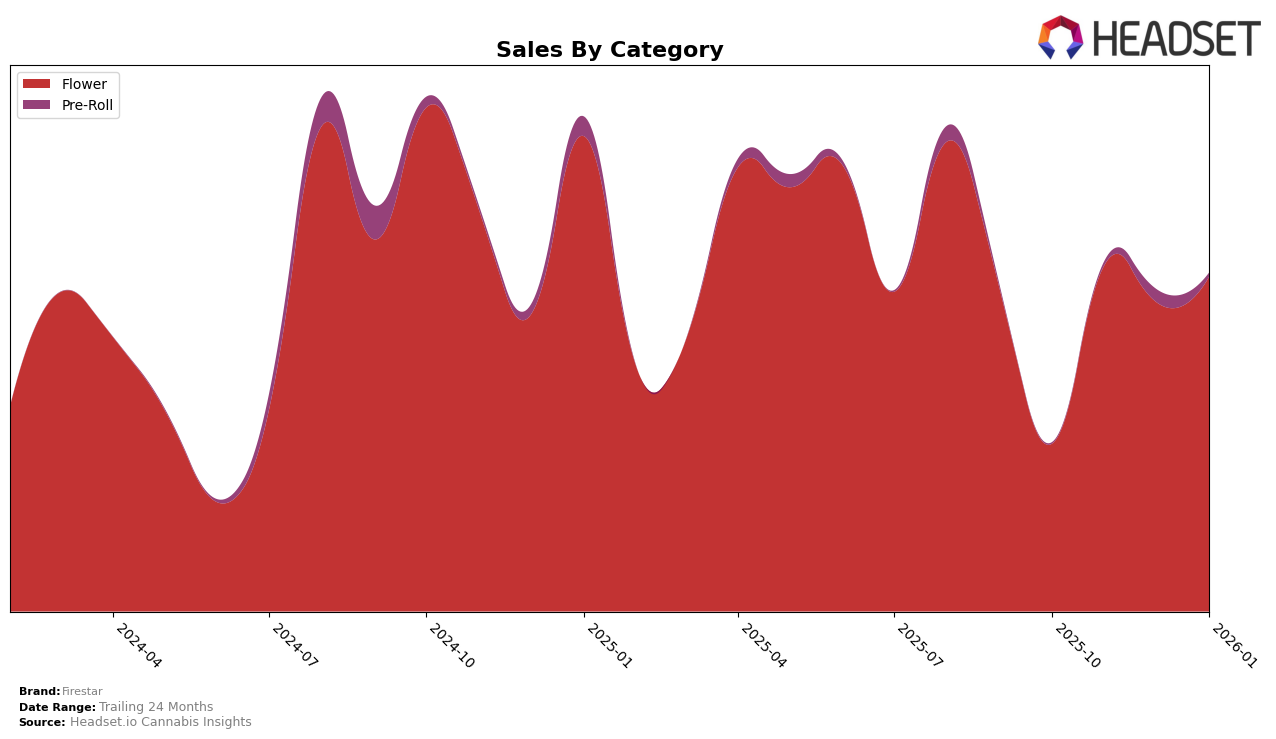

Firestar has demonstrated noteworthy performance in the Nevada market, particularly within the Flower category. In October 2025, they were ranked 28th, but by November, they had climbed to 11th place, indicating a significant upward trajectory. This momentum slightly tapered off in December and January, with rankings of 16th and 17th, respectively. Despite these fluctuations, Firestar's sales figures reveal a robust growth pattern, as evidenced by the increase from $218,770 in October to $437,877 by January. Such movements suggest a strong demand for their Flower products, although the brand's ability to maintain a top 15 position remains a challenge.

In contrast, Firestar's presence in the Pre-Roll category in Nevada has been less pronounced. They did not make it into the top 30 rankings from October to December 2025, finally appearing in 52nd place by January 2026. This absence from the top 30 could be seen as a potential area for improvement or a strategic opportunity for growth. The sales figures for Pre-Rolls were not available for the latter months, suggesting either a lack of significant sales volume or a focus on other categories. This disparity between categories highlights the importance of strategic focus and market adaptation for Firestar in maintaining and expanding its market presence.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Firestar has shown notable fluctuations in rank and sales, reflecting both challenges and opportunities. From October 2025 to January 2026, Firestar improved its rank from 28th to 17th, indicating a positive trajectory despite not being in the top 20 initially. This upward movement is contrasted by competitors like Deep Roots Harvest, which maintained a relatively stable presence, peaking at 10th in November 2025, and Srene, which surged to 9th in December 2025. Meanwhile, &Shine and Hustler's Ambition experienced more volatility, with ranks varying significantly over the months. Firestar's sales growth from $218,770 in October to $437,877 in January suggests a strengthening market position, although still trailing behind some competitors in absolute sales figures. This dynamic environment highlights the importance of strategic positioning and market responsiveness for Firestar to continue its ascent in the Nevada flower market.

Notable Products

In January 2026, the top-performing product for Firestar was Motor Breath (14g) in the Flower category, securing the first rank with sales of 1329 units. Mac Rillaz (14g) followed closely, climbing from third place in December 2025 to second place in January 2026. Lemon Essence (14g) made a notable entry into the rankings at third position. Honey Badger (14g), which was previously unranked in November and December 2025, secured the fourth spot in January 2026. Lemon Cherry Marker (14g) dropped from third in November 2025 to fifth in January 2026, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.