Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

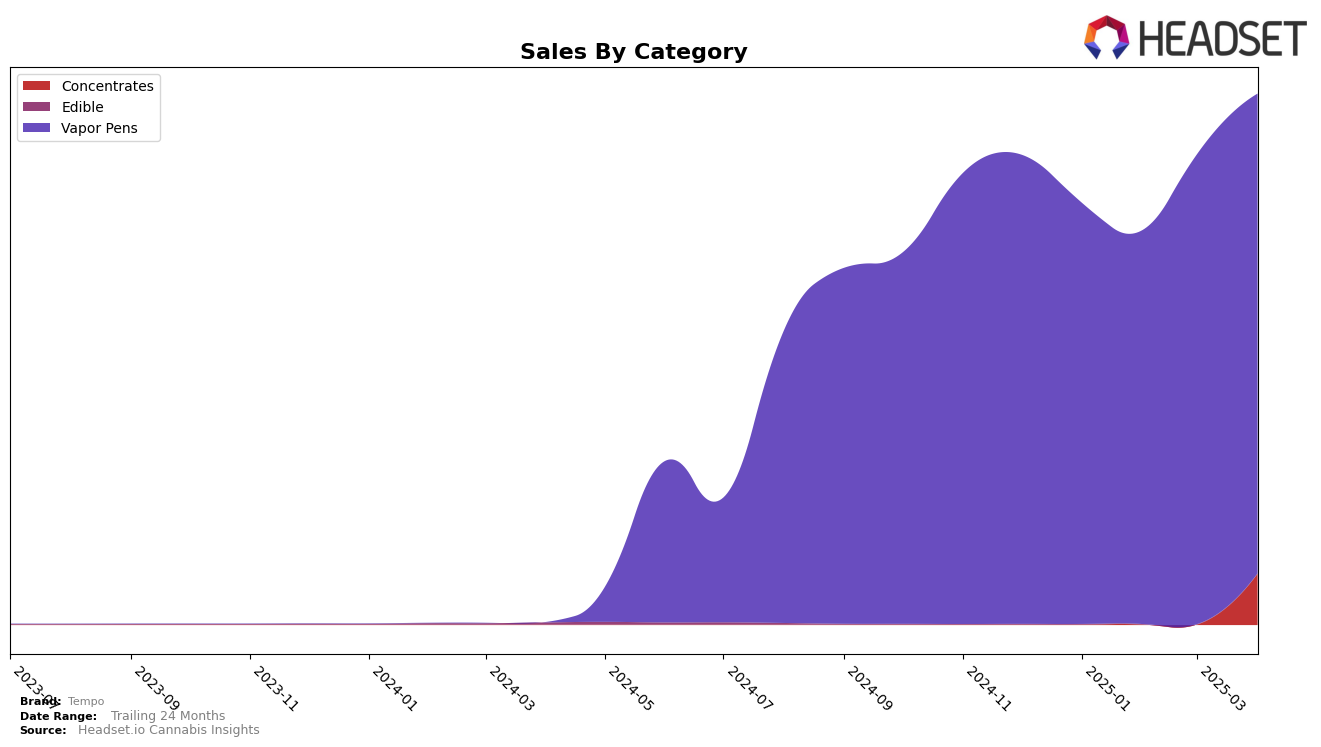

In the state of California, Tempo has shown notable performance in the Vapor Pens category over the first four months of 2025. Starting at a rank of 36 in January, Tempo made a steady climb to reach the 29th position by April. This upward trajectory indicates a positive reception and growing consumer interest in their vapor pen products within the state. However, in the Concentrates category, Tempo did not make it into the top 30 brands, which suggests that there is significant room for growth or a need for strategic adjustments in this segment.

While Tempo's overall presence in California's cannabis market is noteworthy, the lack of ranking in the Concentrates category highlights a potential area for improvement. The brand's ability to break into the top 30 for Vapor Pens by April is a positive sign of its competitive edge and market penetration in this popular category. The data suggests that Tempo's strategic focus on Vapor Pens might be yielding results, though the absence from the top ranks in Concentrates could imply missed opportunities or a need for greater emphasis on product innovation and marketing in that category.

Competitive Landscape

In the competitive landscape of vapor pens in California, Tempo has shown a positive trajectory in recent months, climbing from a rank of 36 in January 2025 to 29 by April 2025. This upward movement indicates a strengthening market position amidst strong competition. Notably, Tempo's sales have consistently increased, contrasting with the fluctuating sales of competitors like PAX and Almora Farms, which have seen declines in April. While Flavorade maintained a stable rank, their sales dipped in April, suggesting potential vulnerabilities that Tempo could capitalize on. Meanwhile, Punch Extracts / Punch Edibles has consistently ranked higher than Tempo, but their sales have decreased over the months, potentially opening opportunities for Tempo to capture more market share. This dynamic environment underscores the importance of strategic positioning and could be pivotal for Tempo's continued ascent in the California vapor pen market.

Notable Products

In April 2025, OG Grape Live Resin Disposable (1g) from Tempo maintained its position as the top-performing product within the Vapor Pens category, with sales reaching 3340 units. Kiwi Kush Distillate Disposable (1g) climbed to the second spot, showing consistent improvement from its fourth position in January. Mystic Mango Distillate Disposable (1g) remained stable in the third position, despite a brief absence from the rankings in February. Cherry Passion Ice Distillate Disposable (1g) re-entered the rankings in fourth place, marking its first appearance since February. Huckleberry Ice Distillate Disposable (1g) consistently held the fifth position throughout the first four months of 2025, indicating steady demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.