Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

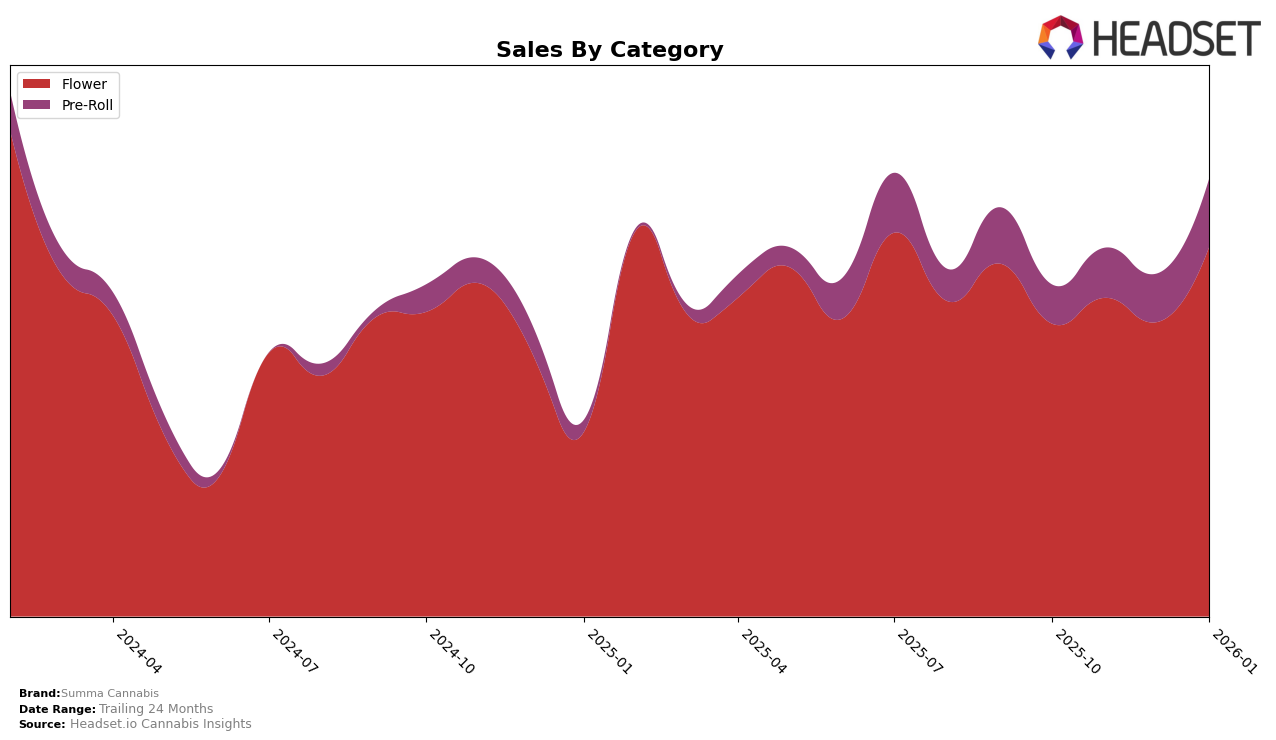

Summa Cannabis has shown a consistent presence in the Nevada market, particularly in the Flower category. Over the months from October 2025 to January 2026, the brand maintained a stable ranking, fluctuating slightly between 12th and 15th positions. This stability indicates a strong foothold in the Flower category, with a notable increase in sales from $402,660 in October to $505,114 in January. The directional trend suggests that Summa Cannabis is effectively capitalizing on consumer demand in Nevada, although it hasn't broken into the top 10 yet, leaving room for potential growth.

In the Pre-Roll category, Summa Cannabis experienced more dynamic movements in rankings. Starting at 25th in October, the brand improved its position to 17th by January 2026. This upward trajectory in the rankings is accompanied by a substantial increase in sales, indicating a growing consumer preference for their Pre-Roll products. However, the fact that they were not in the top 30 in some months in other states could suggest either a lack of presence or competitive challenges outside Nevada. This presents both a challenge and an opportunity for Summa Cannabis to expand its footprint beyond its current stronghold.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Summa Cannabis has shown resilience and adaptability amidst fluctuating market dynamics. Over the observed months, Summa Cannabis maintained a stable presence, with rankings oscillating between 12th and 15th place. This stability is noteworthy when compared to competitors like FloraVega / Welleaf, which experienced a more volatile ranking trajectory, dropping to 21st in December before recovering to 12th in January. Similarly, Srene made a significant leap from 21st to 9th in December, indicating a potential threat to Summa Cannabis's market share. Meanwhile, &Shine and Lavi also demonstrated fluctuations, with Lavi dropping to 20th in December before climbing back to 13th in January. Despite these shifts, Summa Cannabis's consistent sales growth, particularly a notable increase in January, suggests a solid customer base and effective market strategies that could help it maintain or improve its competitive position in the Nevada flower market.

Notable Products

In January 2026, the top-performing product for Summa Cannabis was the Mule Fuel Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place rank from December 2025 with notable sales of 5,240 units. Grape Gas Pre-Roll (1g) climbed the ranks to secure the second position, a significant improvement from its third-place standing in December 2025. Grasshopper Pre-Roll (1g) entered the rankings for the first time, claiming the third spot. Mule Fuel (3.5g) in the Flower category moved up to fourth place from its previous absence in the rankings. Glitter Bomb Pre-Roll (1g) witnessed a drop, falling from its third-place position in November 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.