Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

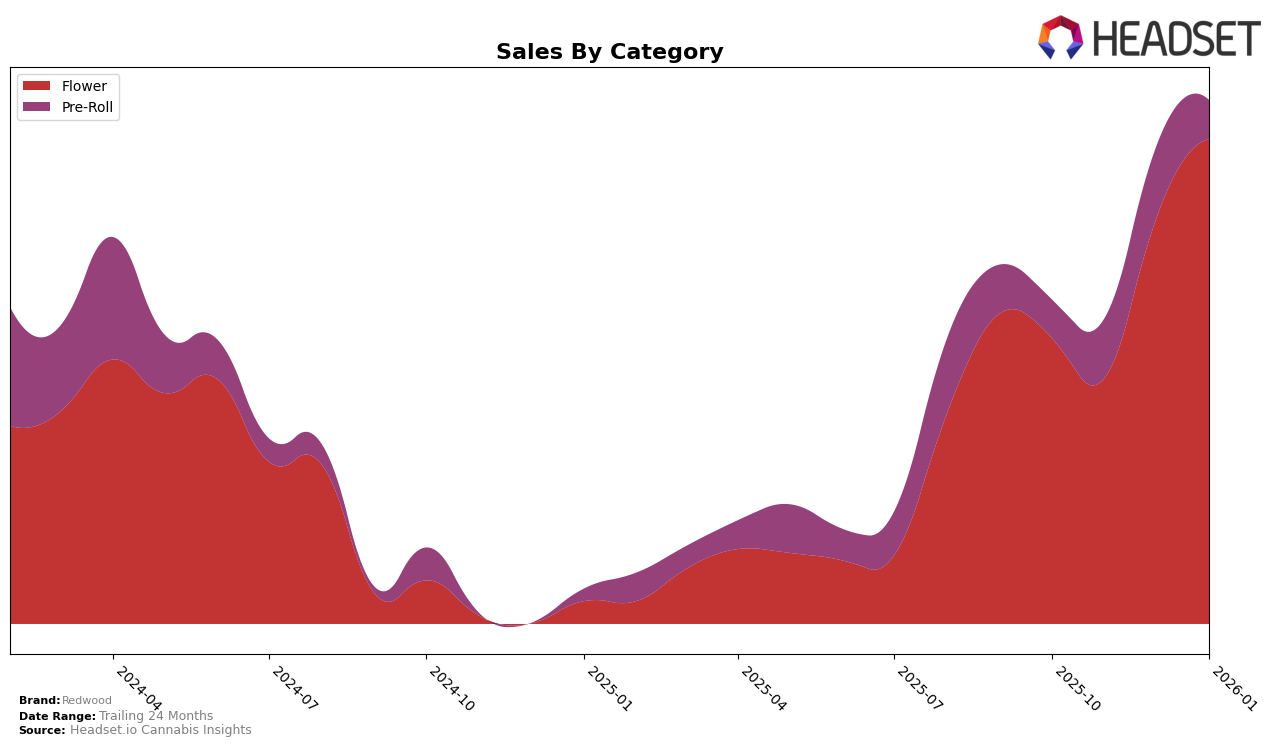

Redwood has shown a strong upward trajectory in the Flower category within Nevada. The brand improved its ranking from 18th in October 2025 to 9th by January 2026, indicating a significant gain in market presence. This rise in ranking is supported by a substantial increase in sales, with January 2026 figures reflecting a considerable boost compared to October 2025. Such performance suggests that Redwood is successfully capturing consumer interest and expanding its footprint in this category. However, it is important to note that Redwood did not make it into the top 30 brands in the Pre-Roll category in October 2025, which might indicate areas needing strategic focus or market adaptation.

In the Pre-Roll category, Redwood experienced a fluctuating performance in Nevada. The brand's ranking improved from 34th in October 2025 to 13th in December 2025, but then fell back to 32nd by January 2026. This volatility suggests that while there are periods of growth and consumer attraction, maintaining a consistent market position remains a challenge. The sales data corroborates this, as there was a peak in December 2025 followed by a decline in January 2026. This pattern may indicate seasonal demand or competitive pressures affecting Redwood's market share in Pre-Rolls. Understanding these dynamics could be crucial for Redwood to strategize effectively in this category.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Redwood has shown a notable upward trajectory in recent months. After starting at the 18th position in October 2025, Redwood experienced a dip in November, falling out of the top 20, but made a significant comeback by December, climbing to the 11th spot and further improving to 9th in January 2026. This positive trend in rank is mirrored by a substantial increase in sales, particularly from November to January, where Redwood's sales surged by nearly double. In comparison, Nature's Chemistry and Solaris have maintained relatively stable positions, with Solaris also showing a strong performance in December. Meanwhile, Good Green consistently ranks higher, maintaining a top 7 position throughout the period, indicating a strong market presence. Kushberry Farms experienced fluctuations but remained competitive. Redwood's recent gains suggest a growing consumer preference and effective market strategies, positioning it as a rising contender in the Nevada flower market.

Notable Products

In January 2026, Flat White (3.5g) emerged as the top-performing product for Redwood, leading the sales with 1,818 units sold. Following closely, Flamingo Float (3.5g) and Drooler (3.5g) secured the second and third positions, respectively, indicating strong demand within the Flower category. Gelato Bouquet (3.5g), which previously held the top rank in November 2025, slipped to fourth place, showing a slight decline in sales momentum. Banana Pie (3.5g), once the top seller in October 2025, now ranks fifth, highlighting a significant shift in consumer preference over the months. Overall, the January rankings reflect a dynamic market with notable changes from previous months, particularly in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.